WTI drops below $ 56.00 if OPEC+ accelerates output trip

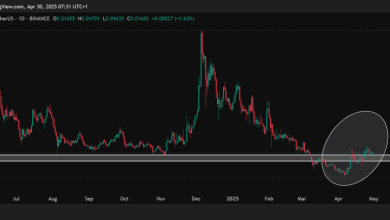

- WTI Price loses nearly $ 55.75 at Monday Asia, which is 4%a day.

- OPEC+ is set to accelerate oil output hikes, considering the price of WTI.

- Iran said it would hit me when the US or Israel attacks.

The US crude oil comparative west Texas Intermediate (WTI) trades about $ 55.75 at the Asian trading lesson on Monday. The price of WTI falls after the organization of petroleum export countries and allies (OPEC+) agreed to produce 411,000 barrels per day in June.

OPEC+ agreed on Saturday to increase the production of another 411,000 barrels a day in June. The decision will follow the surprise in April, agreeing to a larger production hike than May, despite the slowing of weak prices and demand. Reuters said it could launch as many as 2.2 million barrels by November.

Oil prices were the highest monthly loss in April from 2021, as US President Donald Trump's tariffs have been concerned about the economic downturn, which slows down demand while OPEC+ increases production rapidly.

Meanwhile, escalating geopolitical tensions in the middle can cover the negative side of the WTI. Israeli Prime Minister Benjamin Netanyahu has promised to revenge against the Houths after the group shot Israel's head to the airport. Iranian Defense Minister Aziz Nasirzadeh said on Sunday that Tehran would hit me when the US or Israel attacks.

WTI oil whack

WTI Oil has a type of crude oil sold in international markets. WTI denotes West Texas Intermediate, one of the three main types, including Brent and Dubai crude oil. WTI is also called “light” and “sweet” as it is a relatively low gravity and sulfur content, respectively. It is considered a high quality oil that is easy to finish. It is procured in the United States and distributed through Cushing Hub, which is considered “pipeline crossroads”. This is a benchmark for the oil market and the price of WTI is often quoted in the media.

Like all assets, the main thrust of the WTI oil price is the supply and demand. As such, global growth may have increased demand for engine and, on the contrary, with weak global growth. Political instability, wars and sanctions can interfere with supply and impact prices. The decisions of the OPEC, a group of larger petroleum -producing countries, is another major thrust. The US dollar value affects the price of WTI crude oil, as oil is predominantly traded in US dollars, so the weaker US dollar can make oil more affordable and vice versa.

WTI oil price is influenced by weekly oil reserves published by the American Oil Institute (API) and the Energy Information Agency (EIA). Inventory changes reflect a volatile supply and demand. If the data shows the decline in stocks, it may indicate increased demand by increasing the oil price. Higher stocks can reflect an increased bid by pushing prices down. The API report will be published every Tuesday and the day after that. Their results are usually similar, falling by 1% of 75% of the time. The EIA data is considered more reliable as it is a government agency.

OPEC (Oil Exporting States Organization) is a group of 12 petroleum processing countries that jointly decide on double meetings of the Member States. Their decisions often affect WTI oil prices. If OPEC decides to lower the quotas, it can reduce the offer by raising oil prices. If OPEC increases production, it has the opposite effect. OPEC+ refers to an extended group that includes ten additional non-OPEC members, the most remarkable of which is Russia.