Strategy Starts May With 1,895 Bitcoin Buy—Is More Coming?

Michael Saylor's approach was announced by a new Bitcoin purchase to start in May. Here's how the remaining month could go, based on the previous pattern.

The approach only added 1,895 BTC to its bitcoin stack

To a new one Post In X, strategy chairman and co-founder Michael Saylor announced the company's latest Bitcoin purchase. According to the SEC filing, the approach gained a total of 1,895 BTC at an average price of $ 95,167 between April 28 and May 4.

With this $ 180.3 million purchase, the firm's BTC holdings combined to 555,450 BTC. In total, the company spent $ 38.08 billion to get this stack.

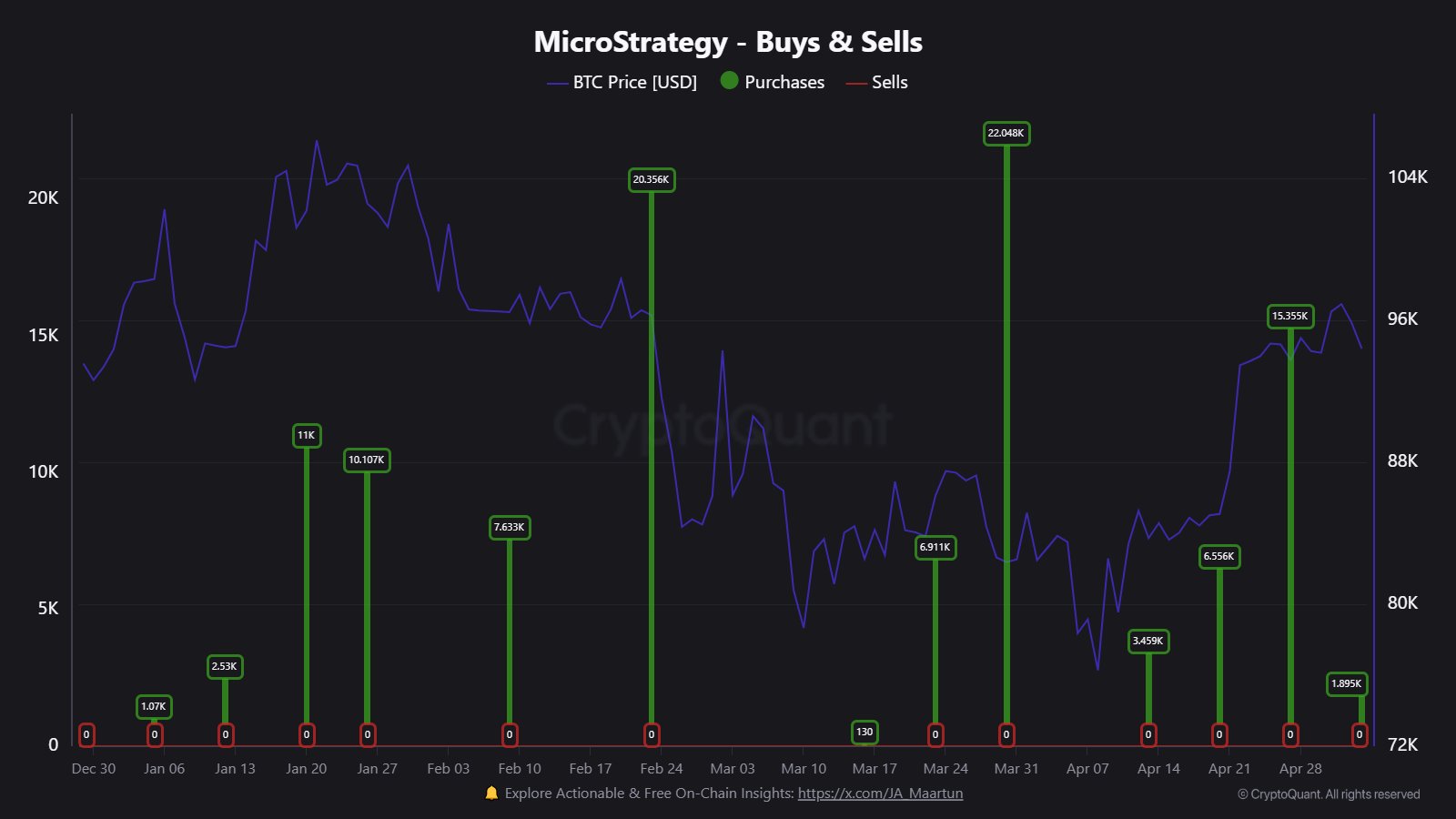

In the past few months, the approach has been active in their purchase of Bitcoin and Cryptoquant Community Analyst Maartunn noticed an interesting -kinda pattern related to these purchases.

Below is the chart shared by the analyst.

The timeline of the purchases made by the firm during the last few months | Source: @JA_Maartun on X

“The first purchase of Microstrategy of the moon is always the smallest. It develops as the moon is emerging,” says the analyst. The latest 1,895 BTC acquisition is already happening the first for the month of May. As such, it is possible that later to buy this month, if any, it will involve a larger amount than this, if the pattern should go through.

The company's Bitcoin Reserve currently has a cost of around $ 68,550, so at the latest cryptocurrency exchange rate, it sits on a revenue of about 38%. So far, it will appear that the stakes of the Saylor firm are working.

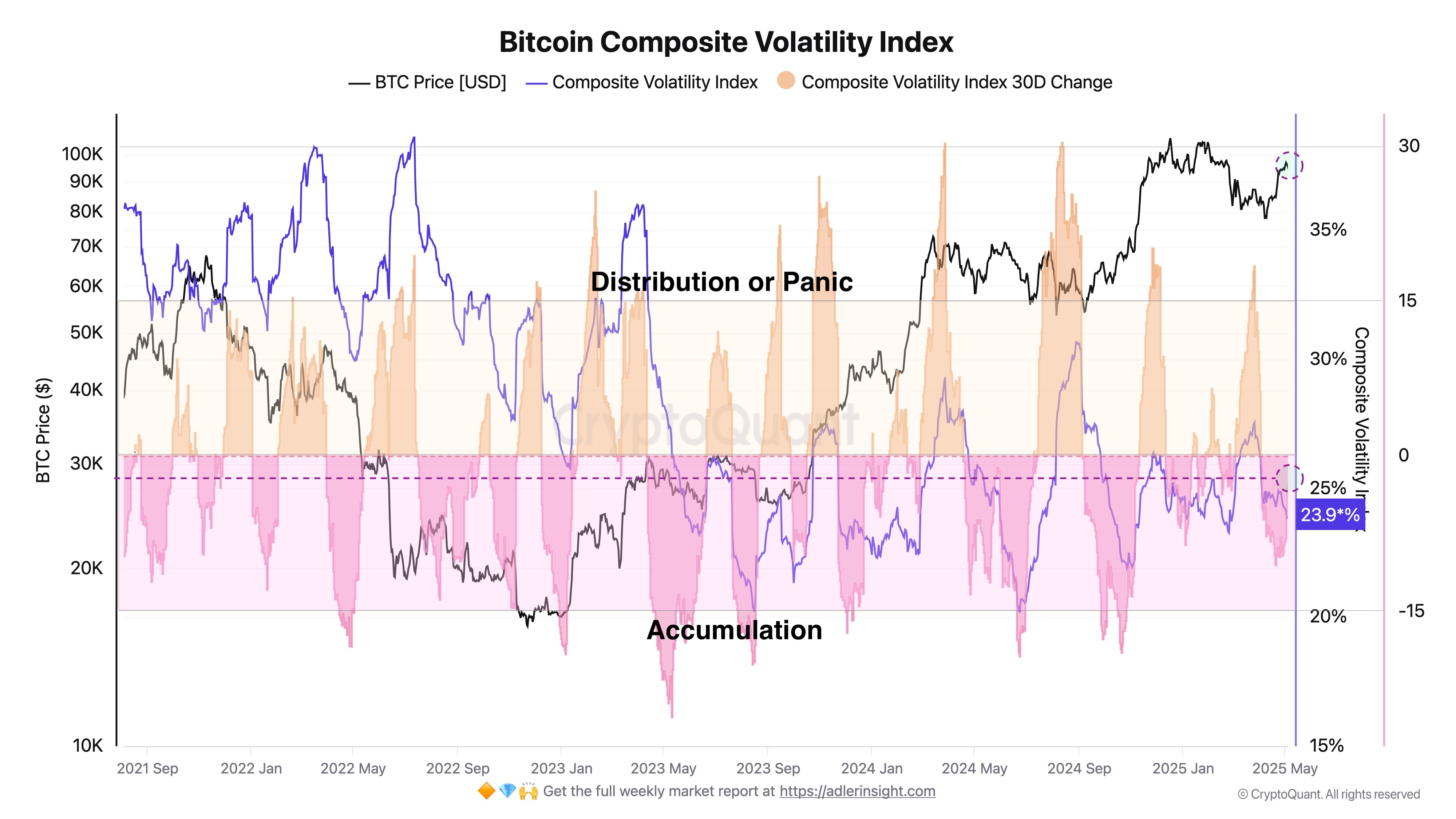

In some other news, there is a cryptoquant set Axel Adler JR has shared how BTC is currently looking from the Lens of the Composite Volatility Index created by the analyst.

“The assessment of Bitcoin's address activity, which undergoes the composite volatility index and its 30-day change, allows us to identify the market macro phases,” says Adler Jr.

Here is the chart for an analyst-shared indicator, which shows the trend in its daily value and 30-day change in the last few years:

Looks like the 30-day change in the metric has been negative in recent days | Source: @AxelAdlerJr on X

According to Adler JR, the 30-day change in the Bitcoin Compositive Volatility Index which below the 0% mark suggests a stage of accumulation from investors. Similarly, it is more than 15% indicating a distribution or phase of sale of panic.

From the upper graph, it is clear that the 30-day change in the indicator has been a negative value recently. Currently, it is sitting at -3.5%. Therefore, from the perspective of this indicator somehow, investors accumulate.

BTC price

Bitcoin saw a pullback at levels below $ 94,000 earlier in the day, but it appears that the coin has found a rebound because its price has returned to $ 94,800.

The trend in the BTC price over the last five days | Source: BTCUSDT on TradingView

Featured image from Dall-e, Cryptoquant.com, chart from tradingview.com

Editorial process For Bitcoinist centered on delivering thoroughly researched, accurate, and unbiased content. We promote strict sources of sourcing, and each page undergoes our team's enthusiastic examination of the leading technology experts and timely editors. This process ensures the integrity, relevance, and value of our content for our readers.