Bitcoin Miners Show Confidence After $95,000 Breakout

Bitcoin's decisive rest on the above significant psychologically $ 95,000 marks has been deprived of fresh optimism in the market, at least for miners.

This main milestone triggers a transfer to miner's sentiment, with data on-chain showing a striking outbreak in BTC miners in recent days.

Miners bet on BTC upside down as the reserve jumps from the annual low

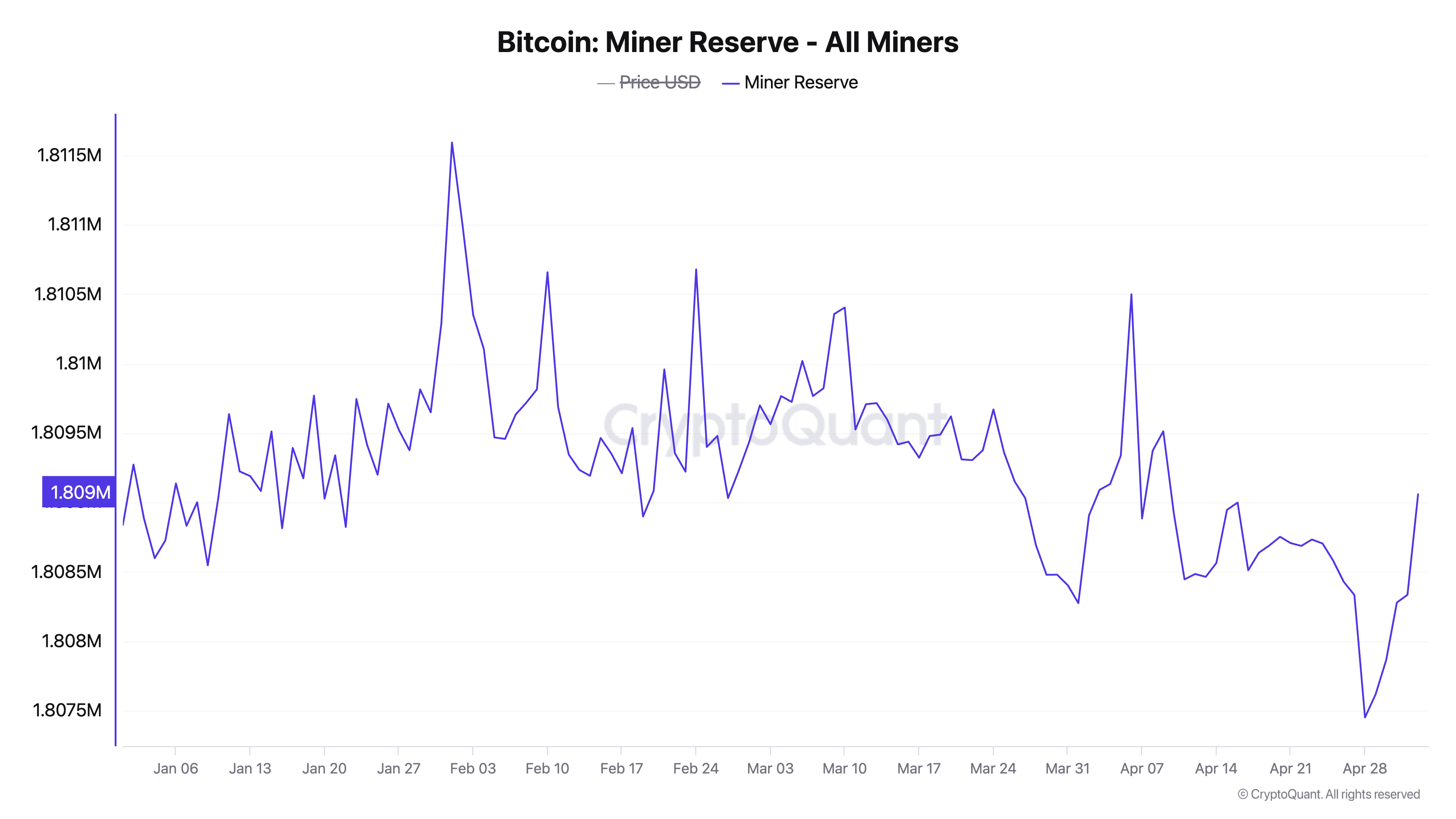

According to the cryptoquant, the Miner Reserve of Bitcoin, which is in a sustainable dowrend, began to rise on April 29, shortly after the BTC closed above a $ 95,000 threshold.

For the context, the reserve dropped a year-to-date low to 1.80 million BTC only a day before the course of the course and the display of accumulation signs.

Bitcoin's Miner Reserve monitors the number of coins held in miners' purses. It represents the miners of the coin reserves have not yet sold. When it falls, miners move coins in their wallets, usually for sale, proving the growing emotion against the BTC.

Conversely, when this scale is rising, as it is today, it suggests that miners are holding on to more of their mine coins, which often reflect the growing confidence in BTC price appreciation.

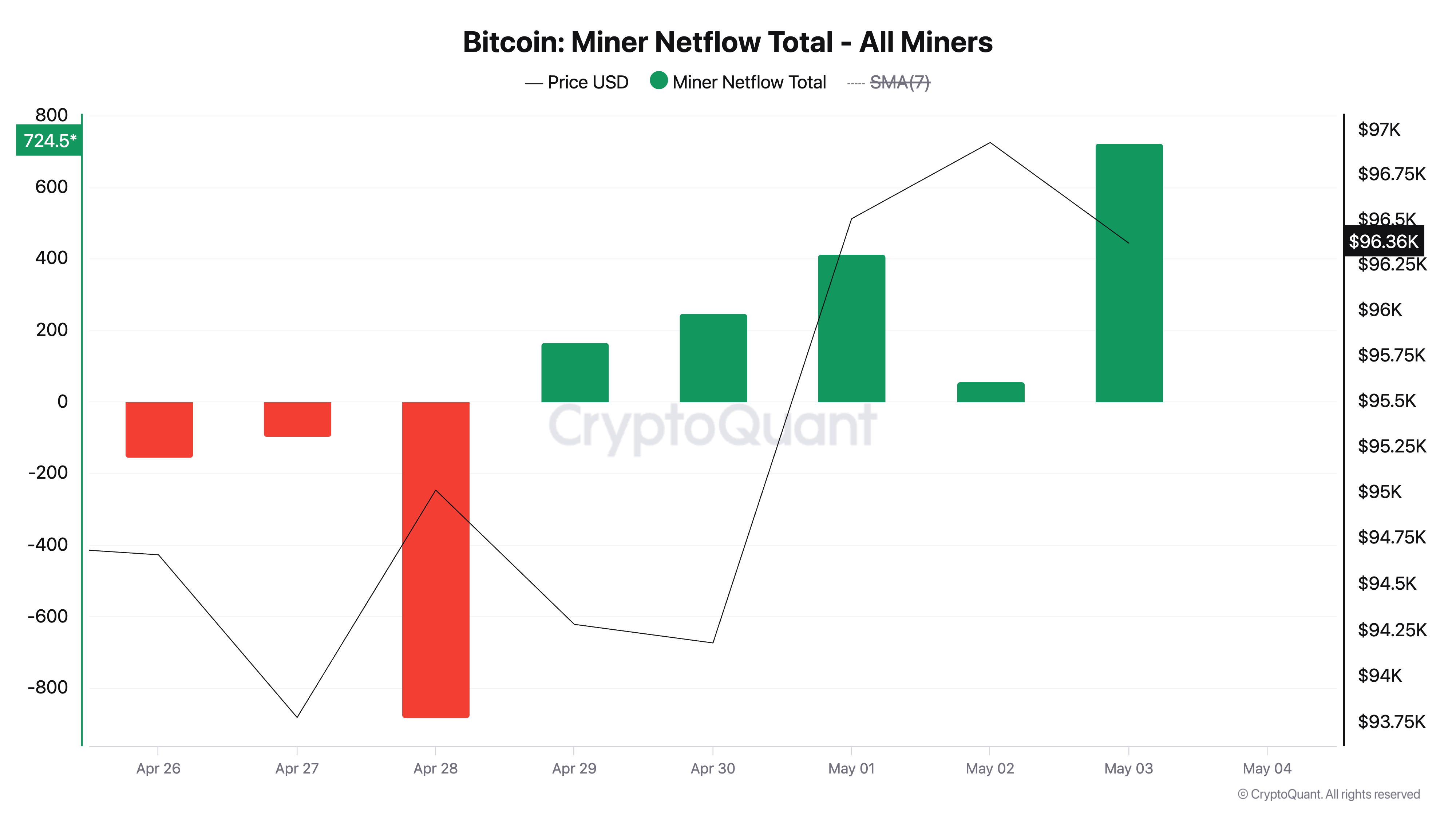

Moreover, the bullish shift in the miner's sentiment has been further supported by the positive Netflow miners recorded since April 29. These signals that more coins are placed on the miners dompet instead of offloading the exchanges.

Such behavior reflects trust further upside down, as miners, often seen as long-term owners, prefer to accumulate instead of liquid.

May catch

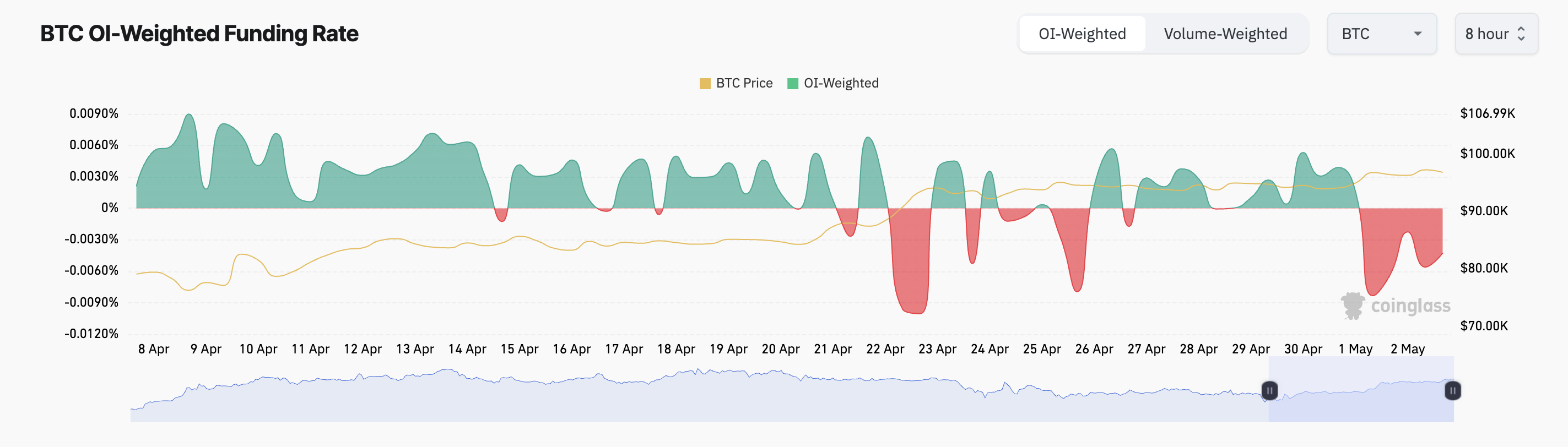

However, emotion is not worldwide. While BTC miners turn away from sale, derivatives data tell a different story.

In the Futures market, the BTC funding rate has remained negative since the beginning of May, a sign that a significant portion of merchants has estimated a close price correction. At the time of press, the coin funding rate is -0.0056%.

The rate of funding is a time -to -date payment exchanged between long and short merchants with eternal futures contracts to maintain the price of the contract aligned with the price of the area.

When it is positive, it means that entrepreneurs who hold a long position pay the short positions, indicating that bullish feelings are dominant in the market.

On the other hand, a negative funding rate as this signal is shorter than long ones, suggesting bearish pressure on BTC prices.

Breakout or Breakdown as merchants and miners are deviating

While the miner's behavior can be directed to the altered confidence, the steady sentiment in the derivatives suggests that merchants remain cautious in a potential pullback.

If coin accumulation reinforces, BTC can expand its gains, break the resistance to $ 98,515, and attempt to recover the $ 102,080 price score.

However, if the bearish bets against the leading coin win and witnessed a deficiency in demand, its price could fall below $ 95,000 to reach $ 92,910.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.