New Bitcoin Whales May Drive Rally as BTC Nears $100,000

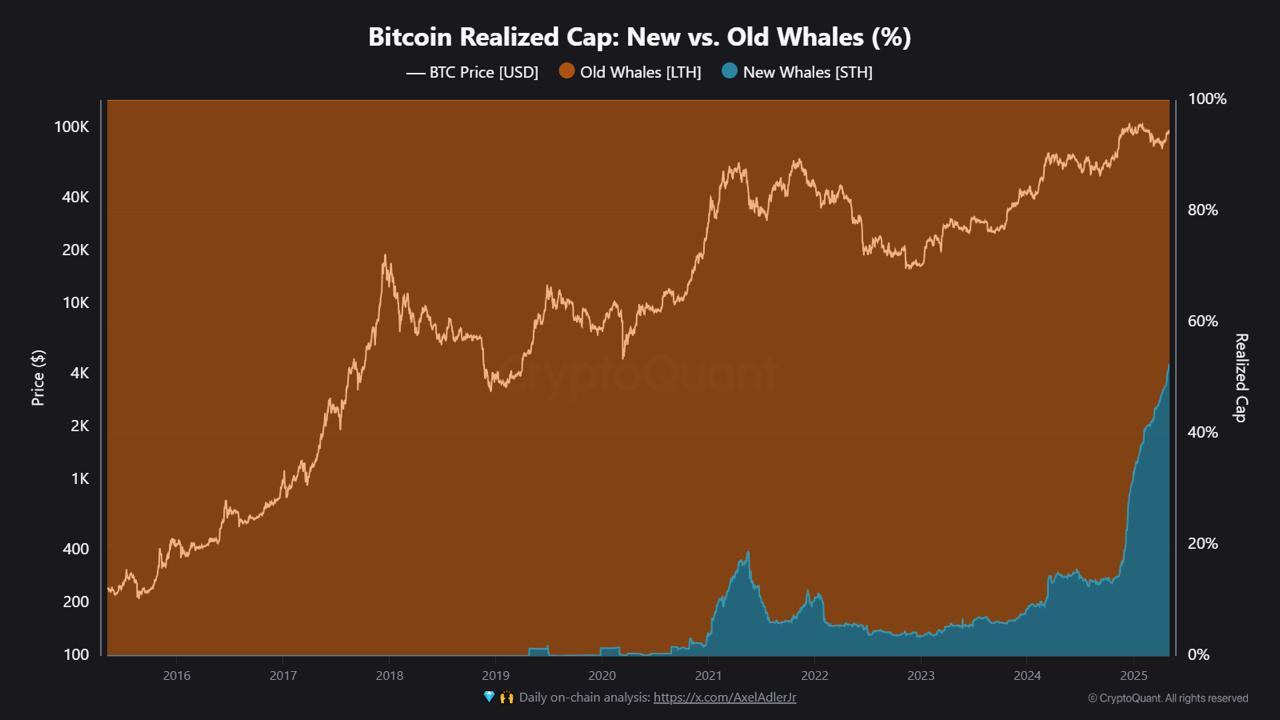

In the chain report from the cryptoquant shows that short -term “new whales” are now holding 52.4% of bitcoin whales realizing the cover, reaching the long -term term holders for the first time.

BTC trading near $ 96,800, driven to the part of fresh capital that enters the market at a high price level.

Bitcoin's new whales collectively hold more properties than long-term holders

Realizing the cap values per Bitcoin at price when it last moved to the chain. Cryptoquant analyst Ja Maartunn explains that active addresses within the past 155 days are counted as new whales.

Meanwhile, dormants that no longer qualify as old whales.

The average basis of the average whales is $ 91,922, compared to $ 31,765 for old whales. This change marks a historical change in the distribution of capital to the major holders.

From 2015 to late 2019, Bitcoin's new whales would cost under 5% of the whale realized cover as prices rose from $ 200 to $ 10,000.

During the 2020 -early 2021 Bull Run, their share rose to 25% as investors at retail levels and institutions were stacked.

The bear market of 2021–2022 has seen a new whale participation falling below 10% in the middle of capitulation. Recovery throughout 2023 and early 2024 pushed their part back to about 20 %.

Since mid -2024, the price of Bitcoin has emerged from $ 30,000 to $ 100,000. The chart shows new shares of whales strongly from about 20 % to 52.4 % in conjunction with the rally.

At the same time, the cover held by the old Bitcoin's old whales now represent only 47.6%

What does it mean for the dynamic price of bitcoin?

Cryptoquant data means that most bitcoin's “big money” holders are now stacked at a higher price. Over half the whale, the level capital has been sitting on coins that last move within the past five months.

In general, it is a major momentum driver for the BTC market. The fresh whale bought for $ 90,000 pushing BTC to $ 97,000. Their demand was created by most of the recent rally.

Also, the average cost of the new whales is about $ 92,000, so they only have a little non -realized benefit. A drop below their expense can motivate fast sale, increasing down pressure.

Meanwhile, long -term whales bought $ 31,000 on average. They have no reason to sell now, which limits the supply from that group.

In simple terms, the current bitcoin strength depends on new, high cost consumer. If they hold, the uptrend may continue. If they start selling around their break – even point, expect sharper swings

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.