JPMorgan Chase starts blocking Zelle payments from social media after $ 206,800,000 in fraudulent lost

The largest bank in the United States has begun to block Zelle's transactions after the payment platform allegedly facilitated hundreds of millions of dollars into fraud.

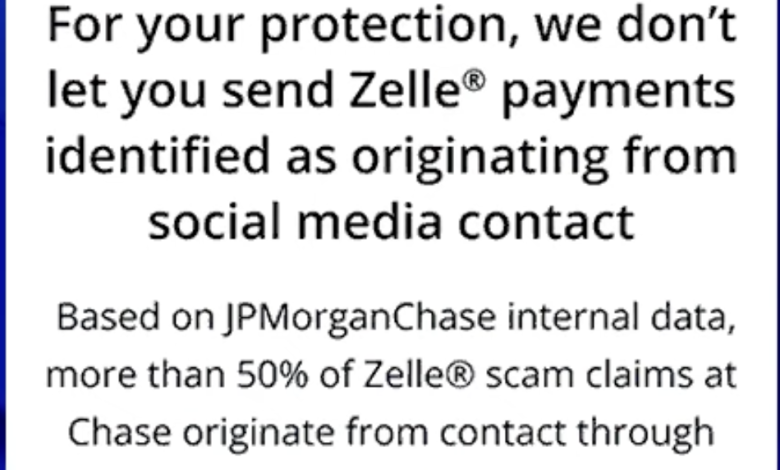

US banking giant JPMorgan Chase now gives pop -up windows to Zelle users trying to send money to people who appear from social media, CNBC reports.

The bank warns that more than half of Zelle fraud has been initiated through social media platforms.

Melissa Feldsher, Head of Payment and Loan Innovation in JPMorgan, says the bank does not recommend using applications such as Zelle to send payments to people you are not familiar with.

“Many interactions in social media are between people who don't know each other, and as a result you have communication [that are] which leads to money exchange between people who do not know each other.

We think that in the case of making and sending money to someone you don't know, you should use a product that has purchasing, products we offer at Chase, such as debit cards and credit cards. We don't think you should use products like Zelle – you wouldn't use someone you've never met money to send money to send money or goods you've never seen. ”

Recent Senate report Since July last year, it was found that $ 207 million in Zelle payments would be disputed as fraudulent fraud of JPMorgan Chase, Bank of America and Wells Fargo – the vast majority remained around.

https://www.youtube.com/watch?v=Z11u8nyhc3o

Follow us on XTo do, Facebook and Telegram

Do not skip a stroke – order to receive e -mail notifications directly to your inbox

Check the price of the prices

Surf a blend of everyday hodl

& Nbsp