Mexican Peso holds steady, poised for weekly losses

- USD / MXN apartments nearly 19.58 as a Mexican Mous and Banxico manufacturing weighing strong data on American jobs.

- Mexico's dismal data suggest that the economic slowdown could continue while the PMI reaches a hollow over three years, the confidence of companies is deteriorating.

- Banxico is noted reduction rates in May, expanding the gap of policies with the Fed and the pressure of Peso's perspectives.

The Mexican Peso (MXN) has remained firm against the US dollar (USD), although it is about to finish the week with losses of more than 0.40% after the economic data revealed in Mexico painted a dark economic perspective, despite the fact that the economy has surprisingly increased USD / MXN near the brand temperature brand in solid states.

Mexico’s economic file revealed that businesses have deteriorated for the third consecutive month in April. At the same time, S&P Global revealed that the manufacturing activity for the same period had dropped to its lowest level in three years, contracting for the fourth consecutive month according to the PMI manufacturing index.

Through the northern border, the positive news of trade between the United States and China have crowned the gains of the USD / MXN pair while the greenback has displayed losses. On the data front, the non -enlarged payment of April exceeded the estimates and followed the previous reading. At the same time, the unemployment rate is Pat, highlighting the robustness of the American labor market.

The Federal Reserve (Fed) should have unchanged rates at next week's meeting. On the contrary, Banco de Mexico City (Banxico) reported its intention to continue to alleviate monetary policy at its May meeting to support the economy, even if inflation has not really achieved the objective of 3%. Consequently, the divergence between the two central banks could put pressure on the peso and stimulate the prospects of the US dollar.

Daily Digest Market Movers: Mexican Peso imperturbable by bad data

- Mexico's commercial confidence in April came to 48.5, down 49.7 revealed by the Instituto Nacional de Estadistca Geografia E Ironitica (INEGI). This and the contraction of S&P Global Manufacturing PMI for the same period, going from 46.5 to 44.8, suggests that the economic prospects in the future seem worse than expected.

- Although the latest figures for the gross domestic product (GDP) surprised the markets, showing that the economy has increased, the prices imposed on Mexican products, as well as the reduction of the budget, would keep the country's financial sector.

- The United States (PNF )'s wage bill increased by 177K in April, beating 130K expectations, although slightly below 185k revised downwards from March. The stronger than expected printing contrasts with the lowest ADP employment report earlier in the week, which suggests a slower impulse of hiring.

- The unemployment rate remained stable at 4.2%, in accordance with forecasts. Stable work data can give the federal reserve to retain the softening of short -term policies.

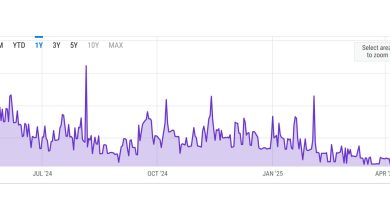

USD / MXN technical perspectives: Mexican peso remains optimistic because the USD / MXN remains below 200 days SMA

The downward trend of the USD / MXN remains in place, although the recent price action suggests a potential BOTHing around the beach of 19.46–19.50. The flat lines of the relative resistance index (RSI) near level 30, signaling the depletion of the seller.

A drop below the low ytd at 19.46 would expose the psychological level of 19.00, and a new weakness could lead to a high support test from June 28 to 18.59.

On the other hand, moving above the SMA 20 days to 19.88 and the 200-day SMA almost 19.97 was going to change dynamism in favor of buyers, opening the door to recover the mark of 20.00, followed by SMA of 50 days to 20.12.

Mexican peso faq

Mexican peso (MXN) is the most exchanged currency among its peers in Latin America. Its value is largely determined by the performance of the Mexican economy, the country's central bank policy, the amount of foreign investments in the country and even the levels of funding of funds sent by Mexicans who live abroad, in particular to the United States. Geopolitical trends can also move MXN: for example, the proximity process – or the decision of certain companies to move manufacturing capacity and provide channels closer to their country of origin – is also considered a catalyst for Mexican currency, because the country is considered a key manufacturing center of the American continent. Another MXN catalyst is oil prices because Mexico is a key exporter of the goods.

The main objective of the central bank of Mexico, also known as Banxico, is to maintain inflation at low and stable levels (or near its 3%target, the median point in a strip of tolerance between 2%and 4%). To this end, the bank establishes an appropriate interest rate level. When inflation is too high, Banxico tries to tame it by increasing interest rates, which makes more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for Mexican Peso (MXN) because they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data versions are essential to assess the state of the economy and may have an impact on the assessment of Mexican Peso (MXN). A strong Mexican economy, based on strong economic growth, low unemployment and great confidence is good for MXN. Not only does it attract more foreign investments, but it can encourage the Bank of Mexico (Banxico) to increase interest rates, especially if this force meets with high inflation. However, if the economic data is low, MXN is likely to depreciate.

As an emerging market currency, Mexican Peso (MXN) tends to strive during risk periods or when investors perceive that the larger risks of the market are low and are therefore impatient to engage with investments that include a higher risk. Conversely, MXN tends to weaken in times of market turbulence or economic uncertainty because investors tend to sell higher risk assets and to flee to more stable shelters.