DeFi on the rise while ADA and XRP lead the losses

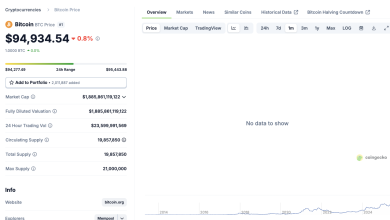

In one more context macroeconomic uncertainty and anticipation for Federal reserveDecisions, the cryptocurrency market, has shown mixed signals. While Bitcoin remains stable above $ 94,000some of the main tokens like Cardano (ADA) And Xrp recorded significant losses.

On the contrary, the tokens linked to Decentralized finance (Challenge)such as THRESHING,, AaveAnd CRVhave gained ground, reporting a change in investor interest to projects with concrete utility And yield mechanisms.

ADA and XRP declining: The wait for the Fed weighs on the markets

Tuesday, Cardano (ADA) And Xrp led the losses among the main cryptocurrencies. The decline, around 4% respectively, occurred at a time of great anticipation for the outcome of the next Federal Open Market Committee (FOMC) meeting. Although forecasts indicate that interest rates will remain unchanged, market players are on alert for all signals that could emerge from the president of the Fed president, Jerome Powell.

Even Ethereum (ETH) experienced a slight decrease, with a drop near 1%while DOGECOIN (DOGE) lost 2%. On the other hand, Bnb recorded an increase in 1.3%. THE Coindesk 20 (CD20) The index, which follows the main tokens by market capitalization, has lost a total of 1.8%reflecting a careful feeling among investors.

Despite the volatility that affected other digital assets, Bitcoin (BTC) Maintained a certain stability, remaining above the threshold of $ 94,000. After a brief drop below this level on Sunday, the most capitalized cryptocurrency continued to move to a narrow beach, indicating a consolidation phase.

This stability of bitcoin seems to reflect greater caution among investors, pending macroeconomic developments and clearer signals from the American Central Bank.

Increased: Media, Aave and CRV attract attention exceeding Ada and XRP

While even Losing the call, the interest of investors moves to projects with solid and well structured foundations tokenomics. In particular, the tokens linked to DEFI benefit from this change of direction.

Among these, the media shock stands out, the token of Hyperliquidal platform, which recorded an impressive increase in 72% Last week, positioning itself as the best interpreter among the 100 best tokens by capitalization. Aave and CRV have also shown powerful growth signals, with bulls 40%.

According to Kay luCEO of Hashkey eco labs“While the same fall from the radar of investors, the emphasis moves to projects with More robust fundamental And More sustainable economic mechanisms. “In a message on Telegram, Lu added that” Defi ecosystems benefit from this change, especially in a context where Bitcoin shows less volatility and macroeconomic uncertainty persists. »»

All eyes of the Federal Reserve

The main catalyst for markets, both traditional and crypto, remains the decision of the federal reserve on interest rates. General expectations indicate a increased breakBut Jerome Powell's words could provide crucial indications for the future positioning of bulls and bear investors.

According to Augustin fanhead of ideas Signalplus::

“We do not expect the FOMC to trigger an important movement on the markets. This is a situation of “heads or tails” concerning management. Cryptocurrencies will probably take the growth in profits growth and how the economy will absorb the impact of recent trade policies. ”

Fan also stressed that, although the stock market is a tariff in a risk of moderate recession, around 8%, signals from bond markets and macroeconomic forecasts are decidedly more cautious.

Trump and China: no imminent dialogue, but the risk is contained

To further complicate the macroeconomic image, last week President Trump Confirmed that there were no immediate plans to reopen commercial negotiations with China, refreshing the hopes of a possible agreement. However, the possibility of Separate trade agreements helped maintain some optimism between investors, avoiding a collapse of the feeling of risks.

This dead end in relations between the two global economic powers adds an additional layer of uncertainty, which is also reflected in the cryptocurrency markets, more and more sensitive to geopolitical developments and monetary policies.

“` Html

A look to the future: Defi as a refuge in uncertain times?

“”

Bitcoin showing signs of stabilization and interest in the same decrease, decentralized finances could emerge as one of the most resilient sectors on the cryptography market. Recent media threshing gains, Aave and CRV suggest that investors reward projects with real utility,, sustainable yieldAnd economic transparency.

In a context of Contained volatility and macroeconomic uncertainty, DEFI could represent a New growth border For the cryptocurrency sector, offering investors a more solid alternative compared to speculative trends in the past.

While the markets are impatiently awaiting the next movements of the Federal Reserve and the evolution of trade tensions between Stati uni cinathe cryptography sector continues to reorganize, by rewarding concrete innovation And Solidity of projects.