How Yields Will Kick Off the “Stablecoin Season” in 2025

While Altcoin's Market Caps have not returned to their previous highs, the Stablecoin Market Cap has continued to hit new records in 2025. It has now exceeded $ 240 billion. Investors are looking for ways to optimize returns to a full -time environmental change without immediately providing capital.

Stablecoin yield protocols are emerging as a major choice for 2025. Analysts have shown strong arguments for this trend, and the subject of Stablecoin yields is gaining increasing attention to the crypto community.

Signs of a stablecoin yield wave

One of the brightest signs of growing interest in stablecoin yields is the recent moves of major industry players.

Ledger, the popular hardware wallet provider, announced On April 29, 2025, it included Stablecoin yield features in this live app.

In this update, users can earn up to 9.9% APY in stablecoins such as USDT, USDC, USDS, and Dai. Users maintain their full care of their owners. So far, Ledger has Sold Over 7 million hardware wallets.

Paypal also enters the career. The company now offers a 3.7% annual harvest In its piusd stablecoin. Following Closing the SEC Investigation In the piusd, Paypal is currently facing major obstacles to regulation in the expansion of the Stablecoin initiative.

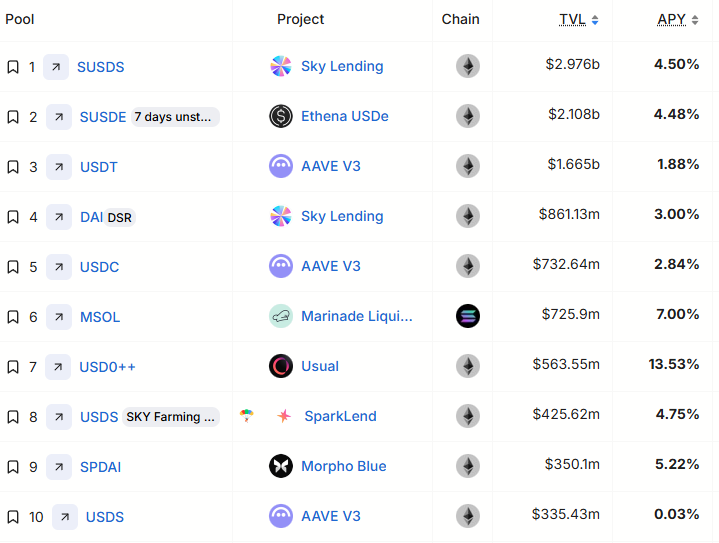

In addition, defillama Data It has been shown that there are more than 2,300 stablecoin pools throughout the 469 protocol and 106 blockchain. This signal is a huge increase in demand for yield opportunities through Stablecoins.

Data also shows that the top 10 stablecoin pools have TVLs from $ 335 million to over $ 2.9 billion. APYs in these pools can reach up to 13.5%.

Although many investors are waiting for a period of Altcoin to recover from portfolio losses, the current Momentum points to a “stablecoin season” are driven by attractive -attractive yields.

Why do stablecoin yields become a new investor trend?

GC Cooke, CEO and founder of Brava, have recognized The main causes of investors are returning to Stablecoins to look for returns.

He argues that unpredictable policy changes create ripple effects on the markets. Although traditionally “safe” stock now experiences wild swings on a single headline. He believes that moving from stocks to yield assets with yields such as stablecoin yields is a way to avoid the risk of direction-the risk of sharp price collapse in equality.

Chuk, a builder in Paxos, also mentioned As regulations of frameworks around the stablecoins become clearer in the US, EU, Singapore, and the UAE, harvesting is easier.

As a result, stablecoin wallets may change in personal finance hubs, eliminating the need for traditional banks.

“[Stablecoin] The wallets can: receive a payroll. Issue cards tied to Stablecoin balances to enable direct spending without converting Fiat. Enable P2P payment worldwide. Offer yield through tokenized currency markets. It continues an existing trend: The purse becomes a financial hub – no bank branch required, ”Chuk Says.

But what are the risks?

Despite optimism, the Stablecoin yield market has well -known dangers.

Analyst Wajahat Mughal taught That fewer than 10 stablecoins have over $ 1 billion market covers. Most stablecoins still have market caps below $ 100 million.

Some protocols offer high APys. Teller offers 28%–49% Provides for USDC pools. The financial year offers, founded by Andre Cronje More than 70% APY In the Pools of CRV. FX-Protocol and Napier Provide 22% -30% APY to Rusd and Eusde, respectively. But these high returns often carry significant risks.

Choze, a research analyst in the mold, HighlightD There are many concerns. Many pools still have low TVLs, from $ 10,000 to $ 120,000, meaning these strategies are early and can be new.

Some rewards rely on ecosystem tokens. Strategies often involve many protocols, increasing complexity. He warned that investors should pay attention to the long -term ecosystem growth of each project.

“Opportunities are true, especially for those who know how to navigate smaller, emerging farms. But it is important to understand what your real farming is: not only stable produce, but also the growth of ecosystem and incentives in the early stages,” choze Says.

Investors can also face risks such as lending or staking platforms for stablecoins that are hacked, exploited for weaknesses, or experiencing technical failures, all of which can lead to loss of funds. Some algorithms or less honorable stablecoins can also lose their peg in the dollar.

However, one cannot deny the growing role of stablecoins. With attractive produce and strong real-world use cases, it is reunited with how investors engage in crypto markets.

It opens up new ways to earn income without relying just next time Altcoin.

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.