Without these 3 key rates, there is no mesh season

Nic Puckin, CEO and co -founder of Cypto Education's media company Coinbrureu, has shared the alteration realistic. Former Tradf entrepreneur and prominent digital asset lawyer have highlighted three necessary conditions for Altesason.

Altsason still on the ice: what must change

Alteasason defines the period in the crypto pull in the market, where altcoins significantly outperform Bitcoin. This is a completely welcome event that introduces investors to registering mass profit due to smaller market share of altcoins compared to Bitcoin.

Alteazon's potential in the current bullfield has previously been questioned, analysts refer to the increase in the number of altcoins compared to previous cycles.

In this discourse contributing to Puckin countries The fact that alteseas usually occurs 320 days after Bitcoin half – a target filled after the last half in April 2024. However, Pukrin explains the alt of the current bull cycle, which may only occur after the three important signals are being developed.

First, the analyst states that the dominance of bitcoin must fall below 54%. Bitcoin dominance measures the BTC part of the entire cryptocurrency market. It denotes the percentage of crypto investment in Bitcoin.

Namely, the altum is only apparent after the decline in the dominance of Bitcoin, indicating that investors rotate their capital into altcoins. Nic Puckin explains that the dominance of bitcoin must stop the rise and fall below 54% of the threshold to confirm this rotation.

Despite the need for BTC domination autumn, the Boss Bureau states that Bitcoin has to exceed the highest all of the highest all time in order to induce the Altcoin bull market. Premier cryptocurrency must achieve this feat without pulling liquidity from the whole market.

It is worth noting that in earlier cycles, the Altcoin Market Rally arrives after Bitcoin establishes market dominance, then consolidates, giving investors space to bring their liquidity to speculative assets with lower capital.

The final condition of Nic Puckrin states that the US Federal Reserve must stop all quantitative effort measures (QT) and confirm incoming interest rate cuts to combat current interest rates as 4%. In doing so, Fed may induce the increase in market liquidity, which is necessary for alteration.

An overview of the crypto market

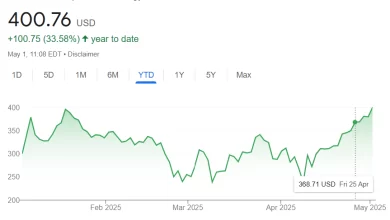

During this writing, the entire crypto market has now taken back the $ 3 trillion brand after last week's overall bullish swing. At the same time, the volume of market trade has fallen by 16.82% and its value is $ 68.83 billion.

Namely, the altcoin season index is still 21 years old, which shows that Bitcoin is still outperforming the big percentage of the Altcoin market and currently not in view of Alttsason. Historically, altate times occur when the index is more than 75, indicating a broad strength throughout the altcoins.

Highlighted Picture from Pexels, Graph of TradingView

Editorial For bitcoinists, the focus of the provision of precise and impartial content has been focused. We support strict procurement standards and each page passes a careful overview of our top technology experts and experienced editors. This process ensures the integrity, relevance and value of the content of our readers.