How Miners Select and Order Transactions in Bitcoin

Link

Abstract/zusammenfassung

Newspapers

Recognition

Chapter 1: Introduction

-

Introduction

1.1 General -Idesa of thesis contributions

1.2 Thesis Outline

Chapter 2: Background

2.1 Blockchain and Smart Contracts

2.2 Transaction Prioritization Standards

2.3 Transaction Prioritization and Contention Transparency

2.4 Decentralized Management

2.5 Blockchain Scalability with Layer 2.0 solutions

Chapter 3. Transaction prioritization standards

-

Transaction prioritization standards

3.1 methods

3.2 Study of compliance with the standard

3.3 Investigation of violations of the standard

3.4 Dark transactions

3.5 ending reminders

Chapter 4. Transaction Prioritization and Contention Transparency

-

Transaction prioritization and dispute transparency

4.1 Procedure

4.2 In the transparency of dispute

4.3 In Prioritization Transparency

4.4 Finishing reminders

Chapter 5. Decentralized Management

-

Decentralized management

5.1 methods

5.2 Attitude Attitude

5.3 Compound management

5.4 Finishing comments

Chapter 6. Related Tasks

6.1 Transaction Prioritization Standards

6.2 Transaction Prioritization and Contention Transparency

6.3 Decentralized Management

Chapter 7. Discussion, limitations and future labor

7.1 ordering transaction

7.2 Transaction Transaction

7.3 Distribution of Voting Power to Change Intelligent Contracts

Conclusion

Appendices

Appendix A: Further Analysis of Prioritization Standards of Transactions

Appendix B: Further Analysis of Prioritization and Contention Transparency Transactions

Appendix C: Further Analysis of Voting Power Distribution

Bibliography

In this chapter, we provide the required background to blockchains and intelligent contracts. We then demonstrated the context for the prioritization of the transaction prioritization, followed by the transaction transaction and transparency. Next, we displayed background information about decentralized management. Finally, we introduced background details about layer 2.0 solutions aimed at enhancing the scalability of blockchains.

2.1 Blockchain and Smart Contracts

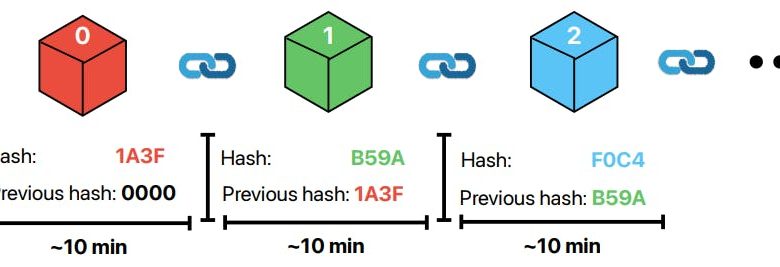

A blockchain is a decentralized and distributed ledger of cryptographically linked records of transactions stored in blocks. A block is a set of zero[3] or more transactions. In the case of Bitcoin, a block also includes a Coinbase transaction, which is responsible for transferring rewards (or compensation for miner's efforts) to the miner's purse. These blocks are coherent, tracking back to the original (or “Genesis”) block. Figure 2.1 presents a description of a blockchain with a rate of integration of 10 minutes. The Ledger was maintained and continued to be expanded by the blockchain participants by conducting a variety of operations. For example, those who provided the transaction, issued transactions and shared it with other participants through a peer-to-peer network (P2P). Such transactions are considered unconfirmed until they are added permanently to the blockchain. Some more, called miners[4] . They suggest the new block on the P2P network where others can verify and, if successfully, add to their blockchain copy – to expanding the ledger or chain of blocks. The miner generally collects a reward in the form of new minted coins as an incentive for their contribution to

The network includes transaction fees provided by the givers. We use the word “fee” to generally refer to the incentive offered by a user to miners for prioritizing the integration of their transaction into a block, although its exact form may vary, for example, fee (or paid-per-byte) to bitcoin and gas price at Ethereum[5]. To join a blockchain, miners use a software implementation (with the hardware) we refer to as a node. A node allows a miner to receive broadcasts of transactions and blocks from their peers, prove data, and mine a block. The nodes line up with unconfirmed transactions received through broadcasts in an in-memory buffer, called mempool, from which they are dequered for integration in a limited block size. One can also configure the node to skip mining and use it only as an observer.

Some blockchains, such as Ethereum, give -up to the implementation of Smart contracts– Contractual agreements that are discounted on software programs running above the blockchain. Smart contracts are usually developed using solidity, a language programming specific domain (solidity team, 2023), and they can be performed at the Ethereum Virtual Machine (EVM). Their implementations comply with standards such as the ERC-20 (Ethereum Foundation, 2023A) and ERC-721 (Ethereum Foundation, 2023B) to ensure compatibility and interoperability to them. These standards determine, for example, the basic functions for the creation and implementation of smart contracts for fungible tokens (e.g.

2.2 Transaction Prioritization Standards

An important detail that is not in the design of a blockchain per (Nakamoto, 2008) is any notion of a formal detail of the prioritization of the transaction. Stately stated, Nakamoto's design does not formally define how miners should choose a set of candidate transactions for confirmation from all available non -confirmed transactions. Despite this shortcomings, “customs” are derived from the use of miners of a shared software implementation: for example, in Bitcoin, miners are mostly using the bitcoin core (bitcoin.org, 2023) software for talking to their peers (e.g.

Specifically a note on the popular implementation of the Bitcoin Core is the GetBlocktemplate (GBT) mining protocol, implemented by the Bitcoin community in February 2012.[6] Getblocktemplate rank of transactions on transactions based on-per-byte fee (i.e., transaction fees that are normalized by transaction size) metrics (bitcoin wiki, 2023a).

In Bitcoin, the term size, refers to the virtual size, each unit which corresponds to four units of weight as defined in the proposal improving the Bitcoin BIP-141 (Lombrozo et al., 2015). The size (or maximum capacity) of a block is also limited to 1 MB virtual size. The prevailing use of GBT (by using the bitcoin core) of miners along with the fact that GBT is maintained by the Bitcoin community that explicitly establishes two criteria. A third standard comes from a parameter of adjusting the Bitcoin core implementation. We are now removing these three customs.

I. When mining a new block, miners choose transactions for integration, from mempool, based solely on their fee rates.

II. When building a block, the miner's order (area) higher pay rate transactions before lower pay rate transactions.

III. Transactions with a fee rate below a minimum threshold are ignored and never focused on the blockchain.

The implementation of the GBT protocol on the Bitcoin Core is the source of the first two criteria. The GBT rank order determines the same which sets of transactions are selected for integration (from mempool) and in what adherence -is placed in a block. GBT dictates that a transaction with higher pay-by-byte will be selected before all other transactions with lower paid-per-byte. It also sets that within a block of a transaction with the highest-by-by-by-by-by-payment, followed by the next highest fee-per-byte, and so on.

The third standard comes from the fee-by-by-by-by-byte threshold parameter. The bitcoin core, by design, will not accept any transaction with a fee rate below this threshold,

Essential filtering of low-rate transactions from even received in mempool. The default (and recommended) value for that -configure threshold is set to 1 Sat/b. [7]

May -set:

(1) Johnnatan Messias Peixoto Afonso

[3] As miners can also mine a block without any transaction here, we refer to those blocks as empty blocks. [4] Throughout this thesis, we use terms of miners, mining pools, mining pool operators (MPOs), and hinder the proposer to replace. [5] Ethereum recently replaced the consensus mechanism from the Proof-of-Work to Proof-of-Stake with the Merge Hard Fork deployed on September 15, 2022, in Block Number 15537394 (Ethereum Foundation, 2022A, B).