How BlackRock’s $1 Billion Bitcoin Investment Could Propel BTC Toward a $2 Trillion Market Cap

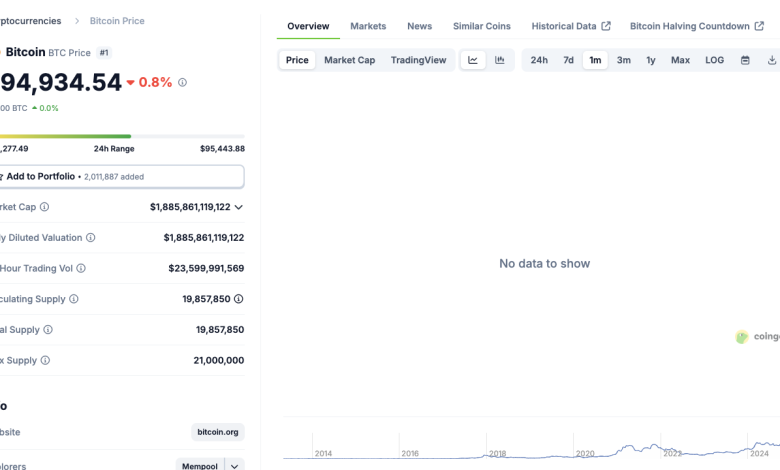

The price of bitcoin between a slight 1% on Wednesday, April 30, with increasing institutional entries, BTC now looks at the milestone in the market capitalization of 2 billions of dollars.

The Bitcoin price raped $ 95,000 in the middle of $ 1 billion in the BlackRock FNB Bitcoin FNB Bitcoin

Bitcoin (BTC) reached a local summit of $ 95,400 on Tuesday, April 29, while the Ishares Bitcoin Trust (IBIT) of BlackRock recorded a billion historic dollars at daily entries. This marks the largest influx of a day since the launch of the ETF in January and reflects an unprecedented demand from institutional investors.

According to data from FlirtatiousThe current BTC market capitalization is a little less than $ 1.9 billion, many analysts providing for a break beyond the bar of T2 dollars if the momentum persists.

The influx in IBIT signals increasing the confidence of investors in the long -term role of Bitcoin as a macro and alternative hedge.

In particular, Geoff Kendrick of Standard Charterd also reiterated his forecasts of $ 120,000 BTC in the second quarter of 2025, citing an expansional institutional adoption and macroeconomic fragility as key engines. In the long term, he considers the $ 140,000 mark as achievable if the liquidity conditions improve.

BlackrockThe disproportionate role in institutional integration helped BTC become a basic portfolio component from global asset managers. As fund entries are built, market observers expect higher pressure on prices before summer.

BTC's institutional demand coincides with weak work data

The upward inclination of the cryptography market is aligned with the deterioration of macro indicators which could open the door to a potential drop in Fed rate. On April 29, the US Labor Department indicated that March job offers fell to 7.2 million, or less than 7.5 million planned. This marks one of the lowest readings since 2021.

Simultaneously, the confidence index of Conference Board has dropped for the fifth consecutive month, reaching its lowest level since January 2021. Historically, such low American work data often trigger forecasts to intervene with expanding monetary policies, which tend to promote risky assets like Bitcoin.

This model could repeat the increase in money supply could propel the price of Bitcoin to $ 120,000 such as predicts the standard analyst standard Geoff Kendrick.

In the meantime: what is the next step for the price of Bitcoin at T2 2025

On Monday, the Ibit intrigue of $ 1 billion in Blackrock could be the clearest signal for the time when Bitcoin matures in a global institutional asset.

Associated to weaken the American macro-data, the BTC price could be about to escape the market capitalization phase of 2 dollars.

The BTC price already negotiating above $ 94,000, it only needs a modest thrust of 5 to 6% to reach the market capitalization phase of 2 billions of dollars.

If companies' investments continue to pay capital in the Bitcoin ETF in anticipation of the Fed Dovish, the Bitcoin price is likely to cross the market capitalization of 2 dollars in the coming weeks.

While regulatory risks and commercial policy shocks are still active, unusual entries suggest that Bitcoin Bitcoin, the next high distance of all time, could already be in progress.

Bitcoin Price forecasts today: BTC Eyes $ 98,500 while business demand increases

The Bitcoin price is consolidated nearly $ 94,200 at the time of the press after having tested weekly peaks at $ 95,500 after the ETF entry of $ 1 billion in BlackRock.

Technical indicators on Bitcoin price forecasts show Bollinger's upper band at $ 98,554, acting as short -term resistance.

With BTC Price holding well above the midline ($ 88,979), it strengthens a bullish story.

Beyond that, the relative force index (RSI) at 65.59 suggests an upward momentum without registering in a territory on attack, which gives BTC place to push higher. A

The decisive closure greater than $ 95,000 could propel the price to $ 98,500 in future sessions, especially if institutional entries persist. Conversely, a break below the median line of the Bollinger strip could open a reversion to $ 79,400, the lower band.

Warning: The content presented may include the author's personal opinion and is subject to the market state. Do your market studies before investing in cryptocurrencies. The author or publication does not hold any responsibility for your personal financial loss.

✓ Share: