FTSE100 Flat: All Eyes on BOE

- Summary:

- The BOE decisions and US-UK trade news focused for a flat FTSE, explore the basic level of support and resistance with potential market effects.

By opening the trading on Thursday, British sharing has increased, supported by investors optimistic to an important BOE decision and the announcement of a trade agreement between the US and the UK.

Earlier, the FTSE index rose 0.25%, while the British pounds dropped more than 1% against the dollar up to 1.32.

And for the German index, DAX rose 0.4%, with the French, CAC40, climbed 0.6%.

Boe's Monetary Decision: How can this affect FTSE100?

Bank of England's interest rate decision is the most important event for markets today. Markets expect a cutting rate of 0.25% amid tariff tensions.

Any change in interest can lead to increased volatility throughout the market. This will affect the value of British pounds, as cutting rates will weaken the pounds, which will affect the positive of FTSE as it will be good for companies that are highly dependent on exports, as their goods are becoming cheaper for international consumers.

Also, lower rates usually reduce borrowing costs for companies and boost investment and expansion, making it more attractive -stocks.

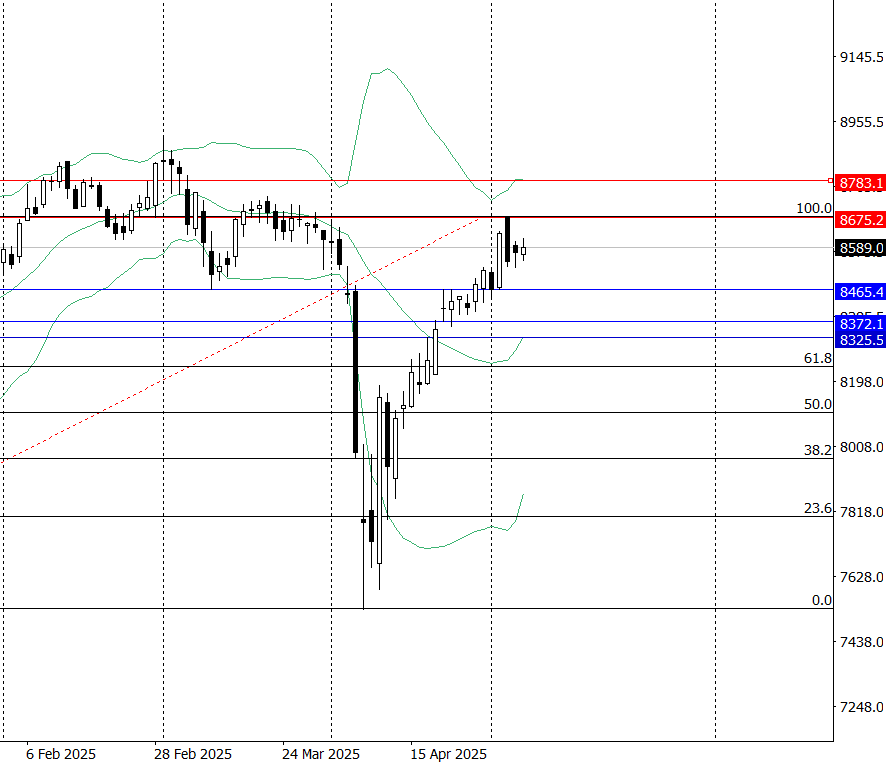

Technical levels of FTSE100:

According to the live chart, the index is still trading flat. As long as the FTSE trades under strong resistance to 8675.2, the bearish scenario is highly recommended. When the index breaks the support level at 8465.4, it opens the door to reach a lower level like 8372.1 and then 8325.5.

See also

On the flip side, any strong news affects the index positively and provides support to break strong resistance to 8675.2, climbing more likely to climb and reach a new resistance of bollinger bands at 8783.1

FTSE100 is waiting for US-UK trade deal with Trump's main announcement:

US president Donald Trump said a major trade agreement will be announced on Thursday, and some reports state that the UK is likely a partner. (FTSE 100 Index Up as Trade Tariff Talks)

This agreement can be a significant step toward a closer economic relationship, which will lead to investors to keep their eyes on what happens to help predict how markets can react.