Bitcoin (BTC) rally? The inflow will disappear

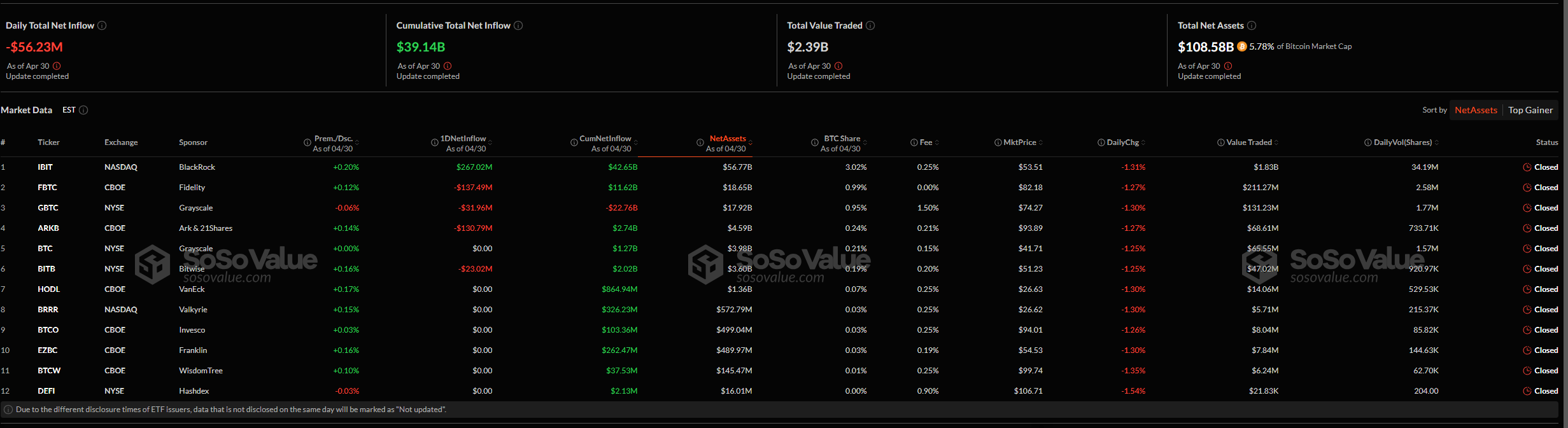

Although the price of Bitcoin is still floating with just over $ 95,000, there is an upcoming problems to maintain the break of the beginning of this month. Although technically bullish, the market is a decline in the ETF inflow, indicating that institutional interest in BTC exposure has begun to decline. Bitcoin Spot ETFS on April 30 was a net outflow of $ 56.23 million.

The only ETF, which announced a $ 267 million cleaning, was Blackrock Ibit, which showed that the entire sector's decline was not due to the overall market state. Other important players, such as the ARK Invest ARKB and Fidelity FBTC, suffered significant damage in the meantime, with $ 137 million and $ 130 million respectively. After changing the ETF, the Grayscale GBTC, which has already experienced a steady outflow, lost 0.31%.

Although the total ETF's total market is still a cumulative inflow of $ 3.914 billion, sudden one-day bleeding is appropriate. Bitcoin is struggling to break through the $ 95,000 limit, so it retreats. As Bitcoin took over $ 90,000, the volume of the Spot Market has fallen, indicating that the momentum is shrinking.

The property is approaching RSI, which circles about 66 but 66, but there is not enough inflow to support continuation. The short-term belief of institutional players is, according to ETF, a decline. If the inflow does not return, the market may experience a period of consolidation or even a correction period, although long-term configuration is still in place, especially considering the possible golden perpendicular to the 50-200-day moving average average average.

The situation of Ethereum is comparable. Fidelity's Feth was the only fund with an inflow on the same day as ETH ETF saw a net outflow $ 2.36 million. Bitcoin is not only under pressure; All cryptocurrencies are exposed.

Despite the continued strength of Bitcoin in the chart, the capital current shows otherwise. If the institutional inflow does not come back soon, the rally may run out of steam before six numbers.