Futu integrates Bitcoin and USDT deposits into retail investment app

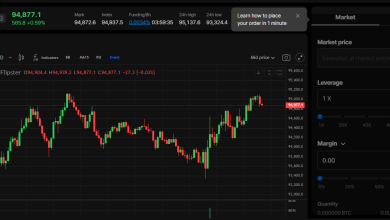

The brokerage company based in Hong Kong, Futu Securities, launched a crypto deposit and trading service. The company revealed this in an official announcement, declaring that accredited investors can deposit and exchange Bitcoin, Ethereum and Tether USDT.

According to Future, The service is available via its Niuniu retail application application, and users can switch between traditional financial products and cryptocurrencies in one click. Thus, it offers users the possibility of investing and managing a variety of diversified assets. The announcement said:

“Investors can play with crypto + tradfi assets via an application, quickly switch between virtual and traditional asset markets, and choose appropriate investment products to control market fluctuations.”

Futu is one of the main retail brokerage platforms in Hong Kong. According to the company, one in two adults from the city uses its platform, and it ranked first for downloads from all detail brokerage applications. The company is also authorized by Hong Kong Securities Regulatory Commission, which means that it complies with regulations.

Interestingly, the company seeks to attract more cryptographic investors to use its platform and now offers new users up to 1,600 HK in Bitcoin awards. Depending on the company, this is a limited offer with terms and conditions.

Futu wants to fill tradfi with crypto

Meanwhile, the company intends that its application offers an easy way to connect Tradfi with Crypto. He said most traditional crypto exchanges offer only one asset, and that most Tradfi institutions do not have cryptographic infrastructure, which reduces the opportunity to invest for most users.

To achieve this, the FUTU platform offers a complete account where users can manage various assets from a portfolio and access all investment options via a single window platform.

Interestingly, it seems that Futu does not take care of cryptographic assets deposited on its platform. The announcement indicated that the cryptographic assets of customers are deposited on the exchanges of enforced cryptography against the guard.

Speaking of the new product, the director general of the company, XIe Zhijian, noted that the company had the technical capacity and the force of capital to provide negotiation services of crypto to qualified investors. He said:

“As a technological broker, we hope to build a bridge between emerging assets such as virtual assets and traditional assets, and also hope to promote the activity and participation of these two markets at the same time.”

The company plans to offer deposits and negotiate more cryptocurrencies. It should be noted that it already offers trading of Crypto ETF, simulation trading and other functions. Thus, improving interoperability between Crypto and Tradfi assets for investors is its main objective.

Hong Kong ranks second among the cities most suited to crypto

Meanwhile, future efforts highlight the growth of the digital asset market in Hong Kong. The city has become one of the main crypto hubs in the world due to regulatory clarity and local institutions adopting blockchain technology.

In recent years, it has adopted several laws allowing cryptographic companies to become in accordance with regulations. Hong Kong Monetary Authority (HKMA) has also adopted blockchain technology with a pilot program for E-HKD digital currency, currently in phase 2.

Unsurprisingly, it is classified as the second most friendly city for Crypto in the world, ahead of Singapore, Abu Dhabi and Zurich. According to the migration platform Multipolitan, Only the capital of Slovenia, Ljubljana, ranks ahead of Hong Kong.

Multiolitan has classified cities according to factors such as the tax regime, regulations, wealth and digital infrastructure, and Hong Kong obtained a high score on most of the criteria. However, its push to become a world crypto hub could be threatened while pro-Crypto movements in the United States increase its appeal for cryptographic companies.

Thread difference cresure Help the crypto brands to unravel and dominate the headlines quickly