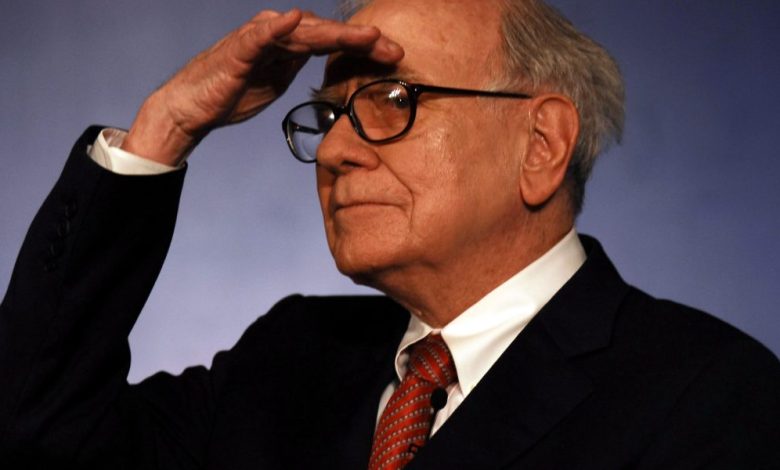

Warren Buffett has this advice for young investors—and it has nothing to do with where they should put their money

- During the annual meeting of shareholders of Berkshire Hathaway On Saturday, CEO Warren Buffett was invited to share Pivots lessons and life tips for young investors. His response did not imply picking stock or the best long -term assets. Instead, he talked about the type of people that investors should be around their lives.

The CEO of Berkshire Hathaway, Warren Buffett, was invited to share life lessons and advice for young investors, and his response did not involve the picking of actions or the best long -term assets.

During the annual meeting of shareholders of the conglomerate on Saturday, he rather talked about the type of people that investors should be around the course of their lives.

“To whom you associate is extremely important, and do not expect you to make each decision on this subject,” said Buffett. “You will advance your life in the general direction of people with whom you work, that you admire, who become your friends.”

He added: “There are people who make you want to be better than you and you want to spend time with people who are better than you and you feel better than you.”

It's different to follow someone who earns a lot of money and try to copy what he does, said Buffett.

Instead, he said he had tried to be with intelligent people he could learn. In addition, people should return all use that others offer them, he added.

“So you get a composition of good intentions and good behavior, and unfortunately, you can also get the opposite in life,” said Buffett.

He also urged people to look for a profession they would do if they didn't need money and warned against those who “tell you to do something you shouldn't do”.

Buffett added that it found it interesting that many workers in the investment world leave the company after earning a lot of money.

“You really want something for which you stand, you know, if you need money,” he said.

Answering a separate question from a young investor who asked what she had to do to be hired at Berkshire Hathaway one day, Buffett replied: “Keep a lot of curiosity and read a lot.”

As for the real investment, he has kept in the past that people should not imitate what he is doing with the Berkshire shares portfolio – despite his Legion of followers – and should rather put their money in an Indication fund of the S&P 500.

This story was initially presented on Fortune.com