Buy Pfizer (PFE) in stock for a setback after breaking Q1 EPS expectations?

Pfizer PFE shares grew at a +3%trading session on Tuesday, as the pharmaceutical giant was able to break his quarter's profits this morning.

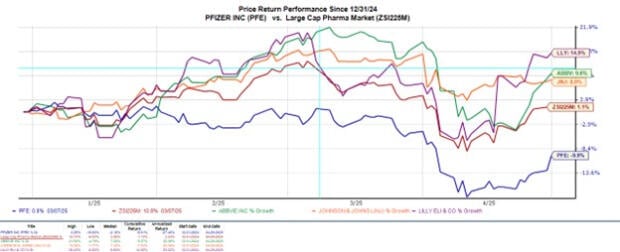

However, Pfizer Stock has fallen by 10% so far and has not given a protective statement that many of this Zacks large pharmaceutical companions have been able to offer, such as Abbvie ABBV, EU Lilly and Johnson & Johnson JnJ.

However, investors may monitor the Pfizer stock in the event of a continuing setback if PFE is still trading near the perennial lowest level, $ 20 per share.

Image Source: Zacks Investment Research

Results of Pfizer Q1

Navigating into a so -called dynamic work environment, Pfizer Q1 said of $ 0.92 per share, breaking EPS expectations of $ 0.64 43% and rising from $ 0.82 per share last year. Pfizer also emphasized that it was on the way to overcome its net cost savings goals. This comes when Pfizer has experienced a decrease in the revenue of cooling products with the inhibition of clinical results of its weight loss, which would help the company compete with EU Lilly and Novo Nordisk NVO.

Posting mixed results, the Pfizer Q1 turnover was $ 13.71 billion estimated estimates of $ 13.83 billion and fell from $ 14.87 billion a year ago. However, it is noteworthy that Pfizer has surpassed the Zacks EPS consensus over 11 consecutive quarters, with an average profit surprise of 43.48% in its last four quarters.

Image Source: Zacks Investment Research

Pfizer re -approves all year coaching

Pfizer confirmed his entire year's 2025 instructions, including revenue between $ 61 billion-64 billion, and Zacks' projections were currently $ 63.48 billion. Pfizer is still waiting for the adjusted FY25 EPS $ 2,80-3.00, with Zacks Consensus $ 2.99.

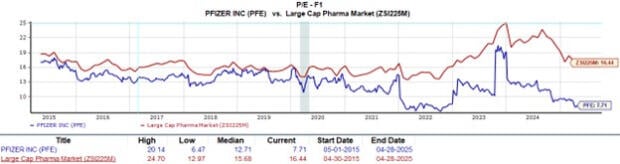

Evaluation of Pfizer 'Cheap' P/E

Long -term investors are most like that Pfizer stock is trading at a price at a low price at a low price to make a profit of 7.7x and significantly below the height of 20.1x. The PFE also trades at a significant discount for S&P 500 21.3x in the amount of several and its Zacks industry average 16.4x.

Image Source: Zacks Investment Research

Pfizer's fascinating dividend

At the current level, the Pfizer annual dividend also stands out with a 7.46% return, which is puzzled by an average of 2.51% and 1.33%. Although Pfizer lost its status as a dividend crisis during the 2008 financial crisis, the company has now increased its dividends for 16 consecutive years.

Image Source: Zacks Investment Research

Conclusion and the final thoughts

After your quarterly report Stock Stock A Zacks rank # 2 (Buy). According to such, the estimated improvements to FY25 and FY26 are up in the last 30 days, and this trend may continue if PFIZER blows EPS expectations, highlighting its cost savings initiatives.

This would certainly support the evaluation of Pfizer's “cheap” P/E and could lead to an extended rally, as PFE seems to offer long -term value to shareholders, taking into account its fascinating dividend.

Want Zacks Investment Research's latest suggestions? Download the top 7 shares in the next 30 days. Click to get this free reportTo.