Buffett explains why he prefers to invest in stocks instead of real estate

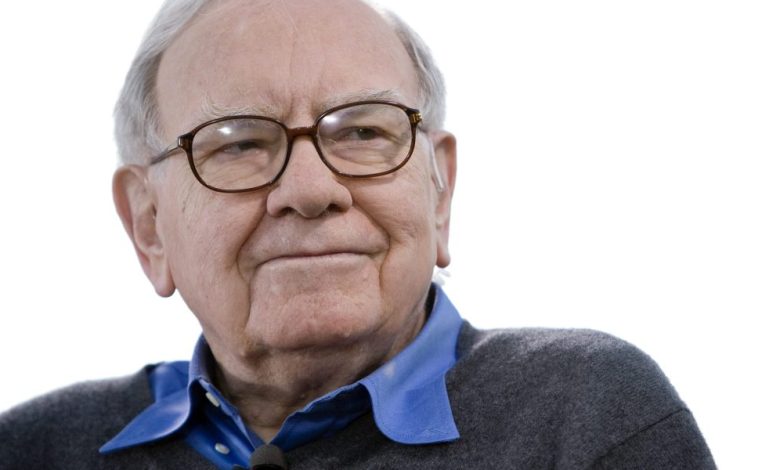

- Berkshire Hathaway CEO Warren Buffett was asked at the annual meeting of the company's shareholder on Saturday about investing in real estate, which he avoided. He prefers to buy and sell stocks for the Berkshire portfolio, saying real estate deals can get tricky and collapse into negotiations.

The investment of legend Warren Buffett, who is planning to come down later this year as Berkshire Hathaway CEO, is known to his wizardry in stocks, but not real estate.

During the annual meeting of the conglomerate shareholder on Saturday, he was asked why he did not buy a property today, at the heart of high rates and economic uncertainty.

“Well, about real estate, it's harder than stocks in terms of communicating deals, time spent, and the participation of many parties in the owner,” Buffett replied. “Usually when real estate is in trouble, you find that you are talking more than the equity holder.”

The popular value -focused value is identified with times when real estate is a bargain, but stocks are cheaper and can be purchased more easily.

He added that the late Charlie Munger, who was Verkshire's vice chairman until his death in 2023, was engaged in more real estate deals and made a significant number of them in the last five years of his life.

“But he's playing a game that is interesting to him,” Buffett said.

However, he believes that if the Munger has a choice between investing only in stocks or just in real estate, his former right hand will choose stocks.

“There are only a lot of opportunities, at least in the United States, which presents itself in the security market than in real estate,” Buffett added.

Another wrinkle in real estate is that a single -owned or a family often owns a huge possession that they have long been, so making a deal is a huge decision for them, he explained.

Conversely, stock deals involving billion -billions of dollars can be made in minutes, completely anonymous, and finally, Buffett said.

Berkshire made some real estate deals in 2008 and 2009, when the mortgage bust sank into the real estate and financial market, but the amount of time they took to close could not compete with stock trade.

“The rate of completion for working on anything in stocks, thinking you have a meeting of price minds, is essentially 100%,” he said. “In real estate, negotiations only start when you agree with deals, and then they take forever. For a 94-year-old, this is not the most interesting thing to engage in something where negotiations can take years.”

Buffett's comments came as the stock market underwent massive volatility in the middle of President Donald Trump's on-again.

Stocks crashed in April after he revealed his “release Day” tariffs, but revealed and revoked the losses on Friday as Trump gave the delays and exclusion, while signing the development of trade deals.

In March, the National Association of Realtors Chief Economist Lawrence Yun mentioned that the wealth of real estate was at all times as stocks broke.

“Maybe people will start focusing to say, where's the stability?” She is told CNBC. “Some people turn toward gold, but maybe other people will return to the solid foundation of real estate at which the mortgage default rate is still close to low -level history.”

This story was originally featured on Fortune.com