Is $100K The Next Target Or A Trap At The Golden Pocket?

Reason to trust

Strict editorial policy dedicated to accuracy, relevance, and no deal

Created by industry experts and reviewed well

The highest criteria for reporting and publishing

Strict editorial policy dedicated to accuracy, relevance, and no deal

MORBI PETUMI LEO et nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible En Español.

The bitcoin bulls are Trying to push higher From just under $ 97,000, trying to confirm the latest breakout above a range of aggregation for many days. After stopping close to $ 95,000 for more than a week, Bitcoin exploded for $ 97,000 before upside down and formed a fair amount of value.

Related reading

This led to a advanced activity in the Blockchain of Bitcoin, and the next perspective was if the current Structure holds for a continuation at $ 100,000 or if this momentum can weaken in a resistance zone.

Bitcoin reached a 6-month peak in network activity

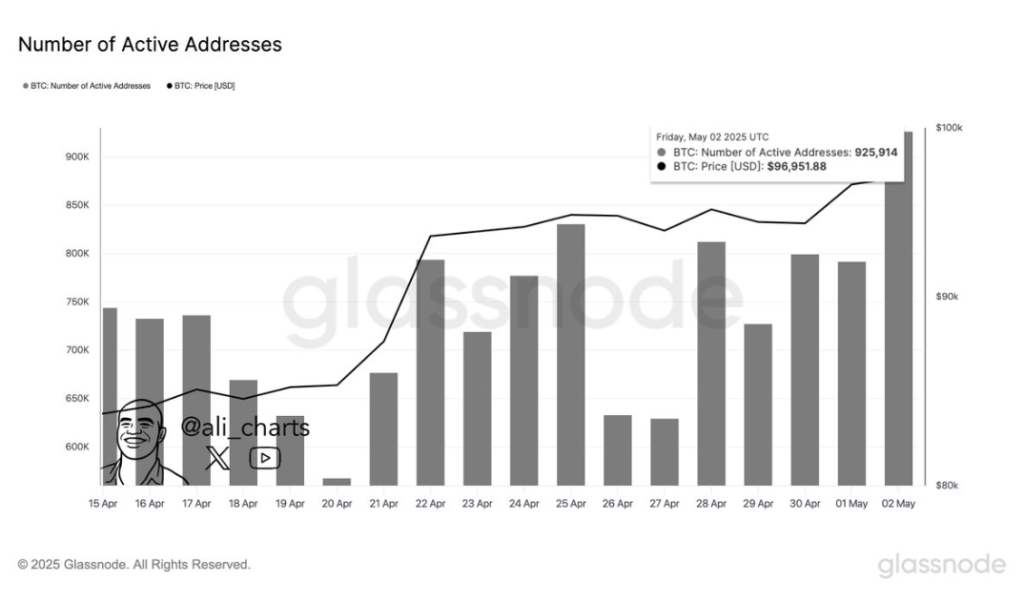

One of the most prominent transfers to the dynamic markets comes from the on-chain side. According to Crypto Analyst Ali Martinez, Bitcoin Only recorded its highest number of active addresses in the past six months. As shared in a post on the Social Media X platform, Martinez noted that 925,914 BTC addresses are active within a day, which is unusual high level of contact In Bitcoin Blockchain.

The accompanying glassnode chart shows how steep this climb, the formation of a gradual climb that began in the last week of April. Notably, the spike in bitcoin activity coincides with the recent reclaiming of $ 95,000 price ranges.

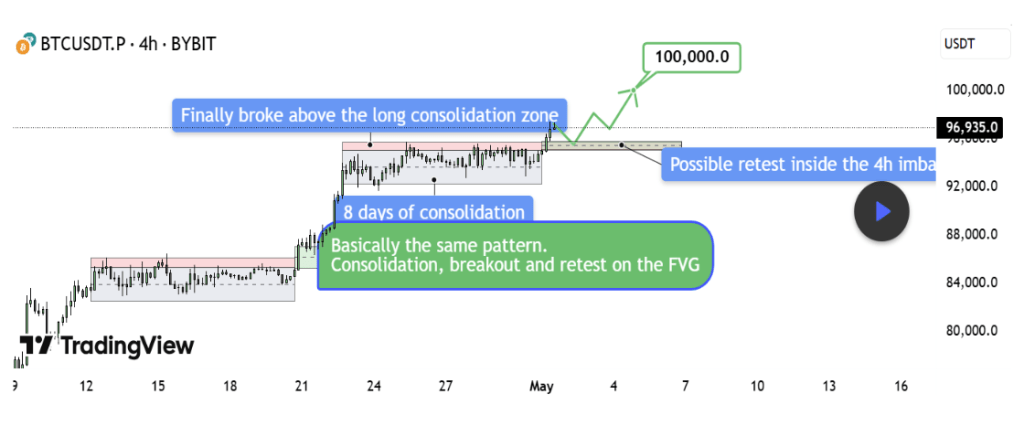

Adding to bullish case, crypto analyst tehthomas shared an engaging Technical examination pointing to a breakout Continuing towards $ 100,000. The interpretation of the BTCUSDT 4 hours time shows the almost identical structure to the one visible in mid -April.

After that, Bitcoin was combined near $ 86,000, exploding, left in a fair amount of value (FVG), retired the space, and raw about $ 10,000. An image of the mirror of this pattern is currently present. The price of bitcoin compressed below $ 95,000, destroyed resistance, and created a fresh FVG between $ 94,200 and $ 95,000.

Tehthomas noted that the key is not chasing the breakout but wait for a clean retest of the new FVG. If consumers are defending that area as they did earlier this month, the road to $ 100,000 is a structure that is not intact. However, even if the structure is currently favored by bulls, the situation can be bearish if Bitcoin returns to the old range below $ 94,000.

Chart from TradingView

Bearish Golden Pocket Setup features risk ahead

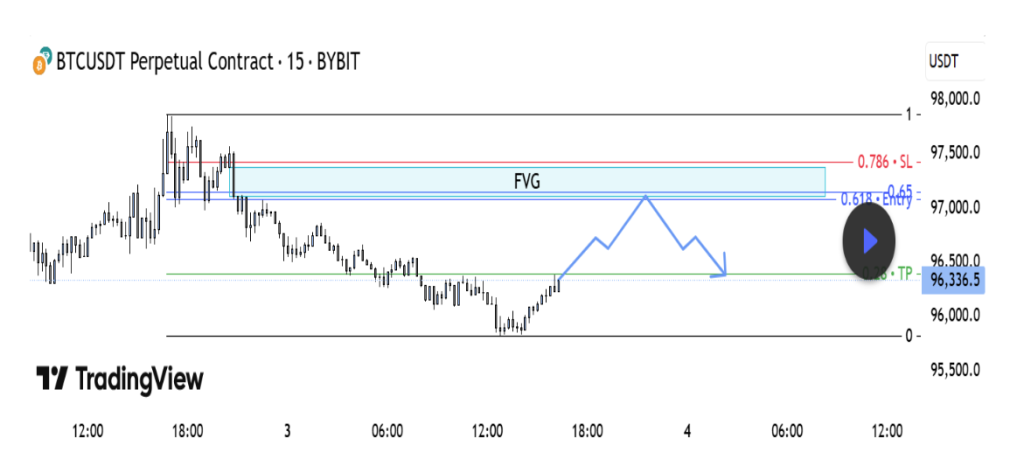

Not all analysts are convinced That bitcoin will reach $ 100,000 again without shakeout first. A counterview to The TradingView platform features a possible short-term bearish setup based on the BTCUSDT 15-minute chart.

According to the analyst, the current upward retirement appears to be corrected rather than impulsive, forming a classic short setup within a strong fair amount of space resistance. The technical examination shows that Bitcoin has withdrawn from a region aligned with a bearish fair value interval and the golden pocket zone defined by 0.618 to 0.65 Fibonacci levels.

Related reading

Like standing, the fair value gap is seated between $ 97,000 and $ 97,450. Should the price fail to break this supply region, it can reverse and catch the bulls.

Chart from TradingView

At the time of writing, Bitcoin traded at $ 96,040.

Featured image from UNSPLASH, chart from tradingview