Solana Faces Death Cross As SOL Price Struggles Below $150

Since April 23, Solana's price has been oscillated within a tight trade range, facing resistance near $ 153.67 and finding support around $ 145.68.

A growing wave of bearish pressure threatens to break this range on the downside, with a basic technical indicator on the side confirmation of a major sales signal.

Solana faces risk while sellers are tightly grip

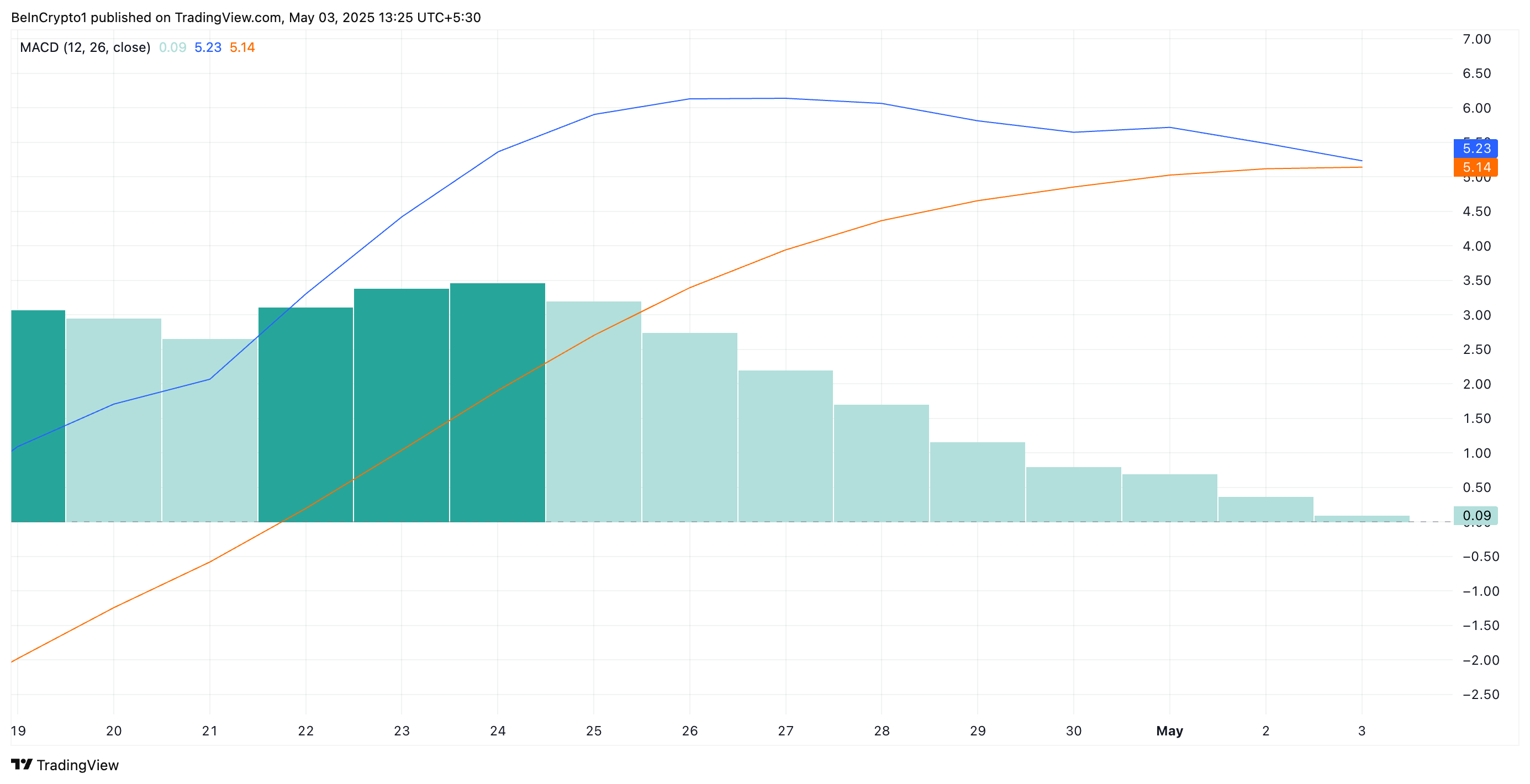

The average average variety of macd indicators prepared to produce a cross cross, a bearish crossover where the MACD line under the signal line.

Like this writing, the MacD line of coin (blue) rests near the signal line (orange), waiting for a catalyst to push it to the bottom. This pattern is often preceded by a long downtrend and widely viewed by merchants as a sign of weakening price strength.

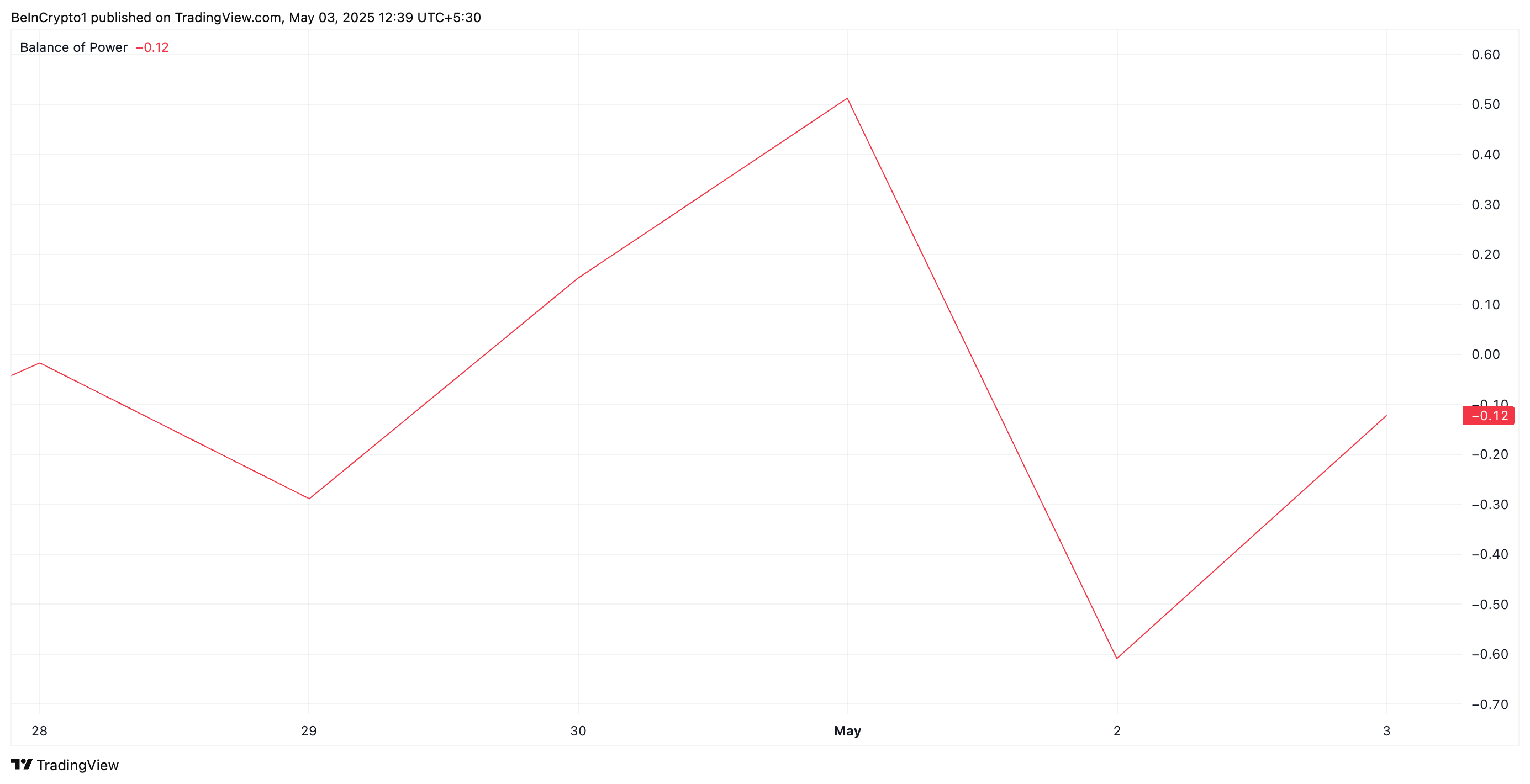

In addition, Sol's Balance of Power (BOP) is currently negative, strengthening the downtrend. This indicates that sellers get control over the market. At the time of press, it stands at -0.12.

The BOP indicator measures the power of purchase compared to the sale of pressure by comparing the closing price to the trading range at a given period.

When the BOP is positive of an asset, indicates that consumers are in control, indicating strong upward momentum and potential for the continuous price gain.

On the other hand, like Sol, a negative BOP value indicates that sellers dominate the market. This suggests an increase in downward pressure on the SOL and clues to the potential initiation of a new stage of decline.

SOL faces the main support test at the center of seller's pressure mounted

As the bearish momentum develops, SOL risks destroy under the support level of $ 145.68. A decisive rest under this threshold will confirm a short-term downtrend and potentially trigger a deeper decline towards $ 142.32.

If consumers fail to recover control at that point, Sol may even slide to test lower support to $ 133.94.

However, this bearish perspective may be invalid if fresh demand appears and purchase of interest strengthening. In that situation, Sol could overcome the resistance to $ 153.67, opening the door for a rally to $ 171.50.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.