XRP Price at Risk of Dropping Below $2 Amid Bearish Signals

XRP was under pressure, down by almost 7% last week. However, its 24 -hour trading volume reached about 52%, reaching $ 2.3 billion, indicating elevated activity around the altcoin.

Multiple technical indicators point to a bearish perspective, including a weak RSI, a fully bearish ichimoku cloud setup, and a floating cross to death on EMA lines. In fragile and basic levels in playing, the next XRP transfer will likely perform if consumer or momentum steps continue to explode.

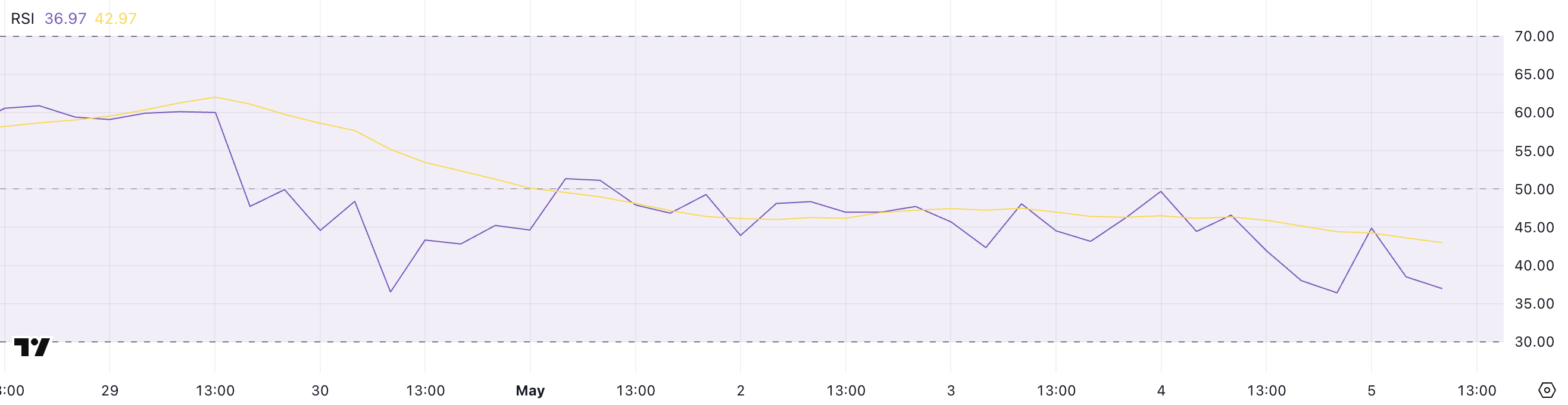

XRP RSI falls to 36.97: Is a upside down?

The KaMag -Child strength of the XRP (RSI) fell sharply to 36.97, down from 49.68 a day ago. This denial suggests a clear loss of momentum, with the indicator approaching oversold territory.

RSI is a widely used momentum indicator range from 0 to 100. It helps entrepreneurs identify potential reversal zones.

The readings above the 70s usually indicate a possession is overwhelming and may face a pullback, while the readings below 30 suggest that it can be oversold and primed for a bounce.

At the RSI of the XRP today at 36.97, it is closer to the oversold threshold but has not reached it yet. This level weakens the purchase of pressure and may mean additional downside in the short time if the sale continues.

However, if the RSI drops below 30 and stabilizes, it can resort to buying interest from entrepreneurs who expect a rebound.

So far, the XRP is in a custody zone-nor is it too strong or impartial-the sealing that price action in the next few days will be important in determining its short-term direction.

Ichimoku signed downtrend for XRP with a clear cloud resistance

The ichimoku cloud chart for XRP shows a specific bearish structure in all the key components. The price is positioned under the Tenkan-Sen (Blue Line) and the Kijun-Sen (Red Line), indicating that the short-term and medium-term momentum is aligned with the downside.

This adjustment usually suggests a continuous sale of pressure without clear signs of returning to the immediate term. Moreover, the Chikou Span (green lagging line) is able to walk well below the current price and cloud, which strengthens a strong emotion from a momentum perspective.

The alignment of these elements indicates that the XRP remains under the downward pressure, with consumers who cannot recover the control of the trend.

Kumo (Cloud), which represents future support and resistance, has become red and expected down – another bearish signal. The price well below the cloud proves that the XRP is in a full bearish phase under the ichimoku review.

In addition, the gap between the Senkou Span A and B lines (the edges of the cloud) expand slightly, suggesting that the bearish momentum can still be strengthened than fading. To move the perspective, the XRP must be broken above the kijun-sen and eventually push into the cloud, neutralizing bearish momentum.

Until then, the technical perspective remains vulnerable, and merchants can remain cautious unless a clear return pattern appears.

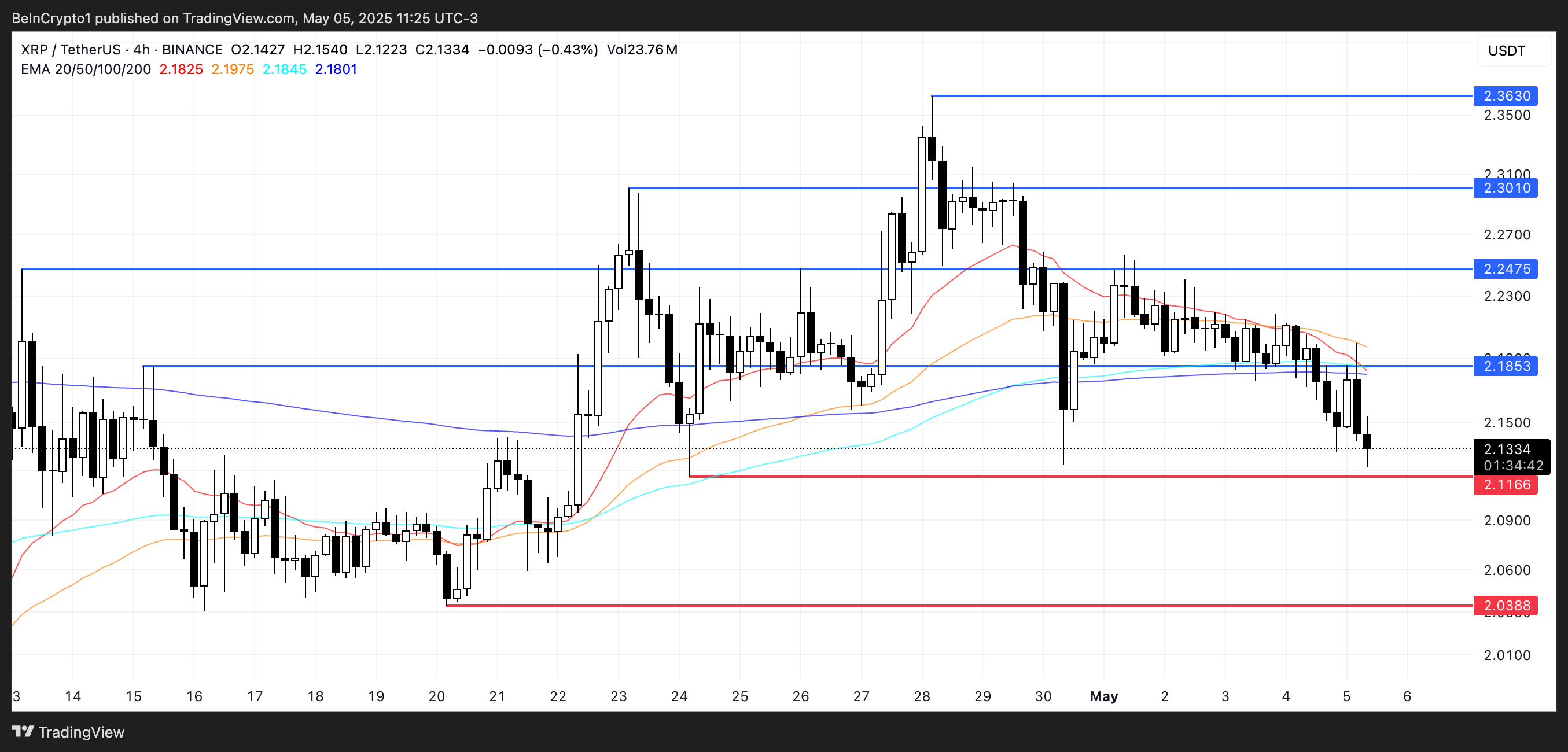

XRP Outlook: Death Cross Looms, Resistance Levels Focused

The exponential transfer of the averages (EMA) of XRP shows signs of weakness, with a potential cross cross formation at a reach.

A cross cross occurs when a short-term EMA crosses under a long-term ema, which sign a possible transition to a prolonged fall. If this Bearish crossover confirms, the XRP price can switch to test the support level at $ 2.11.

A failure to handle that level could speed up the decline, opening the door for further losses towards $ 2.03.

However, if the XRP manages to regain strength and reverse the current momentum, it can target resistance to $ 2.18.

An upper level breakout would be a short -term bullish signal and could push the price to $ 2.24.

Continued buying pressure beyond that can set the stage for a move to $ 2.30 and possibly $ 2.36, especially if the broader market sentiment improves.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.