Bitcoin Enters Third Phase Of Liquidity Expansion – On Track For ATH?

Bitcoin is negotiated above the level of $ 95,000 while the bulls try to recover control and push around six figures. After a solid rebound in April, BTC entered a close consolidation range between $ 92,000 and $ 96,000, market players watching closely a decisive escape. A movement above the bar of $ 96,000 could trigger the next step, potentially opening the door to a milestone test of $ 100,000 long-awaited.

However, macroeconomic risks remain high. The growing fears of a recession, associated with current commercial tensions between the global powers, added uncertainty to the wider market. This makes the sessions to come particularly crucial for the short -term management of the BTC.

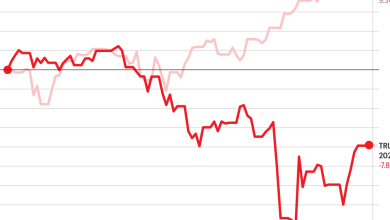

The superior analyst Axel Adler shared ideas pointing towards a deeper structural development under the action of prices. According to Adler, the market is currently in the third phase of the expansion of liquidity – a phase characterized by the increase in chain activity, the increase in exchange flows and the renewed commitment of investors. Its Bitcoin liquidity index, which incorporates network metrics on chain alongside standardized exchange data, is up. This phase, if supported, could support a break and propel the BTC into unexplored territory. The next few days will probably define whether the break is materialized – or if the BTC continues to vary.

Bitcoin grows above as the expansion of liquidity indicates a potential rupture

Bitcoin continues to direct the cryptography market, now negotiating just below the level of $ 96,000 while the bulls try to recover control. After last week's rebound, Momentum remains on the side of the BTC, but time turns. Bulls must go beyond $ 100,000 soon to confirm that the current movement is not only a rescue gathering, but the start of a wider euphoric phase. Without a decisive break, discoloration could bring BTC back in consolidation or trigger another correction.

Despite cautious optimism, Bitcoin is resilient. Healthy retains in key support areas between $ 90,000 and $ 92,000 strengthened an increased conviction. The wider market has followed the example of the BTC, altcoins starting to wake up in tandem.

Axel Adler supports the upper thesisNoting that Bitcoin is now in the third phase of the expansion of liquidity – a turning point historically associated with a significant price movement. According to Adler, this liquidity index combines all the main metrics on chain with exchange data. Above all, each component is standardized to eliminate distortions from the volatility of the BTC / USD exchange rate, giving a clearer vision of the structural market.

Adler stresses that liquidity monthly readings quickly approach quarterly levels. If no external “Swan Black” event derails, he describes three probable scenarios: a level of $ 100,000 level, a recovery of the summits of all previous time, and finally an escape in new summits. For the moment, Bitcoin is stable, but the following movement could define the rest of the cycle.

BTC price prices: bulls grow towards key escape levels

Bitcoin is currently negotiated at $ 95,800 while the bulls continue to recover higher land and confirm the next stage of the rally. The immediate objective is the area from $ 96,000 to $ 98,000, which has acted as a major resistance zone in recent days. A clean break above this beach would probably open the door to a retaining of the psychological level of $ 100,000, considered by many as the threshold for a large-scale market escape.

The feeling of the market remains cautiously optimistic, supported by a strong activity on the chain and an accumulation of whales. However, the battle is not yet over. Bulls must defend the level of support of $ 90,000 to maintain the structural force and avoid invalidating the recent rise trend. A drop below this level could trigger short -term weakness, pushing the BTC to a drop in demand areas in the region from $ 85,000 to $ 88,000.

As long as Bitcoin keeps more than $ 90,000 and recovers $ 96,000 at $ 100,000, the technical configuration promotes the continuation of new heights. The merchants are watching closely for signs of increasing volume and momentum to confirm the break. Until then, the BTC remains in a critical consolidation phase – which could either launch the next major movement, or stall the current rally.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.