Stellar (XLM) Gains Traction, but Bulls Struggle at Resistance

Stellar (XLM) shows a modified momentum, up to 10% in the last 24 hours and over 25% in the last 30 days. Despite the rally, the XLM has remained below the $ 0.30 mark since March 2, having difficulty recovering the basic psychological level.

Recent technical signals – including a sharp increase in RSI, a positive transfer of CMF, and a potential gold cross – draw attention from entrepreneurs. As the bullish momentum builds, XLM is now facing a critical test of $ 0.279 resistance to the zone.

Stellar RSI Surges – Is XLM preparing for a breakout?

Stellar saw his relative -child index (RSI) son jumping hard at 62.21, from 31.47 two days ago.

This steep increase indicates a climbing momentum purchase, such as XLM rebound from oversold territory.

Such a move often reflects a emotional shift, with merchants spinning back to possessing after a period of weakness. If this momentum continues, XLM can set up for a bullish breakout for a short time.

RSI is a technical indicator used to measure the speed and change of price movements. It ranges from 0 to 100, with values below 30 commonly considered oversold and values above 70 that are considered excessive thinking.

Readings between 50 and 70s usually indicate growing bullish momentum. At RSI today at 62.21, XLM is gaining strength but there is still room to run before hitting conditions of excessive thinking.

It suggests that there may be more reversible potential if consumers continue to step, even if traders should remain alert for signs of fatigue as the RSI approaches 70.

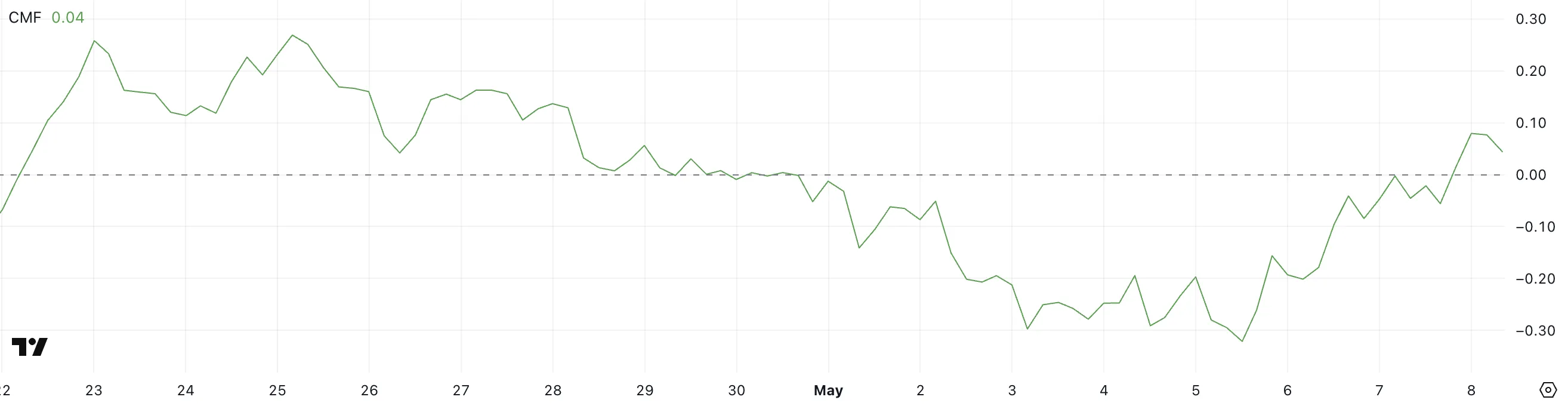

Stellar CMF becomes positive, but the purchase of pressure remains careful

Stellar's Chaikin Money Flow (CMF) indicator is currently sitting at 0.04, rebound from -0.32 three days ago.

This return to the positive territory has signed a short-term move towards the purchase of pressure, even though it has been pulled slightly from 0.08 earlier today.

While Bounce is encouraging, CMF has not been damaged above the level of 0.10 since April 28, suggesting that long -term capital flow will remain limited today.

CMF measures the flow with weight flow of money in and out of an asset at a set time. It covers between -1 and +1, with values above 0 indicating the purchase of pressure and values below 0 signaling pressure seller.

A CMF reading above 0.10 usually confirms strong accumulation, while readings near zero reflect anesthesia or weak beliefs.

In CMF of XLM at 0.04, the market shows early signs of accumulation, but is not sufficient to confirm a strong bullish trend. For further reversal, XLM will probably need to see CMF continuously more than 0.10.

The XLM Eyes Breakout as Golden Cross approaches

The stellar price is currently trading in a narrow range between resistance to $ 0.279 and support of $ 0.267.

Its EMA lines are tight, and a gold cross can soon form-a bullish signal that occurs when short-term ema crosses above the long-term one.

If the XLM breaks above $ 0.279, it can rally towards $ 0.30, with additional targets reversed at $ 0.349 and $ 0.375. If the bullish momentum stays strong, a transfer is also possible at $ 0.443.

However, if the breakout fails, XLM can return to $ 0.267 support. A breakdown below that level will expose the token to $ 0.25, followed by $ 0.239 and $ 0.230.

Beyond the technical ones, concerns about the supply concentration remain focused – data shows the top 10 XLM dompets that hold about 80% of the transfer supply. Binance's XLM balance has also grown from 180 million to 1 billion since late 2023, increasing the risk of volatility when large holders sell.

However, adoption is growing. Stellar's tokenized real-world asset (RWA) moved 84% in 2025, with major players such as Franklin Templeton and Circle helping driving more than $ 500 million in on-chain value.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.