Gold price slips after robust US jobs data, trade optimism

- The collapse of XAU / USD, which has set themselves to lose more than 2.5% per week, traders at the level of the rate reduction of the rate of the Fed Back and the appetite of the risks improves.

- PNF April beats estimates; Unemployment is standard at 4.2%, reducing the expectations of softening of the aggressive Fed.

- China says that the United States is open to commercial talks, stimulating feeling and putting gold.

Friday, the price of gold (XAU / USD) fell by more than 0.35%, about to finish the week with losses of more than 2.50%. An improvement in risks of risks due to the relaxation of trade tensions as well as a solid report on the labor market in the United States (United States) prompted investors to reserve profits before the weekend. At the time of writing this document, XAU / USD is negotiated at $ 3,226 after withdrawing a daily summit of $ 3,269.

Overnight News has revealed that the Chinese Ministry of Commerce said that the United States was ready to start business discussions and prices and reassured Washington that Beijing Porte is open to discussions.

Lingots prices have extended their losses on the title that the payroll not enlarged in April crushed estimates, the unemployment rate holding company compared to March figures. The drop in XAU / USD to the lowest of the day of $ 3,222 was precipitated by traders reducing their bets according to which the Federal Reserve (Fed) would reduce the rates three times instead of four.

The yields of the US Treasury have increased sharply, but the US dollar index (DXY), which follows the performance of the greenback against a basket of six other currencies, cleared 0.20% to 99.98.

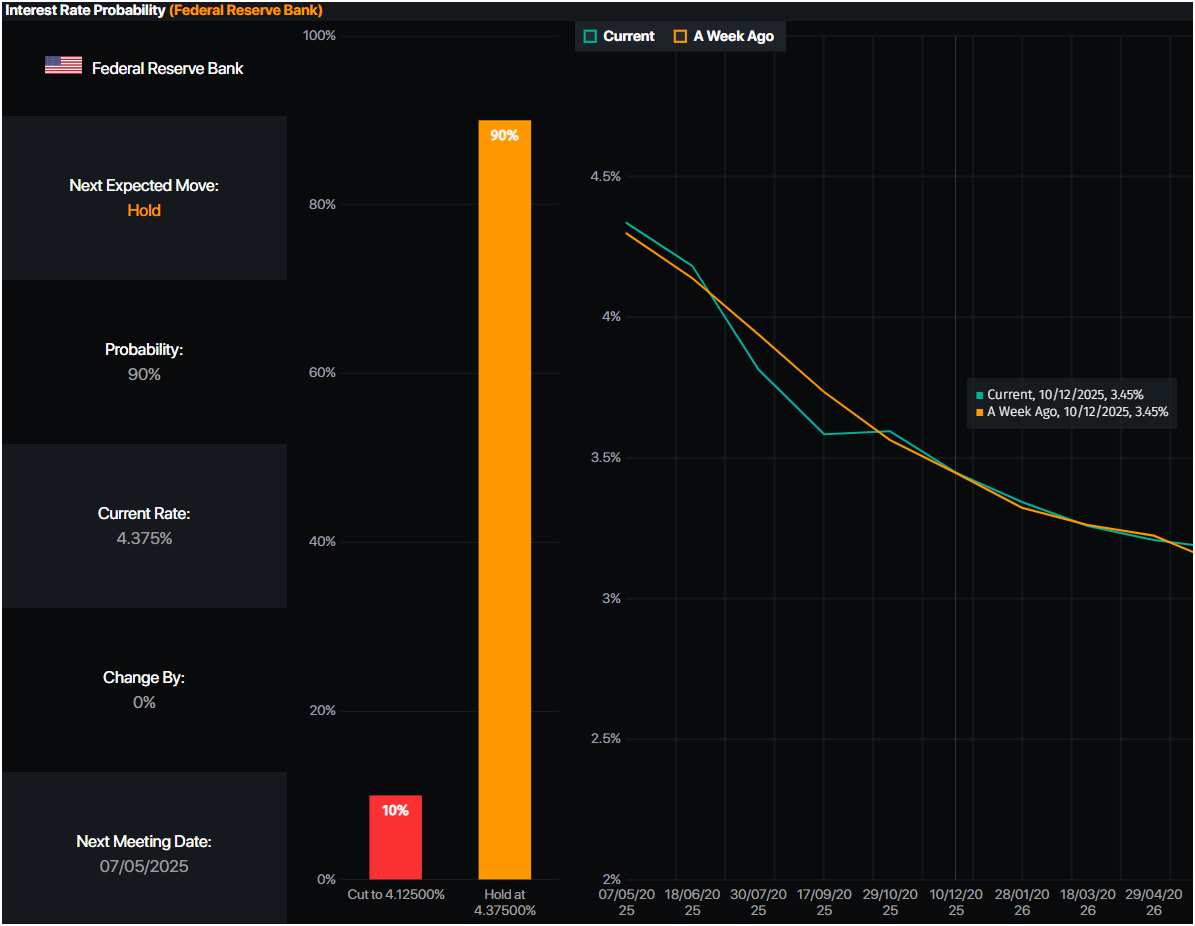

After the data press release, investors rushed to Price in 78 Fed rate reduction points, as data from the primary market terminal reveals.

Source: Main market terminal

Next week, gold merchants are considering the release of the monetary policy meeting of the Federal Reserve, during which the American Central Bank should keep the rates pending.

Daily Digest Market Movers: the edges of the lower gold prices as the US Treasury make the leap

- Recently published data lowered the prices of American bonds, increasing the yields of the US Treasury. The US yield of the 10 -year treasure note is skyrocketed with nine base points, up to 4.312%. At the same time, real yields in the United States have joined nine and a half bps to 2.062%, as the American yields protected by treasury inflation show at 10 years.

- The non -enlarged American wage bill increased by 177K in April, down compared to the number revised downwards 185k in March, but exceeding the estimates of 130 K. Earlier in the week, a national ADP national job change report suggested that companies hired fewer people than the PFF has revealed.

- The unemployment rate of the United States remained unchanged at 4.2%, which is aligned with forecasts and could prevent the Federal Reserve (Fed) from softening its policy.

XAU / USD technical perspectives: the price of gold remains optimistic but ready to drop below $ 3,200

The correction of gold prices has extended below $ 3,250 after the traders tried to recover $ 3,270 but failed. The relative force index (RSI) shows that sellers come together; Therefore, a drop below $ 3,200 figure is likely.

In this result, the next support would be the high of April 3, which has shot support at $ 3,167. Once exceeded, the next stop would be the simple 50 -day mobile average (SMA), at $ 3,080. Conversely, if buyers exceed gold prices greater than $ 3,300, this opened the way to challenge $ 3,350, followed by $ 3,400.

FAQ GOLD

Gold played a key role in the history of man because it was widely used as a reserve of value and means of exchange. Currently, apart from its shine and its use for jewelry, precious metal is largely considered as an asset in Houmle, which means that it is considered a good investment at the turbulent time. Gold is also widely considered as coverage against inflation and the depreciation of currencies because it was not based on a specific transmitter or government.

Central banks are the biggest gold holders. In their objective of supporting their currencies at the turbulent time, central banks tend to diversify their reserves and buy gold to improve the perceived force of the economy and money. High gold reserves can be a source of confidence for the solvency of a country. The central banks added 1,136 tonnes of gold worth around $ 70 billion to their reserves in 2022, according to World Gold Council data. This is the highest annual purchase since the start of the files. The central banks of emerging savings such as China, India and Turkey quickly increase their gold reserves.

Gold has an opposite correlation with the US dollar and American treasury vouchers, which are both the main security and security assets. When the dollar depreciates, gold tends to increase, allowing investors and central banks to diversify their assets on turbulent times. Gold is also inversely correlated with risk assets. A stock exchange on the stock market tends to weaken the price of gold, while sales in the risky markets tend to promote precious metal.

The price can evolve due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly degenerate gold prices because of its security status. As an without efficiency, gold tends to increase with lower interest rates, while the cost of higher silver generally weighs the yellow metal. However, most movements depend on how the US dollar (USD) behaves as the asset is assessed in dollars (XAU / USD). A strong dollar tends to maintain the price of controlled gold, while a lower dollar is likely to raise gold prices.