Ethereum traders change to aggressive long positions, on -site accumulation

Ethereum (ETH) changed its lessons in the last day as prices were over $ 1,900. The whales immediately responded with the amplified long positions and the on -site purchase.

Ethereum (ETH) saw an immediate exchange of the trader and buyers' behavior after weeks of uncertainty. As prices raised over $ 1,900, the whales returned to the place market, while the derivative traders devoted himself to the most important long positions.

ETH is trying to break a six -month downward trend and continue at a higher price range. The immediate reaction of spot and derivative instruments showed ETH still attractive, especially if it shows bullish.

Ethereum whales are switching to a place gathering

During the last day, accumulation of outstanding funds was observed in addition to anonymous whales. Defi traders used their accumulated stablekos, spending Dai and USDT ETH at a price of $ 1,993.8.

2 wallets, probably from one unit, spent $ 14.54 million $ Dai and $ USDT 7 293,44 to buy $ Ethh Price $ 1,993.8.

Addresses:

– 0xef9fc75f3EC4baf72e0de24C8677187523e85c6

– 0xdf72Beb504df8612e7594a4878e23461c5fde34e

Data @nansen_ai pic.twitter.com/sk070lkx5q

– Onchain lens (@onchainlens) May 8, 2025

In addition to whales, Abraxas Capital expanded its exits, building ETH. The last exit of Binance was 2.3k for ETH. The large-scale withdrawal and gathering took about 50,000 ETHs from shifts last day. Keeping ETH in private wallets occurred after the renewal of Ethereum Pectra, which allows you to contribute ETH to ETH more easily in one deposit.

ETH exchange reserves are low at about 8.4 million chips on site and about 10 million in ETH derivatives markets. Demand of ETF is still uncertain: net inlet and outflow days to direct the direction without warning. Eth's scarcity is not as urgent as BTC.

Recent shopping rounds follow capitulation even the earliest ETH owners. Recently liquidated the ICO buyer more than 7200 Eth. But on the past day mood Bullish shifted for smart money, waiting for ETH to trade a lower range after a week.

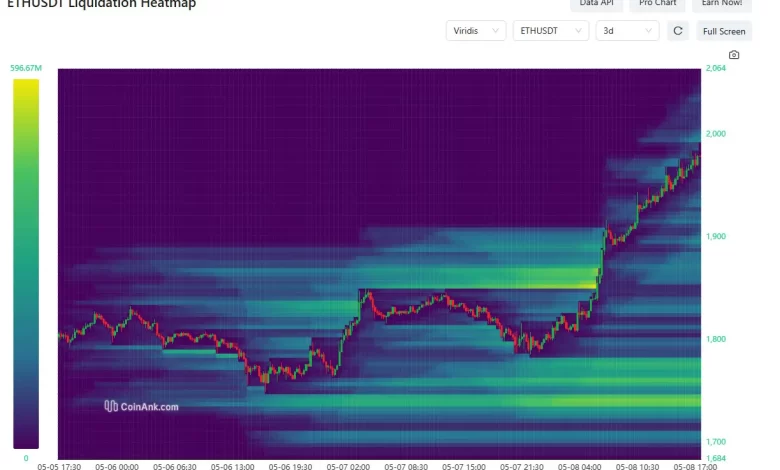

Ethereum traders switch long positions

On derivatives, Ethe traders quickly collected larger open positions. The overall interest rates of centralized markets increased to more than $ 11 billion within a few hours, from the last lowest lowest in the lowest lowest.

Recent collecting ETH over $ 1,900 allowed transactions to open long positions in the $ 1,700 range. The trader's behavior indicates bullish expectations, but can also cause liquidation in the event of an unexpected market drop.

Hyperlique also returned to hyperlique. Vaal deposited over $ 14.5 million to open a long position on ETH. The day of the past position He was in green, raising $ 500,000 to unrealized profits to over $ 600,000 at one point.

Vaal kept a position as ETH broke out to $ 2 001.05, breaking the price level for the first time after March 10. Ethe trading activities were adopted at the early US trading hours as the BTC continued its way to withdraw $ 100,000.

ETH rally follows Pectrator Upgrade, which should become a bullish factor and increases the use of Ethereum and trading. In short, after the Pectra version update, the ethereum network became deflationary as more coins were burned for the gas. Increased activity also pushed fees to $ 0.80, from $ 0.01 from recent lowest dollars, and DEX rose to $ 13.

Main difference wire Helps to break and dominate crypto brands quickly