Hedera (HBAR) Turns Bullish as Bearish Pressure Eases

Hedera (HBAR) has over 6% in the last 24 hours as it tries to get the $ 8 billion market cap. Its trading volume jumped 19% to nearly $ 176 million, showing a modified interest.

The main indicators are mixed. BBTrend remains bearish, but RSI and EMA lines suggest increasing bullish momentum. A golden cross can be easily formed, and HBAR is close to levels of resistance. The next move it can confirm if a breakout or a pullback is coming.

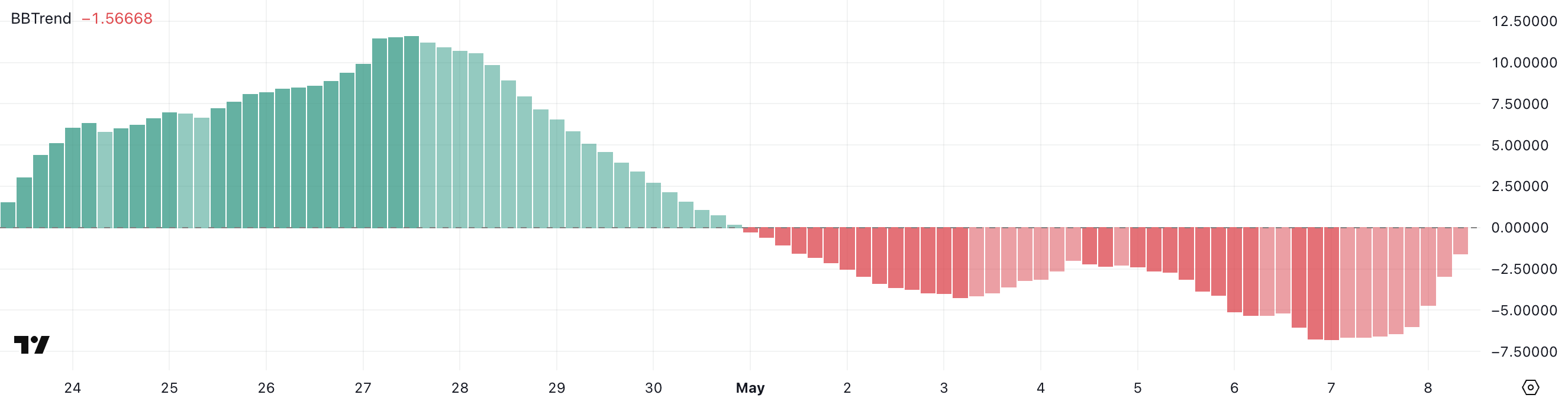

Hedera Bbtrend remains negative – the worst?

Hedera's BBtrend indicator is currently at -1.56 and has remained in negative territory since May 1.

This ongoing negative trend suggests that the descending momentum has ruled the market, even though short-term pressure sale shows signs of easing.

The BBtrend trend indicator, or bollinger band, measures the price positioning associated with the bollinger bands to determine the strength and direction of a trend.

The above +1 values suggest strong bullish momentum, while the readings below -1 indicate strong bearish conditions. A neutral range between -1 and +1 often reflects integration or weak belief in trend.

At HBar's Bbtrend and -1.56, it remains a bearish territory, even though the uprising from the extreme yesterday suggests that the sale may lose the steam.

If BBTrend continues to rise and cross above -1, it can signal a move toward price recovery or at least a downtrend pause.

Hedera approached the overbought zone after a strong rebound

The hedera relatively power index (RSI) climbed 66.2, strongly from 31.41 two days ago.

This rapid increase reflects a strong move to momentum, which draws HBAR from oversold conditions to a zone indicating growing bullish pressure.

Such a move often indicates consumers stepped up aggressively, reversing the recent weakness and potential setting of the stage for a short -term breakout if the pace continues.

RSI is a common indicator of momentum range from 0 to 100. The readings below 30 suggest Oversold conditions and a potential rebound. The values above 70 indicate that the owner may be overwhelming and due to a pullback.

Readings between 50 and 70 show the growing strength in a raid. The RSI of HBAR is at 66.2 – made overbought, but not yet. This indicates a more reversible potential if the momentum continues.

However, entrepreneurs should watch any signs of fatigue if the RSI crosses 70 in the upcoming sessions.

HBAR next move: 38% rally or 33% correction ahead?

The lines of hedera EMA are tight, and a gold cross may be on the horizon as short-term moving averages approach a crossover above the long-term.

This setup is usually seen as bullish, which suggests upward momentum can be boosted as soon as possible. If the Golden Cross confirms and the price of the hedera breaks above $ 0.191 and $ 0.199 resistance levels, the next targets can be $ 0.215 and $ 0.258.

A rally at those levels represents a potential of 38% upside down from current prices.

However, if HBAR fails to break the $ 0.19 zone resistance, it can face a pullback.

A collapse to support at $ 0.175 is the first test, with a deeper decline possible towards $ 0.160 and $ 0.153 if the sale of pressure is intensified.

HBAR can fall for less than $ 0.124 in a strong downtrend, marked a possible 33% correction.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.