S&P 500 rallies stop, focus on technology revenue and economic data

Do stock prices improve their recent profits due to the uncertainty of income and tariff development?

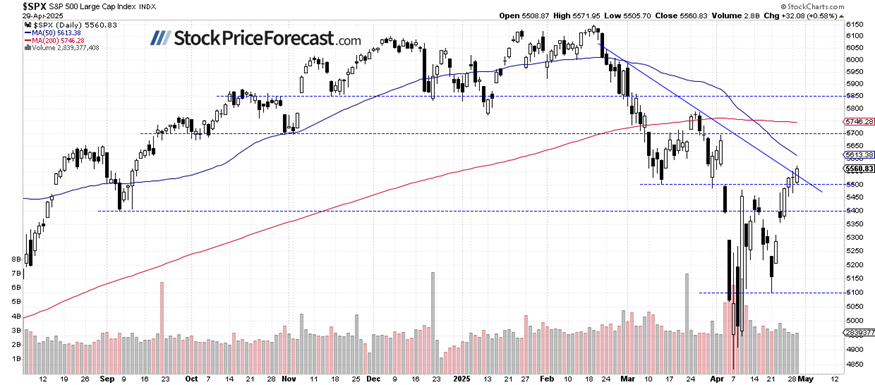

The S&P 500 was closed on Tuesday by 0.58% higher, extending short -term ascent and closing over 5550 levels. The market is now facing potential consolidation, as investors are waiting for major production publications from larger technology companies – Microsoft and Meta today after the session is closed, followed by Amazon and Apple on Thursday. This morning, the Futures refer to the S&P 500 that opens at about 1.4%.

Economic data has been worsening, If today's ADP report is less than expected +62,000 and GDP pre -flow is -0.3% quarter quarter (vs. expectations +0.2%).

Recently, investors' feelings have worsened, as shown last Wednesday in a study by AAI Investor Sentments, stating that only 21.9% of individual investors are bullish, while 55.6% are suffering.

The S&P 500 extended its benefits from 5,500 levels, as we can see on a daily basis.

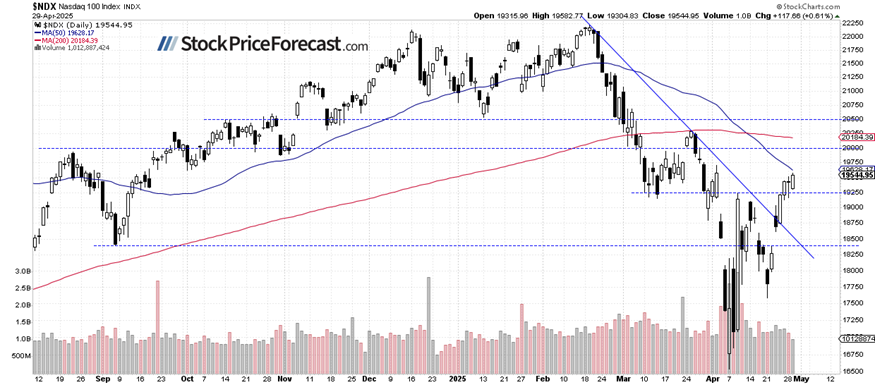

Nasdaq 100 is waiting for key income

The technical sector consolidates before important income statements that could set the market direction. Managers of larger technology companies are likely to deal with their AI investment and the potential impact of Trump policy. Investors focus particularly on the impact of tariff development on future business plans.

Microsoft and META report today after the market closes, tomorrow is planned by Amazon and Apple. These “spectacular seven” shares have been the main thrust of the markets in recent years, although they have largely decreased in 2025.

The NASDAQ 100 potential resistance is about 19,700, denoted by the previous local highest, while the support is between 19,000 and 19,200.

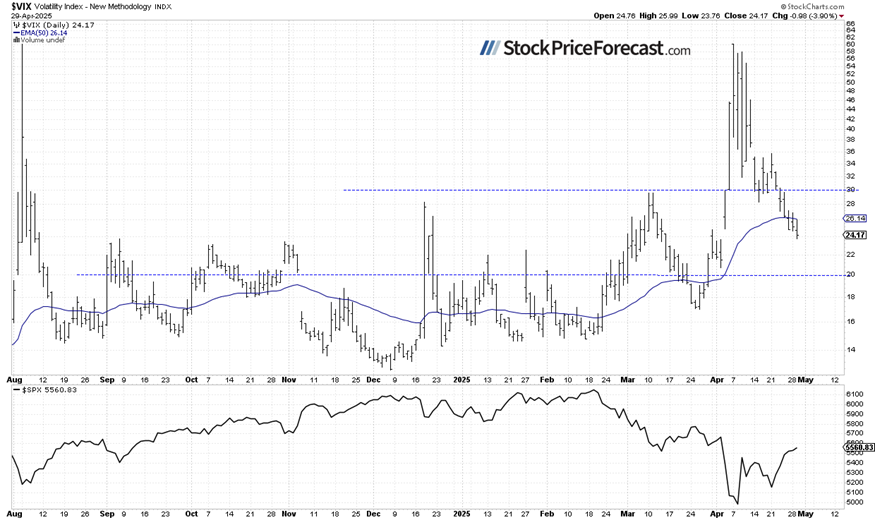

VIX: again lower

The volatility index has stabilized at a lower level, indicating the trust of investors, despite the concern of trade policy and economic growth. Yesterday VIX was as low as 23.76.

Historically, the decline in the VIX shows less fear in the market and the decline in stock market is accompanied by VIX. The lower the VIX, the greater the likelihood of reversing the market. On the contrary, the higher the VIX, the greater the likelihood of marketing.

S&P 500 Future Agreement: Pointing to lower

This morning, the S&P 500 futures contract will be lower, pulling back from its recent climbs near 5,600 levels. The support level is about 5400, which are characterized by some of the lowest. The market will take evaluation after weak economic data.

Conclusion

The S&P 500 is likely to improve some of its recent progress after the worse economic data than expected. It is expected to open 1.4% lower, pulling back 5,500 levels. At the moment, it only seems to be a correction of the ups.

Last week, the market developed several positive catalysts, including the alleviation of tariff fears, possible peace developments in Ukraine and expected quarterly profits. However, it is uncertain whether it is a new rise or a mere decline correction.

Here is a division:

-

The S&P 500 was closed at 0.58% higher on Tuesday, but today it is much lower to open up weak economic data.

-

The market is waiting for Microsoft and Meta's income statements today after the session.

-

The development of trade policy is focused.

Do you want free follow -up to the above article and the details are not available to 99%+ investors? Sign up for our free information page today!