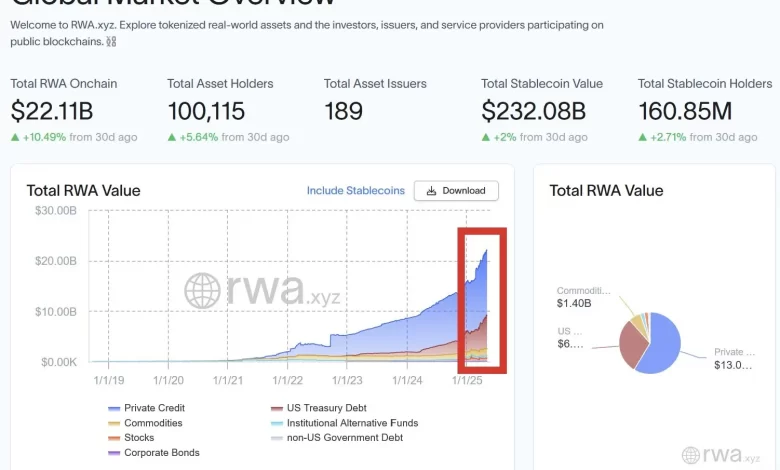

RWA tokenization market surges to new all-time high

Channel data have shown that tokenized real world assets reach a top of $ 22.1 billion, an increase of 10.5% in just 30 days. The Rwa.xyz analysis platform revealed that the push was motivated by the private credit and the debt of the American treasury.

Last week, she alone saw many announcements of traditional financial institutions and native blockchain companies advance their RWA initiatives. Companies like Blackrock, Libre and Multibank have revealed their new RWA initiatives, reporting an increasing adoption of RWA.

Real assets tokenized have reached a top of all time

🚀 TOKENIS real world active ingredients reach a top of $ 22.1 billion in onchain!

🔸 + 10.5% growth in just 30 days

🔸rose by private credit and the debt of the US Treasury

🔸Over 100K holders actively participating pic.twitter.com/2fudabfdpz– Leon Waidmann 🔥 (@leonwaidmann) May 6, 2025

The Rwa.xyz analytical platform noted that on May 6, the active world tokenized reached a summit of 22.11b. Channel data have also shown that active tokenized real world have seen a 10.5% leap over the past 30 days.

The analysis company has shown that RWA holders have reached just over 100,000, or 5.64% compared to 30 days. At the time of publication, there is also a total of 189 tokenized active ingredients.

Rwa.xyz said that the leap into the tokenization of active assets was widely fired by $ 13 billion in private credit and $ 6.6 billion in the Debt of the US Treasury. Public equity has represented $ 448 million in total RWA value, basic products with $ 1.4 billion and institutional alternative funds adding around $ 470 million.

The analysis company revealed that on May 1, the Stablecoins recorded nearly $ 30.5 million in new emission volume. The company stressed that the total value of the stablescoin exceeded $ 232 billion, with 160.85 million total stablecoin holders.

Rwa.xyz data have shown that the market value of the US Treasury Tokenized is currently amounted to $ 6.5 million. The company also noted that Ethereum explains the share of the market lion, welcoming more than $ 4.9 billion in token treasury.

Institutional adoption feeds the growth of RWA

Blackrock laid On April 30, to create a class of digital technology shares for its tripper cash fund of $ 150 billion. The firm said that DTL actions will take advantage of Blockchain technology to maintain a shareholding mirror recording for investors. Blackrock has also added that the actions will follow his BLF Treasury Trusts Fund (TTTXX), which can only be bought from Blackrock Advisors and New York Mellon (BNM).

Free too announcement On the same day, tokensize $ 500 million in telegram debt thanks to its new telegram bond funds (TBF). The company said that the fund will be available for accredited investors and usable as a guarantee for ONCHAIN loans.

The biggest title to finish the week came from Dubai, where the Multibank group sign A RWA tokenization agreement of $ 3 billion with the Arab real estate company of Arab Emirates Mag and the Blockchain Mavryk infrastructure provider. The company argued that the agreement was the largest RWA tokenization initiative to date.

“The recent increase is not arbitrary. This happens because everything aligns. The rules become clearer on the main markets. The technology is stronger, faster and ready to evolve. And the great players do it really – Blackrock is token funds.”

-Eric Priscini, CEO of Hashgraph.

The co-founder of Redstone Marcin Kazmierczak argued that recent announcements demonstrate that tokenization has exceeded theoretical discussions in practical applications by market leaders. He also thinks that growing adoption by large institutions gives space more credibility, making others more confident to join us and help stimulate new ideas and investments.

Karmierczak also recognized that the renewed interest in the RWA tokenization is motivated by the pro-Crypto administration of US President Donald Trump and the growing regulatory clarity. Trump was committed to “Make in the United States the world capital of cryptography.” Crypto regulators such as the Ministry of Justice (DoJ) have also announced the dissolution of its cryptocurrency application unit, which reported A softer approach to industry.

Onofrio’s Brickken Felipe’s technology director said that progress in technological capacities, especially in portfolios, also played a key role in propulsion in the adoption of tokens. He argued that macroeconomic pressures push institutions to seek efficiency and liquidity in traditionally illiquid markets.

The CEO of the Herwig Koningson safety tokens market noted that companies love Blackrock have shown that it is possible to build large -scale tokenized token products worth billions of dollars using more than one blockchain simultaneously. He thinks that this is why banks and traditional companies now use authorized blockchains or even private DLT systems.

Cryptopolitan Academy: to come soon – a new way of winning a passive income with DEFI in 2025. Find out more