Can Positive Global Cues Sustain the Rally?

- Summary:

- Sensex and Nifty 50 rose on May 6 as markets react to revenues and global clues. Can the rally hold the Fed decision?

Indian markets opened positively on Monday, May 6, as the benchmark indices expanded up the upward momentum last week. Sensex climbed to 80,661.62 in early trade, while Nifty 50 opened up to 24,419.50.

The start of this upbeat will come after the funny 50 spent most of the last week of trading in a tight 600-point range. The action is now lifted up the hope of a breakout, with bulls looking to recover higher areas before the FOMC policy decision later this week.

Sensex price now, May 6: Can bulls break at 81,000?

Sensex opened the firm this morning, but it collapsed in the fight just under the 81,000 mark; That level clearly makes the nervous traders. The recent run-up has been steady, but not exploding, and the candle is now showing hesitation. You can see how it grinds higher from the base of April, but the move is tedious. If it removes 81,000 and holds it, there is a room to 82,700.

If not, there is a true risk of a pullback around 78,500, a zone that has been sticky before. So far, the bulls are in control, but they are not getting a free ride.

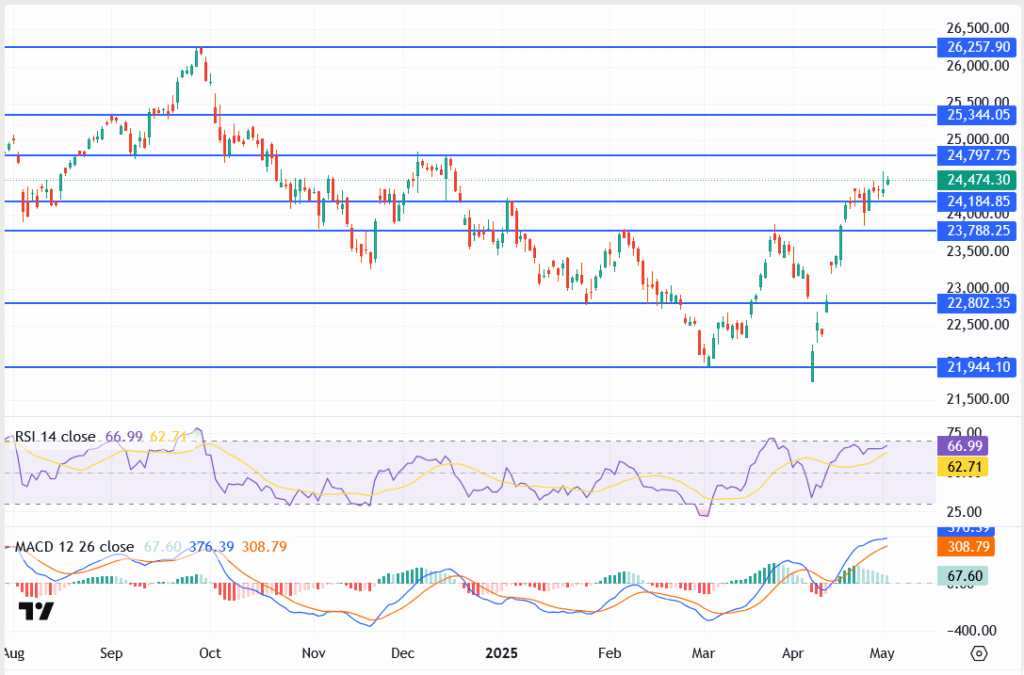

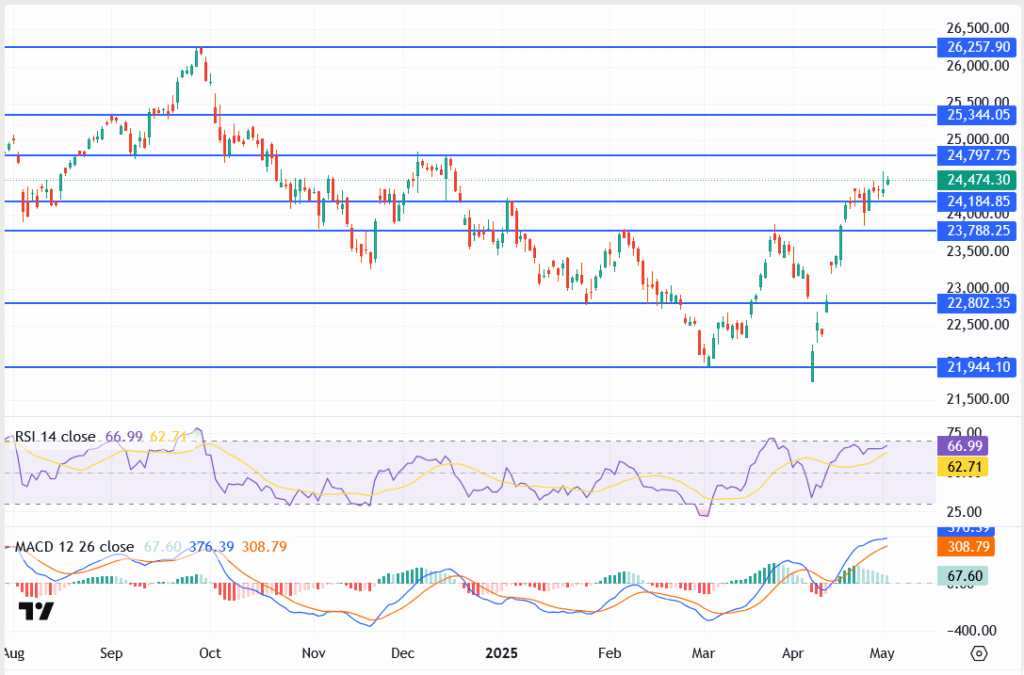

Nifty 50 Prices Now: Index coils under resistance near 24,500

Nifty tries to be free from the recent 600-point range, and the early trade suggests bulls testing the upper band. The index is held above 24,000 for most of the last week, and the push now to 24,500 brings it to 24,800-255,300, which is the next technical barriers.

See also

Momentum indicators are leaning against bullish, but the index is more than 1,800 points away from all times high. A clean breakout and near the top of 24,600 will need to signal strength. So far, it is still bound, but the pressure is building.

Conclusion

It was a strong start on Sunday, but still didn't call it a breakout. There is still a lot of the table, income, global motion, and the fed decision to come. So far, markets are holding well, but merchants are not ahead of themselves.