Trump's tariff shock has reduced consumer feelings and GDP in quarter

President Donald Trump claims that his second white house has the best start of US history. Fresh economic figures tell another story.

Home products slipped in January in January -Marka Quarter, which is the first contraction over three years. Economists blame the imported import wave before the entry into force of new tariffs. In addition, hiring continues and inflation has cooled after the jump last year.

Expectations of household trust, company investment plans and sales, employment and growth have fallen sharply. According to analysts, the main culprit is the tariff fight, which the President triggered the trade partners around the world.

Current financial markets reflect tensions. US shares post the weakest income of every modern presence, and the value of the dollar has fallen further than George W. Bush, Barack Obama or Joe Biden. The voters who support Trump have largely begun to doubt this record for his economic message.

Trump promised to close the trade gaps by means of import duties

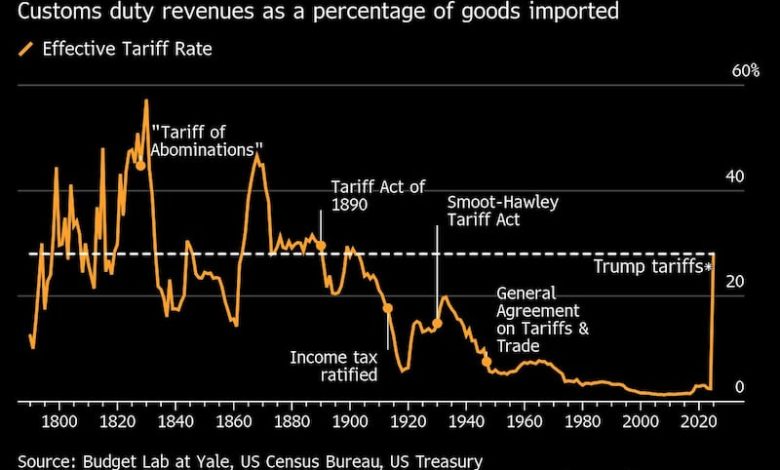

Throughout the campaign and during his first term, Trump promised to use imports to close trade gaps, increase government revenue and bring factory jobs to American soil. The tariffs set out since the beginning of April are the highest obstacle to foreign goods for more than a hundred years, even after the administration suspended the part of the tasks announced on April 2.

The reversals, plus warnings on future fees, have left companies home and abroad, considering the rules that may change overnight. Bloomberg The uncertainty index of the global trade in the economy is now much higher during the collision of the first term of office.

Trump often quotes a trade deficit in over five decades as evidence of a trade deficit that the United States has been “torn”. However, the first effect of new fees was the flood of imports. The companies rushed away from the higher prices, and the monthly trade gap reached the record in early 2025. This import period was large enough to subtract from GDP and tilt the economy into the first quarter.

Working has continued in quarter 2025

In the opening months of the year, renting continued. Employers added 456,000 positions from January to March, exceeding the estimates of the forecasts and the unemployed rate increased slightly. “Great jobs, much better than expected. It is already working,” Trump wrote on social media on April 4, the day the March report appeared.

But the forward -looking data again differ from historical censuses. Most private economists say that major import tasks reduce the cost of both external and domestic products, feeding faster inflation. Studies show that consumers also think: expectations for both one and five-year price increases have increased dramatically.

Retailers saw spending at the end of last year and in the winter, when buyers grabbed cars, computers and other large pond goods before the tariff prices increased. Now that the households are due to the steeper cost and slower growth, several meters of consumer moods have fallen last during the pandemic decline in 2020.

Company executives are equally cautious. Industry surveys will find plans for capital points at the lowest level for more than two years, although companies have historically large cash pads. Leaders say that without clear tariffs, they cannot predict costs or map global supply chains, so equipment orders are on hold.

Cryptopolitan Academy: Soon – a new way to earn a passive income with a defi in 2025. For more information