Nifty, Sensex Amid Operation Sindoor Buzz

- Summary:

- Indian stock markets for volatility as Sindoor operations are rising tensions in Pakistan. Will Nifty and Sensex be cracked under pressure?

India's equity markets open this Wednesday morning against the back of the geopolitical tension following the Sindoor operation, the high level of military response against terrorism camps supported by Pakistan. Through global cues that are covered and local balancing sentiment between caution and hope, traders are focused on the laser-focused news in the Indian stock market tomorrow, especially how Nifty and Sensex navigate the current resistance zones.

Operation Sindoor Fuels Risk that repricing to markets

While Indian accuracy strikes a sharp reaction to regional markets, including a slide on Pakistan's KSE-100 Benchmark, domestic indices have shown stability. Nifty 50 and Sensex both retreat to early volatility, which is assisted by the steady action of MidCap and keeps purchase at the auto banks and stocks.

- The mood mood remains guarded but does not havepanic

- FII kept quiet but the direction was not reversed

- Headlines remain focused on geopolitical escalation, but the underlying market width remains healthy.

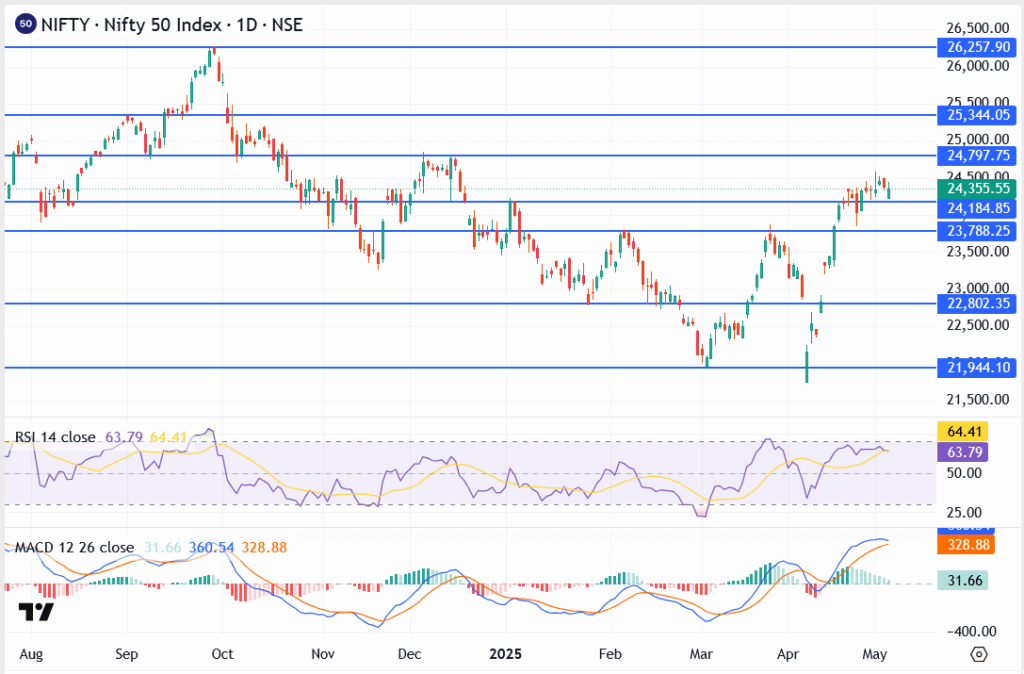

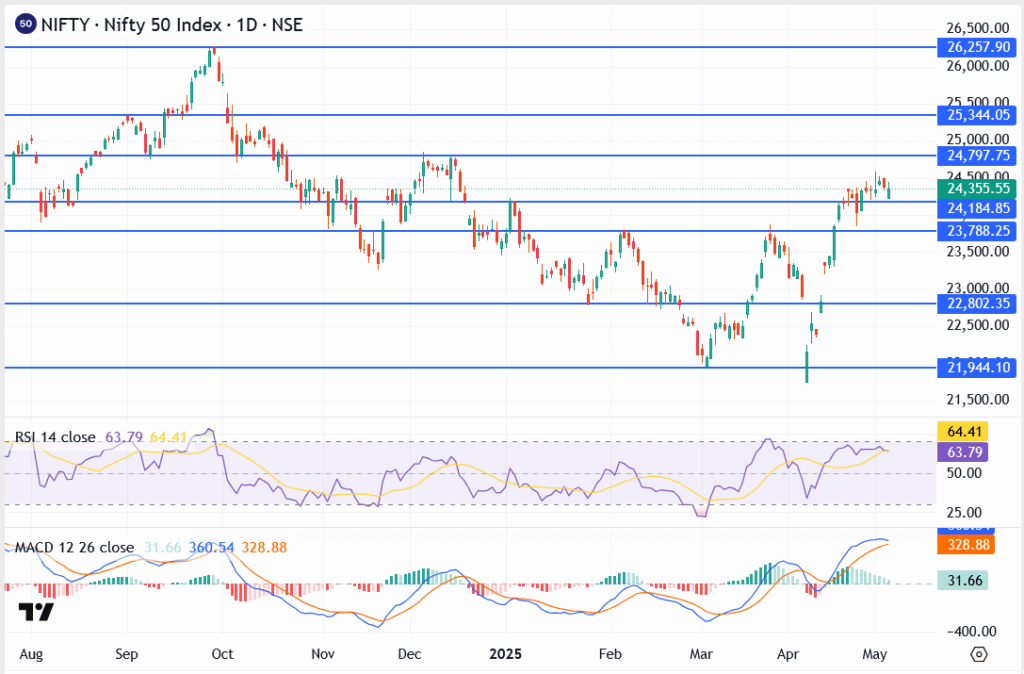

Nifty 50 Technical Assessment: Bulls Hold Ground, Eyes at 24,800

The Nifty 50 index remained firm around 24,355 by market close, cooling after a strong two -week rally.

Nifty 50 basic levels to watch

- Resistance to 24,797, then 25,344

- Immediate support to 24,184, stronger floors to 23,788

- RSI at 63.79, still briefly suspected but lost steam

- The MacD crossover remains bullish, though the histogram shows the weakening of momentum

The index can combine between 24,200 and 24,800 short terms. A breakout above 24,800 can trigger the updated Fomo purchase towards the psychological 25,000 zones.

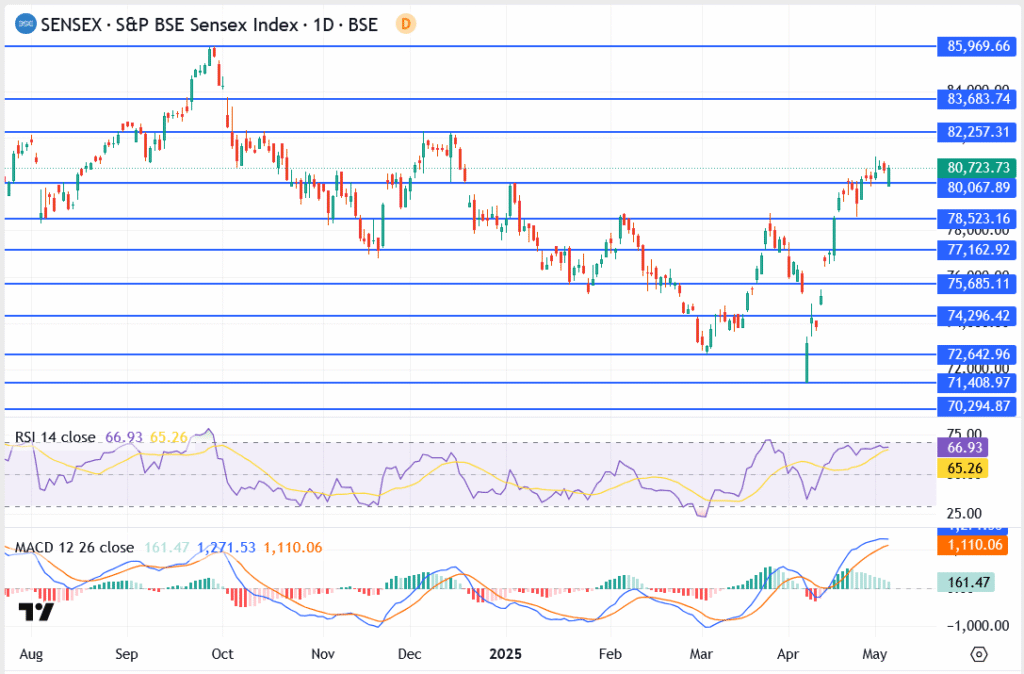

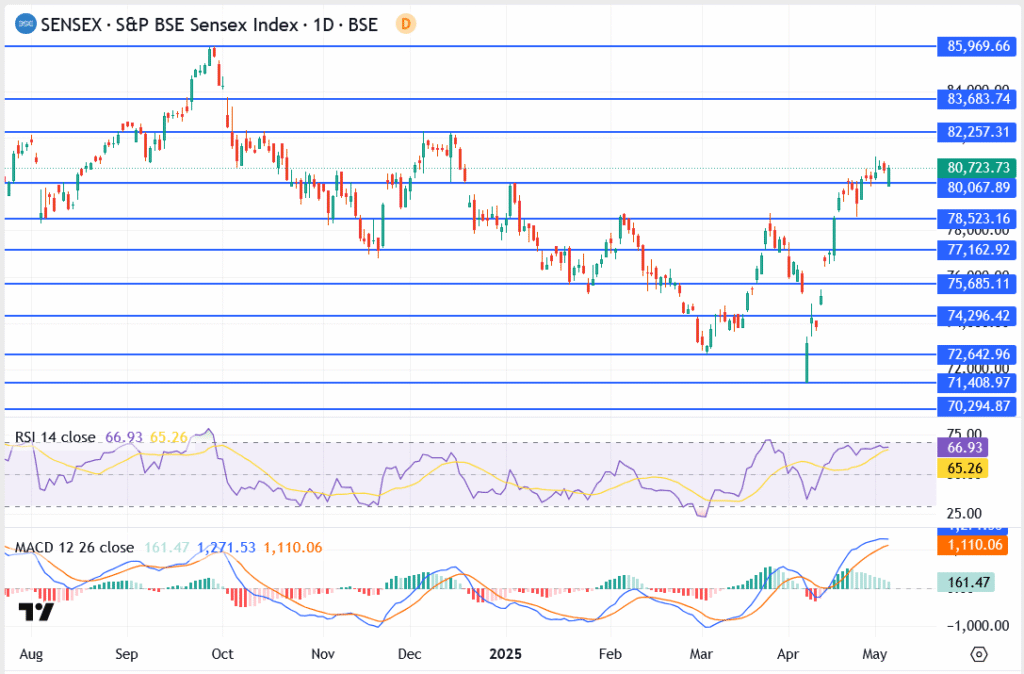

SENSEX ASSISTANCE: Rally stalls close to 80,700, but have not yet -back off the bulls

The BSE Sensex posted a narrow sun range, closing 80,723, a whisker above the short-term ceiling.

Levels of the main chart

- Immediate objection to 80,723, next key hurdle to 82,257

- Zone support depends on 78,523, deeper floors near 77,162

- RSI prints 66.93, territory of excessive territory

- Macd is still bullish but flittens -possibly i -Pause in advance

See also

Unless the global emotion deteriorates or worsens the headlines, the sensex appears to be in healthy digestion mode. The breakout above 82,200 can invite an aggressive index claim.

Tensions on the Indian-Pakistan border can spark short-term volatility in markets

In the Sindoor Operation that performs titles this morning, investors are ignoring the risk of a short-lived river. IndI-Pakistan tensions always have a way of seizing the sentimental sentiment, not necessarily with full panic, but enough to cause hesitation.

Some traders may light their exposure, especially in oil -related sectors or exporters, to be careful. However, if history is any guide, these flare-ups tend to fizzle out in the long run. Nifty and Sensex can be immersed in emotion, but a broader perspective on growth, income, liquidity, and demand structures tend to remain intact.

Defense stocks caught a tail from security jitters

Indian military manufacturers suddenly return to businessmen. After the cross-border operation, a chatter was updated about budget changes towards folk defense. Companies like HAL and Bel, familiar names at the PSU rally, can benefit if this momentum is handling.

Not only are these titles, though. Investors seem to have estimated that the government would not reward words but could double tech tech, border equipment, and tracking systems. This type of narrative tends to stick longer than a single strike, especially in a hungry market for new themes.