Palantir Stock Price Forecast 2023, 2025, 2030: Buy PLTR Shares?

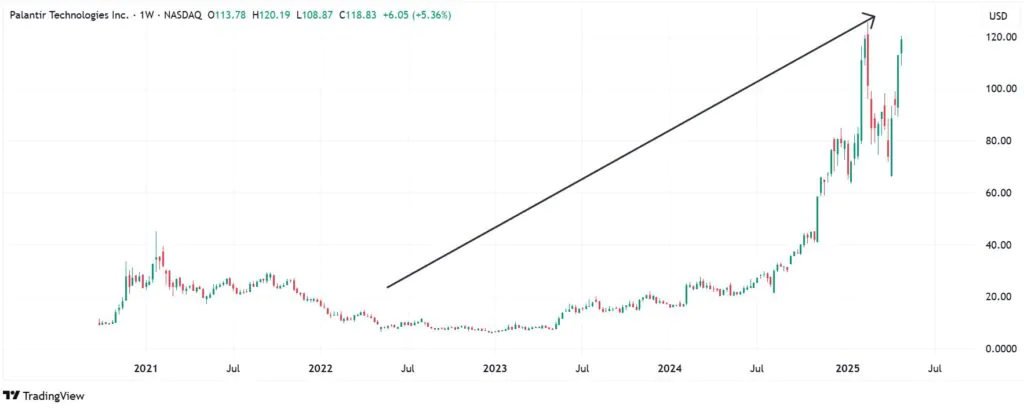

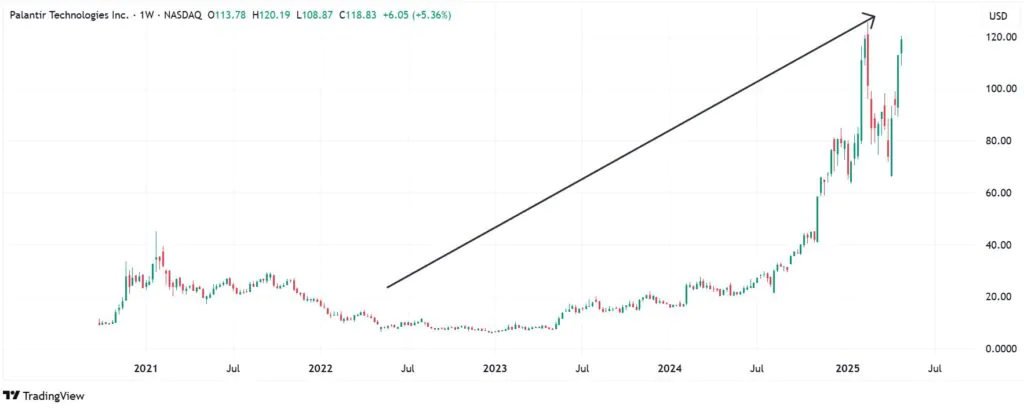

Palantir (NYSE: Pltr) The stock price is higher than 2025, which destroys the wider trajectory of the AI industry. Shares have gained 55.4% year-to-date, and traded at $ 120 as this writing. In addition, it gained 420% in the last 12 months, the dwarfing market leader of 24% acquired. Using it, its market capitalization increased significantly, to $ 279 billion as this article. With this PLTR stock prediction, we will explain its outlook on its growth and asses if it is a good purchase today.

What is Palantir Technologies?

Palantir Technologies is a company started by Peter Thiel, a serial entrepreneur co-established Paypal. The company began shortly after the 911 Terrorism Act to provide tools in the US and other allies to avoid future terrorist activities. It has remained as a private business for years until it has been public in 2020.

Palantir provides its services to the American government. It serves agencies such as military and ice. In most cases, company clients pay millions of dollars for a single expansion. At the same time, the company is seeking to grow its business in the private sector, where it serves companies such as Airbus, Ferrari, Apache, Tyson, BMW, and Merck.

Palantir products and services: What does Palantir do?

Palantir products are not used by most people and most investors do not have a good understanding of what it does. Besides, the products have been deployed to large and highly secret government agencies and large companies. Palantir has three main products. First, there is Gotham, which gives users to identify patterns hidden inside large datasets.

Second, the company provides Foundry, a platform that helps organizations operate by cracking their central operating system for their data. Individuals can use data with speed and try new ideas. Finally, it has Apollo, which is a product that provides fast, safe, and safe software updates.

Why did Palatir refuse the market?

The broader tech market gained a hit following the US trade tariff barriers that had been joking a bearish sentiment across the board. The AI industry is faced with further downward pressure, as the Trump administration is restricting the exports of high-end GPUs and targeted semiconductors in the reward tariff policy.

However, the Palantir stock price remained in the uphill trajectory, thanks to the pillow offered by the Bulk company business to the US government. This means that its order order is not threatened with tariffs or export restrictions, unlike rivals such as Nvidia, Intel and Broadcom.

Latest news on Palantir Technologies

A large portion of Palantir revenue originated in the defense department. In mid-April, Palatir announced that it had won a contract to supply NATO with the AI-Driven Maven Smart System, which tout to enhance Battlefield planning, awareness, target recognition.

Nearly 55% of the company's revenues come from government contracts. With members of NATO under pressure from the US to increase their expenditure in defense of at least 2% of their GDP, this may be the beginning of better days for the company.

Is Palatir very important?

For all shiny views and market defense performances, the price of the Palantir stock price can be potentially driven to an excessive review. At its current level, the stock price costs 74x the company's expected sales and 214X is expected to earn this year. That leaves a small room for the company's business model error.

In addition, the proposed pentagon expenditure reduction may affect the balance of the palatic. Pentagon suggested to reduce its budget by 50 billion per year for the next five years. Therese exists risks that can potentially weigh in palanteir stock prices in medium and long -term

Palantir stock price of history

The Palantir Share Price had a mix of performance after it went public in 2020. The stock initially exchanged for $ 9 where it was listed.

After the initial gains, the PLTR stock price crashed at a full time of less than $ 6.44 as the insider continued to throw the stock. However, it experiences a growing growth in 2024, rising from $ 16.50 in January and peering to $ 84.80 in late December as AI technology gained popularity.

That momentum became a notch higher than 2025, with a palating stock price that hit a full time high price of $ 125.41 in mid -February. The stock has since refused to trade at $ 118.40 as this writing, which translates to 1,084% obtained from the original price list of $ 10.

Is Palantir Technologies earning?

One common question is whether Palanter is a profitable company. The company first struggled to return an income, but since the tables have been flipped. Palatir reported GAAP's first revenue in the Q4 of 2022 and reported revenue per quarter ever since.

It saw its liquidity position to improve by $ 1.9 billion in 2024, it has more than $ 3.1 billion worth of exchangeable security and debt. In addition, Palatir will report the revenues of Q1 2025 on March 5, along with analysts that have reproduced a 62% yoy jump at EPS up to $ 0.13. In addition, its revenues are expected to arrive at $ 864, which translates to 36% Yoy growth.

Is Palantir a great investment? Is pltr a good investment?

Investors are divided about Palantir. Some believe it is a great company that is in an exciting industry that is difficult to disrupt. They also noted the fact that Palanter had a powerful order book, strengthened by government contracts. Moreover, they believe the company will continue to gain traction as geopolitical tensions rise. In addition, the company's commercial income is expected to grow significantly in medium and near-term.

On the other hand, people who are critical of Palanter mention the fact that the company is currently overlapping in connection with its income numbers. Also, they noticed the fact that the company's products were not a bit of a belief that ordinary people were difficult to understand.

Is Palantir buying, selling or holding?

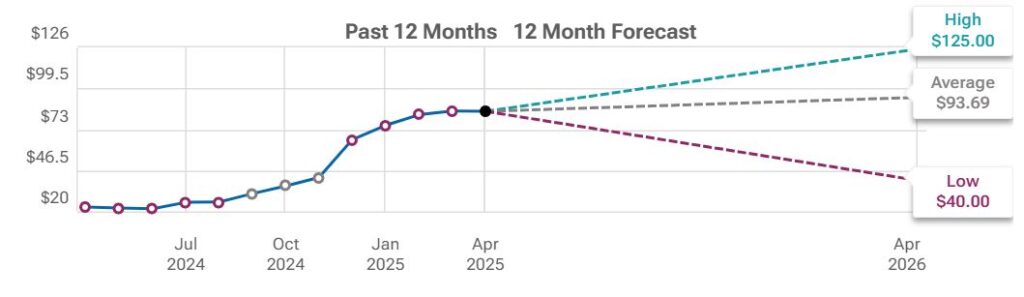

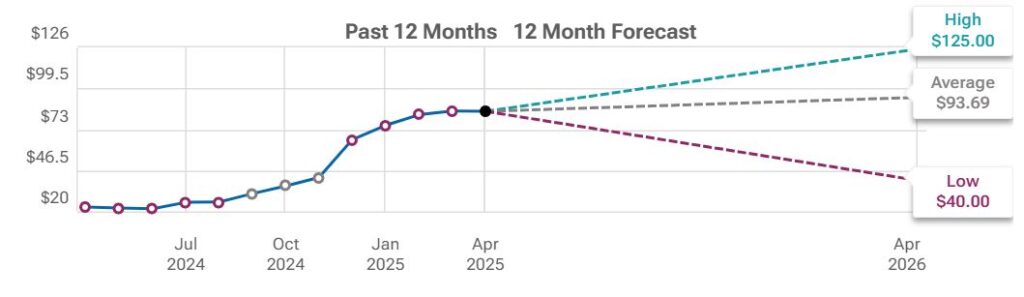

According to Tipranks, 18 forecasts of Wall Street analysts for Palantir stock prices for the next 12 months is $ 93.69. The stock is currently comfortable above that level. In addition, the average minimum price is at $ 40, indicating a 95% downside at the current price. Therefore, it is safe to conclude that analysts are relatively bearish in stock. Upside down, the average target price is at $ 125, indicating a 6% gain from the current level.

Wall Street Analysts Palantir 12-month stock price forecasting. Source: Tipranks

Jefferies recently maintained their target price of PLTR sharing at $ 60, maintaining an “underperform” rating. Goldman Sachs has a “neutral” rating with a target of $ 80, while Morgan Stanley has a price target of $ 90 with a “equal weight” rating. Most of these analysts mention existing trade tariff risks for their measured assessment of company prospects.

Palantir Technologies Peter Thiel Stake

Peter Thiel is one of the richest people in America. According to Bloomberg, he is the 102th richest man in the world with a net worth more than $ 19.2 billion. Forbes puts his net worth it at about $ 19.7 billion. Peter Thiel owns 4.5% of Palanteir Technologies. At the current price, his handling costs more than $ 12.6 billion.

Palantir Stock Price Forecast 2025

The day -to -day chart shows that PLTR stock prices are in a strong bearish trend for months. It remains below the descending trend shown in purple. The Relative Strength Index (RSI) Reading the indicator is at 67.99 in the weekly chart, confirming bullish control. Also, the MACD is tilted upward and above the signal line.

Therefore, my perspective is that the upward trend will continue in the first half of the year, with most pivot action that is likely to range in $ 100- $ 110. The medium-term resistance is likely to be at $ 127.30. However, an extended bulls control may expand the action to test $ 150. Breaking the mark can clear the path to test for $ 200.

On the downside, the price may be bouncing off the first support at $ 86.75, but a stronger descending momentum may be less than the second support at $ 70. Destruction below that level will prove to the reverse narrative and the resulting momentum may send the PLTR price less to test $ 60. Most, how Set a tone for the rest of the year.

PLTR Stock Forecasting Price 2026, 2030

I believe the Palantir stock price will be higher than today in 2025 and 2030. That's because the company has a strong source of income from US government contracts and is likely to benefit from the upcoming NATO budget spikes. In addition, it is likely to continue to attract more commercial clients to medium and long -term. Based on these factors, the Palantir stock price can break into the $ 200 mark by 2026. Also, we can't stop a situation where PLTR stock prices increase up to $ 500 to 2030. Read our previous prediction of PLTR sharing price here.