How Miners and Token Holders Impact Blockchain Fairness

Table of Links

Abstract/Zusammenfassung

Publications

Acknowledgements

CHAPTER 1: INTRODUCTION

-

Introduction

1.1 Overview of thesis contributions

1.2 Thesis outline

CHAPTER 2: BACKGROUND

2.1 Blockchains & smart contracts

2.2 Transaction prioritization norms

2.3 Transaction prioritization and contention transparency

2.4 Decentralized governance

2.5 Blockchain Scalability with Layer 2.0 Solutions

CHAPTER 3. TRANSACTION PRIORITIZATION NORMS

-

Transaction Prioritization Norms

3.1 Methodology

3.2 Analyzing norm adherence

3.3 Investigating norm violations

3.4 Dark-fee transactions

3.5 Concluding remarks

CHAPTER 4. TRANSACTION PRIORITIZATION AND CONTENTION TRANSPARENCY

-

Transaction Prioritization and Contention Transparency

4.1 Methodology

4.2 On contention transparency

4.3 On prioritization transparency

4.4 Concluding remarks

CHAPTER 5. DECENTRALIZED GOVERNANCE

-

Decentralized Governance

5.1 Methodology

5.2 Attacks on governance

5.3 Compound’s governance

5.4 Concluding remarks

CHAPTER 6. RELATED WORK

6.1 Transaction prioritization norms

6.2 Transaction prioritization and contention transparency

6.3 Decentralized governance

CHAPTER 7. DISCUSSION, LIMITATIONS & FUTURE WORK

7.1 Transaction ordering

7.2 Transaction transparency

7.3 Voting power distribution to amend smart contracts

Conclusion

Appendices

APPENDIX A: Additional Analysis of Transactions Prioritization Norms

APPENDIX B: Additional analysis of transactions prioritization and contention transparency

APPENDIX C: Additional Analysis of Distribution of Voting Power

Bibliography

1.1 Overview of thesis contributions

This thesis aims to address the fairness challenges mentioned above. We outline our research contributions in pursuit of this objective below.

1.1.1 Transaction prioritization norms (Messias et al., 2020, 2021)

The conventional wisdom today is that many miners follow the prioritization norms, implicitly, by using widely shared blockchain software like the Bitcoin Core (bitcoin.org, 2023; Coin Dance, 2021). In Bitcoin, the presumed “norm” is that miners prioritize a transaction for inclusion based on its offered fee rate or fee-per-byte, which is the transaction’s fee divided by the transaction’s size in bytes. We show evidence of this presumed norm in Figure 1.1. The norm is also justified as “incentive compatible” because miners wanting to maximize their rewards, i.e., fees collected from all transactions packed into a size-limited block, would be incentivized to include preferentially transactions with higher fee rates. Assuming that miners follow this norm, Bitcoin users are issued a crucial recommendation: To accelerate the confirmation of a transaction, particularly during periods of congestion, they should increase the transaction fees. We show that miners are, however, free to deviate from this norm and such norm violations cause irreparable economic harm to users.

We summarize our contributions as follows.

▶ To quantify the deviation from the norm, we propose two measures that we call signed position prediction error (SPPE) and position prediction error (PPE). These measures

allow us to quantify the transaction deviation (or acceleration) for all transactions in block. It can also be applied to any blockchain that order transactions based on fees-incentive.

▶ We perform an extensive empirical audit of the miners’ behavior to check whether they conform to the norms. At a high-level, we find that transactions are indeed primarily prioritized according to the assumed norms. We also, nevertheless, offer evidence of a non-trivial fraction of priority-norm violations amongst confirmed transactions. An in-depth investigation of these norm violations uncovered many highly troubling misbehavior by miners.

▶ Multiple large mining pools tend to selfishly prioritize transactions in which they have a vested interest; e.g., transactions in which payments are made from or to wallets owned by the mining pool operators. Some even collude with other large mining pools to prioritize their transactions.

▶ Many large mining pools accept additional dark (opaque) fees to accelerate transactions via non-public side-channels (e.g., their websites). Such dark-fee transactions violate an important, but unstated assumption in blockchains that confirmation fees offered by transactions are transparent and equal to all miners.

▶ We release the data sets and the scripts used in our analyses to facilitate others to reproduce our results (Messias, 2023b).

1.1.2 Transaction Prioritization and Contention Transparency (Messias et al., 2023a)

In the context of the lack of contention transparency, not all transactions are publicly broadcasted. Instead, users can submit transactions to a subset of miners or mining pools through private channels or relays that are not visible to the public. In this case, transactions remain private to the relay until they are committed into a block. Additionally, users may choose to submit their transactions exclusively to a particular mining pool that guarantees a fast commit time. This thesis aims to shed light on the growing prevalence of private mining practices, where transactions are submitted to only a subset of the miners. Furthermore, it analyzes the distinct characteristics of these private transactions.

Moreover, with the lack of prioritization transparency, the fees offered by a transaction can be significantly higher than what is publicly declared. For example, a transaction can privately offer additional fees to a miner in order to “accelerate” its inclusion in a block. Many such transaction-accelerator (or front-running as a service (FRaaS)) platforms exist for Bitcoin (BTC.com, 2022; ViaBTC, 2022) and Ethereum (Eskandari et al., 2020; Flashbots, 2022b; SparkPool, 2021; Strehle and Ante, 2020). Furthermore, the same transaction can offer different fees to different mining pools through their relays. The existence of these hidden or dark-fees can undermine the reliability of any fee prediction: Transaction issuers may end up paying considerably higher fees without receiving proportional or any reduction in commit delays. This thesis aims to characterize the prevalence of such dark-fee transactions and analyze the most popular private relay network available in Ethereum, Flashbots (Flashbots, 2022b). We also conduct active experiments in both Bitcoin and Ethereum to validate our assumptions regarding the prioritization transparency.

In addition to demonstrating the non-uniformity of transaction fees across miners, we argue that, given the lack of contention transparency, the lack of prioritization transparency may become even more widespread in the future.

We summarize our contributions as follows.

▶ We provide a comprehensive characterization of the lack of contention transparency in both Bitcoin and Ethereum. Our analysis reveals the widespread use of private channels or relay networks to submit transactions directly to a subset of miners. This practice has the potential to undermine prioritization transparency, as transaction issuers may not be able to estimate the appropriate fees once none of which is publicly visible.

▶ We investigate the prevalence of private transaction fees, with a particular focus on Flashbots bundles in Ethereum. Our findings indicate that Flashbots bundles represent a significant portion (52.11%) of all Ethereum blocks. This lack of prioritization transparency may enable miners to overcharge users when they send their transactions privately.

▶ We investigate whether public transactions are bundled together with private transactions using the Flashbots private relay to exploit arbitrage opportunities through Maximal Extractable Value (MEV). Interestingly, we find that the public transactions within these bundles are, for example, associated with oracle[1] updates, specifically involving the adjustment of prices for particular token pairs. This is made possible by the sequential execution of transactions within the bundle by miners. Consequently, the transaction that is executed right after the oracle update gain immediate access to the updated price information as soon as it is recorded on the blockchain.

▶ We demonstrate evidence of collusion among Bitcoin miners, collectively possessing more than 50% of the network’s total hashing power, particularly concerning the inclusion of dark-fees transactions.

▶ To promote transparency and facilitate the scientific reproducibility of our results, we publicly release our data sets and scripts used in our analysis (Messias, 2023b).

1.1.3 Decision-making power distribution for blockchain governance (Messias et al., 2023b)

This thesis also provides an in-depth analysis of the voting patterns, delegation practices, and outcomes of proposals in one of the widely used governance protocols: Compound (Compound Labs, Inc., 2022a; Leshner and Hayes, 2019). Since Compound records the votes cast transparently on a blockchain (i.e., uses on-chain voting), we conducted measurements studies to analyze the extent to which this voting is decentralized, i.e., how small or large are the set of voters that determine the outcomes for the amendments. Our goal is to thoroughly examine this protocol to better understand how its governance mechanism operates and identify potential areas for improvement.

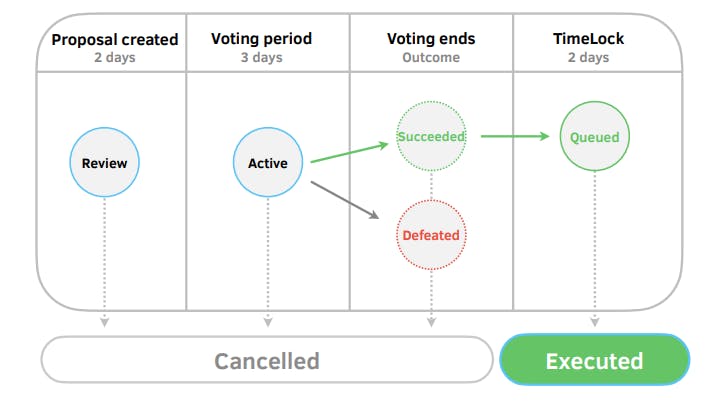

Compound regulates its voting process via the Compound (COMP) token, an ERC-20 asset, as follows. First, it allows token holders to participate in governance by proposing and voting on changes to the protocol through an on-chain voting mechanism where voting power of a user is proportional to the amount of delegated tokens held by them— one token equals one vote. Second, it permits its holders to delegate their tokens to other users, enabling users (who do not wish to exercise their voting rights) to delegate their voting power to others. The protocol essentially supports a form of liquid democracy that

combines direct democracy and representative democracy, where voters can delegate their voting power to trusted representatives (Behrens, 2017; Blum and Zuber, 2016; Carroll, 1884). Some protocol changes that token holders can propose and vote on include adjustments to the borrowing and lending rates, changes to how new tokens are distributed, and changes to the parameters of the voting process. They can also change the duration of the proposal’s life cycle (per Figure 1.2, currently taking on average 7 days) and other aspects of the protocol. To incentivize participation in token lending and borrowing through the protocol, Compound distributes 1234 COMP tokens daily to users and applications in various markets (e.g., ETH, DAI, and USDC), in proportion to the amount that they lend or borrow (Compound Labs, Inc., 2022c).

We summarize our contributions as follows.

▶ We characterize the Compound protocol’s on-chain voting process, showing that it is active and regularly used, with a steady flow of proposals. The majority of the proposals receive significant support: on average, 89.39% of votes are in favor.

▶ We reveal a substantial variation in voting costs, from $0.03 to $294.02, with an average of $7.88. [2] If we normalize the costs per vote by the count of tokens held by users, we obtain an average cost per vote unit of $358.54. Voting costs on Compound can, hence, be unfairly expensive for small token holders, which has fairness implications for the decision-making process.

▶ We show that a small group of 10 voters holds a significant amount of voting power (57.86% of all tokens) and that proposals only required an average of 2.84 voters to obtain at least 50% of the votes. These observations strongly suggest that the voting outcomes in Compound may not reflect the preferences of the broader community.

▶ We also discover potential voting coalitions among the top voters, which could further exacerbate concerns of voting concentration.

▶ To foster reproducible research and inspire investigations into other aspects of governance protocols, we share our scripts and data sets in a GitHub repository (Messias, 2023a).

1.2 Thesis outline

In summary, this thesis addresses three important fairness concerns. First is the transaction ordering where we examine the prioritization of transactions by auditing the order in which they are included by miners. We investigate whether miners adhere to the existing norms or widely accepted practices in this regard. Second, is the transaction transparency where we explore whether miners ensure transparency in terms of transaction prioritization and transaction contention (i.e., the transaction and its content is accessible by all miners), ensuring equal access for all participants. Finally, is the fair distribution of voting power for smart contract amendments where we delve into the distribution of voting power in decentralized governance protocols, with a particular focus on Compound. Both of these concerns are crucial for establishing a fair blockchain ecosystem.

Specifically, this thesis is organized as follows:

▶ In Chapter 2, we begin by presenting the background of blockchains and smart contracts. Next, we delve into the background of transaction prioritization norms. Then, we discuss the background of transaction prioritization and contention transparency. Finally, we explore the background of decentralized governance protocols used for amending smart contracts.

▶ In Chapter 3, we perform an audit of miners’ prioritization norms and evaluate the degree to which they comply with commonly accepted prioritization assumptions. Our findings reveal that miners tend to prioritize transactions based on self-interest, including their own transactions or those from friendly mining pools. Additionally, we highlight the presence of acceleration services provided by miners, enabling off-chain payments to expedite transactions. Unfortunately, the fees associated with these services are dark or opaque to other participants, making it challenging for them to estimate appropriate fees for timely transaction inclusion. Finally, we propose two metrics for verifying transaction ordering misposition within a block. These metrics play a crucial role in determining whether miners adhere to the assumed norms and can be generalized to other blockchains.

▶ In Chapter 4, we conduct a data-driven analysis focused on the prioritization of dark-fees payments by miners. Our results reveal the existence and prevalence of private relay networks (e.g., Flashbots), which allow transaction issuers to privately send their transactions to miners, keeping them hidden from other participants. To assess the level of prioritization provided by miners, we performed two active experiments, where we accelerated the inclusion of transactions by offering dark-fee payments to miners. We discovered evidence of potential collusion among mining pools, where their combined hash rate accounted for over 50% of the network’s hash rate.

▶ In Chapter 5, we conduct an in-depth audit of governance protocols, with a specific focus on Compound, to evaluate the extent to which they have succeeded in achieving their primary goal of decentralizing the decision-making process for amending smart contracts. Our analysis reveals that this goal may not have been fully achieved, as we observe a concerning concentration of voting power among a small number of participants, along with the existence of voting coalitions formed by powerful voters. This concentration stands in contrast to the fundamental objective of decentralized governance protocols, which aims to mitigate centralization in the decision-making process.

▶ In Chapter 6, we review the works in the literature that are relevant to this thesis.

▶ In Chapter 7, we present a detailed discussion of our work and its limitations. Additionally, we explore potential directions for future work.

Author:

(1) Johnnatan Messias Peixoto Afonso

[1] Decentralized Oracle Networks facilitate off-chain data access for blockchains, including exchanges prices, weather forecast, and more (Breidenbach et al., 2021). Typically, blockchain applications rely on these oracles to gather information they need. [2] All costs are in US dollars, taking into account the exchange rate at the time of casting the vote.