Can BTC Price Meet Buying Demand?

After falling because of Donald Trump's tariff plans, which led to a strong market sale, Bitcoin is making a strong return. It is close to $ 100,000, the highest level since late February. But the fear of a backward can slow down this momentum unless the US and China are starting to talk about tariffs as soon as possible. In addition, mixed on-chain signals can increase volatility for the $ 100k level.

Bitcoin's on-chain metrics create mixed emotions

How the tariff communication can play a major role if the economy goes to a backward and where the price of bitcoin will follow. Many experts hope that trade discussions in May will help calm economic concerns. However, Bitcoin may continue to rise even if a backwards hit. In the past 24 hours, around $ 34 million in bitcoin trading has been closed. Consumers graduated $ 8.5 million in positions, while sellers had to close $ 25.4 million to bet against Bitcoin.

Also read: Bitcoin price prediction 2025, 2026 – 2030: When was BTC hit $ 100k?

Bitcoin is close to releasing the $ 100k mark as investor confidence increases. In the last two weeks of April, large investors bought nearly $ 4 billion worth of bitcoin. At the same time, the spot bitcoin and Ethereum ETF saw a strong flow, with more than $ 3.2 billion entering the market last week. The Blackrock's Bitcoin ETF has only been united for about $ 1.5 billion, its biggest weekly benefit this year.

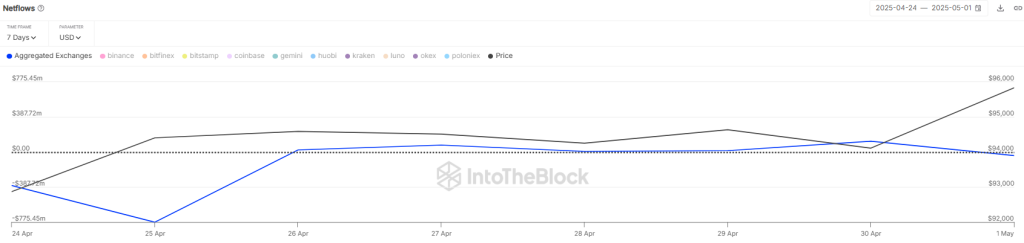

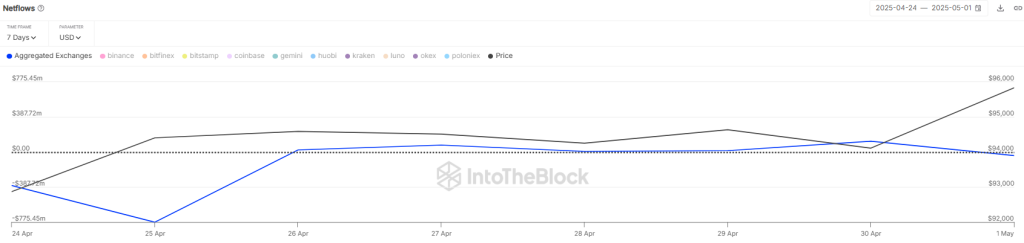

In addition, Bitcoin's Netflow is currently negative by $ 39.79 million, which means more Bitcoin has been moved to exchanges than they are. This indicates that more investors choose to store their bitcoin in private wallets instead of keeping it in exchanges. This is a sign that people are holding their coins, which can reduce the sale of pressure and support the recovery of Bitcoin.

However, the dangers of Bitcoin are a “known increase” in sale of pressure around $ 100k. Glassnode warns that if the price of Bitcoin continues to rise, long -term holders may begin to sell. Their profits are close to 350%, a level where they usually sell the past. If Bitcoin crosses $ 100K, it can trigger a sale wave from older investors.

What's next for BTC price?

Consumers destroy fib levels and they continue to hold the price above the EMA trendy lines. Bears are now defending any further flow above $ 98k while the BTC has faced a recent decline. As of writing, BTC prices traded at $ 97,182, which dropped more than 0.7% in the last 24 hours.

The increase of 20-day moving average to $ 96,892 and a strong RSI suggesting Bitcoin still has a room to move higher. If it breaks above $ 99,500, the price can quickly jump to the key $ 100,000 level. Sellers are likely to put a strong battle there, but if buyers succeed, Bitcoin can climb about $ 103,000.

Also Read: Top 8 Bitcoin Price Predic

On the flip side, sellers can try to drag the price back to the 20-day average move, which is an important level of support. If Bitcoin is bouncing there, the uptrend will remain strong. But if it drops below, it can fall further towards the 50-day average to $ 92.8k.