Ethereum (ETH) Targets Breakout with Pectra Upgrade in Sight

Ethereum (ETH) enters a critical week, with technical signals, data on the chain and a major upgrade all convergent. Pectra upgrade, defined for May 7, aims to improve the functionality of milestones and wallets, but short -term volatility is likely during deployment.

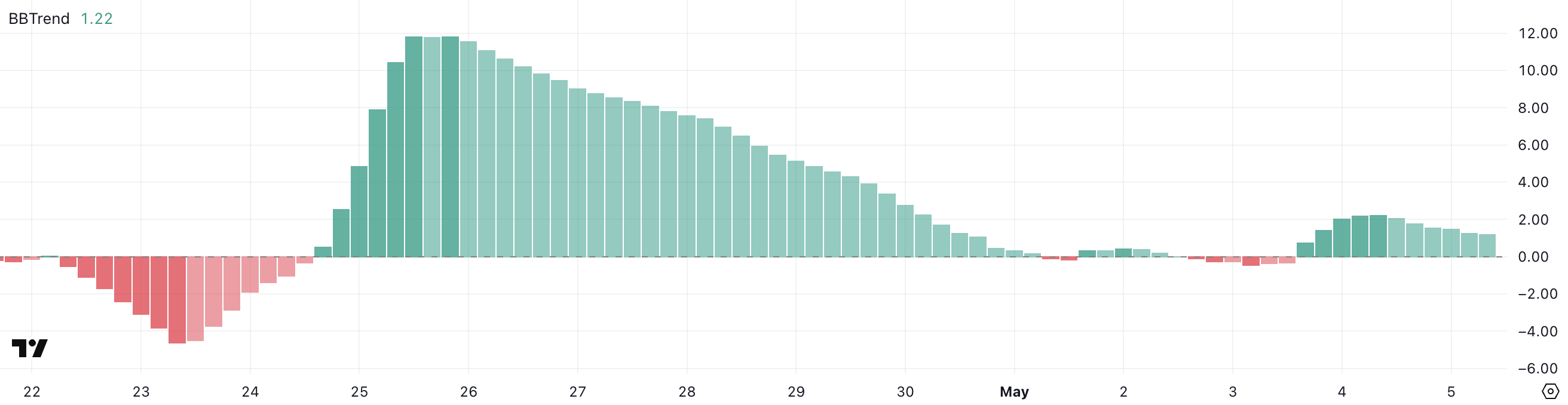

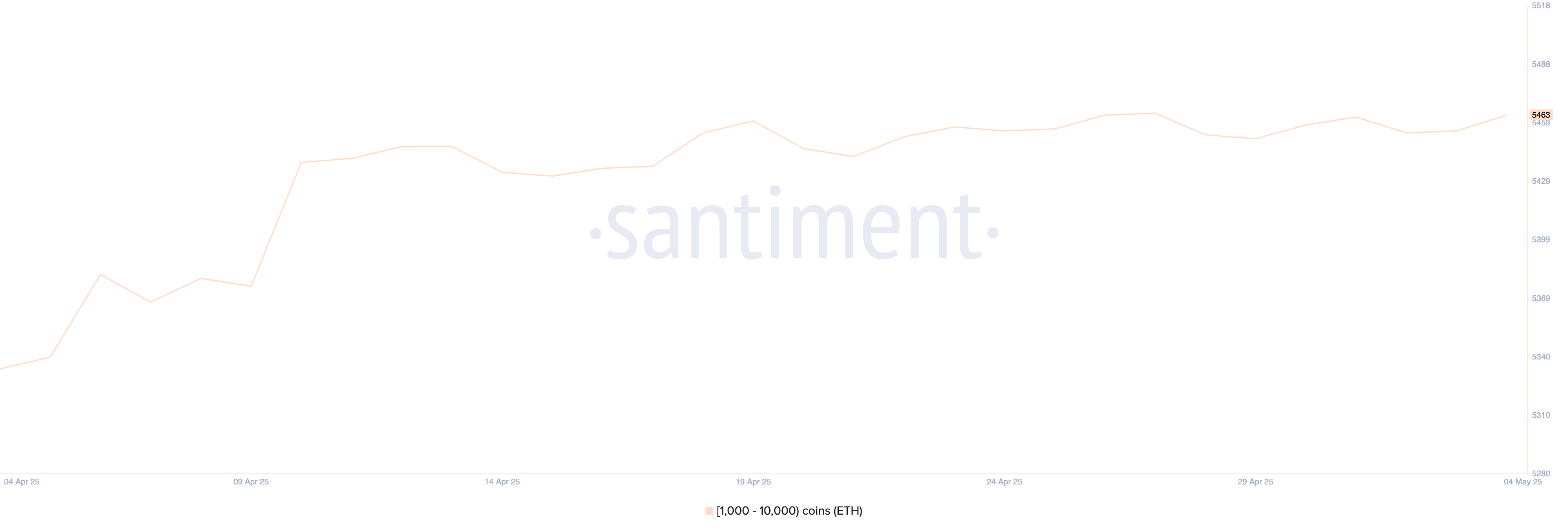

Meanwhile, Bbtrend d'Eth is at 1.22, showing an early upward impulse, but not yet strong enough to confirm an escape. At the same time, the activity of the whales remains close to 5,463 addresses, and the price continues to be negotiated in a tight range between $ 1,828 and $ 1,749 – fixing the scene for a break or a potential break.

Ethereum pectra upgrade set for May 7: what to expect

The long -awaited upgrade of Pectra d'Ethereum should be posted on May 7, introducing 11 new Ethereum improvement proposals (EIPS). The EIP-7251 stands out from the increase in the implementation ceiling from 32 ETH to 2048 ETH, aimed at rationalizing validator operations and stimulating the implementation efficiency.

The upgrade also includes improvements in the portfolio focused on the user experience, such as easier recovery and gas -free transactions, which could lead to a wider adoption of the DAPP. Although this can increase the demand of ETH in the long term, exchanges could temporarily stop ETH transfers during deployment, causing short -term volatility.

Although the upgrade promises significant improvements, it has already faced several delays due to prolonged tests on networks like Hoodi and Sepolia. Fluid deployment can strengthen confidence and price, but all technical problems could trigger negative reactions on the market.

ETH trend signal at 1.22: early rise in early or just noise?

The bbtrend indicator of Ethereum is 1.22, signaling a slight bias bias. During the last day, the BBTREND reached a 2.23 summit, showing a stronger momentum before retreating slightly.

Although current reading has cooled, it remains positive, which suggests that the upward trend is not yet invalidated. The merchants look at if Bbtrend can go up to confirm a renewed force or if the momentum continues to fade.

The Bbtrend (Band-Break Trend) is an indicator based on volatility designed to detect the force and the price of price trends. Readings above 1.00 generally suggest an upward trend, while readings below -1.00 indicate a downward trend.

The values between -1.00 and 1.00 are considered neutral or without trend, indicating a lateral movement or a low conviction in both directions. The more the Bbtrend moves from zero, the stronger the trend, which makes values as 2,23 notable for trend confirmation.

With Bbtrend d'Eth at 1.22, the indicator suggests a weak but positive trend – Ethereum's suggestion can enter the early stages of an upward trend.

However, this is not a solid level of escape, which means that the price could always be reversed if the sales pressure increases or that the momentum fades.

A thrust above 2.00 would probably confirm a sustained bullish impulse, while a fall below 1.00 could indicate a return to consolidation or even a passage to lowering conditions.

Adding to the wider image, the number of Ethereum whales – additional holding between 1,000 and 10,000 ETH – is currently 5,463.

This number has fluctuated in recent weeks, fighting to break decisively. The activity of whales is a critical signal on chain, because these major holders often influence the movements of prices by accumulation or distribution. A stable or increasing number of whales generally signals long -term confidence and accumulation, which could support the price of the ETH in the coming weeks.

Conversely, a continuous stand or decrease in the number of whales can reflect hesitation among the largest investors, which potentially limits the rise up.

ETH remained in a fork while the traders await an escape or a breakdown

Ethereum Price has been negotiated between $ 1,828 in resistance and support of $ 1,749 since April 21. The range has retained more than two weeks, showing the indecision of the market.

The EMA lines remain optimistic, with short -term averages still higher than those in the long term. However, they begin to converge and a death cross could be formed soon.

If the support of $ 1,749 breaks, ETH could fall to $ 1,689. If the downward trend is intensifying, targets like $ 1,538 and $ 1,385 become relevant.

Uplining, if the ETH breaks $ 1,873, it could come together at $ 1,954, and perhaps reaching $ 2,104, recovering the level of $ 2,000 for the first time since March 27.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our general conditions, our privacy policy and our warnings have been updated.