Ethereum Jumps 10% in a Week but Trend Shows Fragile Signs

ETHEREUM (ETH) has been more than 10% in the last seven days as the market shows signs of modified activity. However, the key technical indicators show a mixture of weakening of the treasure and careful optimization from consumers.

ETH is currently fighting the critical resistance zones that can determine if the rally continues or fades. In the momentum still fragile, it could be a decisive month for Ethereum's next major step.

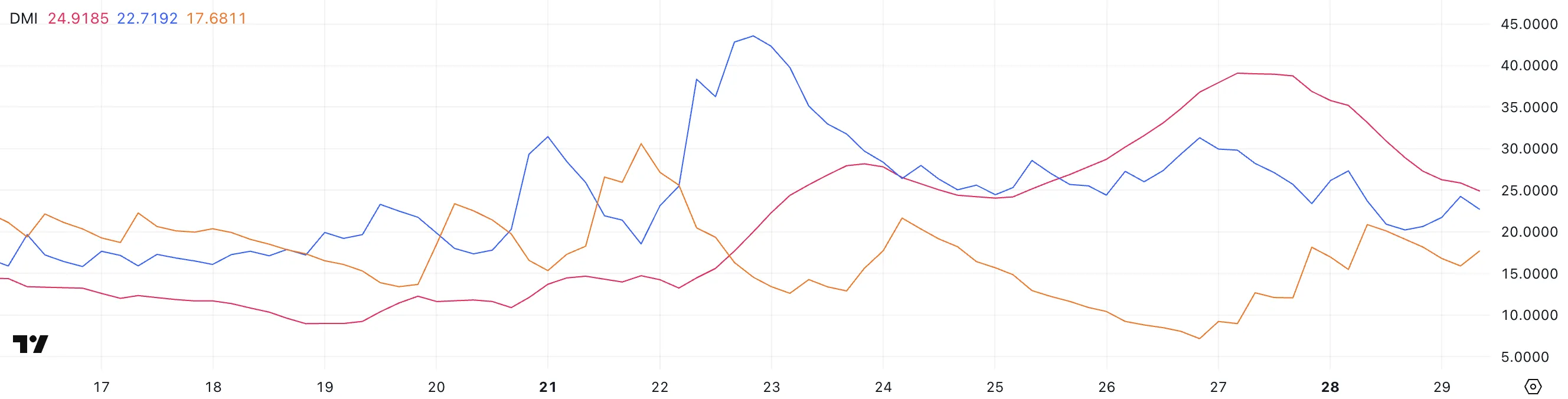

Ethereum trend weakened sharply as bears close

The Ethereum's DMI chart shows its ADX currently at 24.91, a sharp decline from 39 two days ago. The ADX, or average direction index, measures the strength of a trend, up or down.

Typically, an ADX reading above 25 signed a strong trend, while the values below 20 suggest that the market enters a period of weakness or trade bound in the range.

The steep collapse at ADX indicates that Ethereum's recent momentum is rapidly losing strength. Without a modified purchase or sale of pressure, the ETH can stay stuck in a more palatable, a flat pattern for a short time.

Meanwhile, the direction indicators show a clear shift. +Di, which tracks bullish pressure, dropped to 22.71, falling from 31.71 three days ago and 27.3 yesterday.

In contrast, the -di tracks bearish pressure rose to 17.68, from 7.16 three days ago and 15.64 yesterday. Yesterday, the gap between buyers and sellers was almost closed, with +not 20.91 and -di at 20.1, which suggests sellers who almost regained control of the market.

The rising bearish momentum and a weakness of tremors increase the risk of Ethereum price lower if consumers cannot defend the basic levels. However, if the Bulls manages to touch the ground and recapture the momentum, the ETH can still be able to map another recovery attempt.

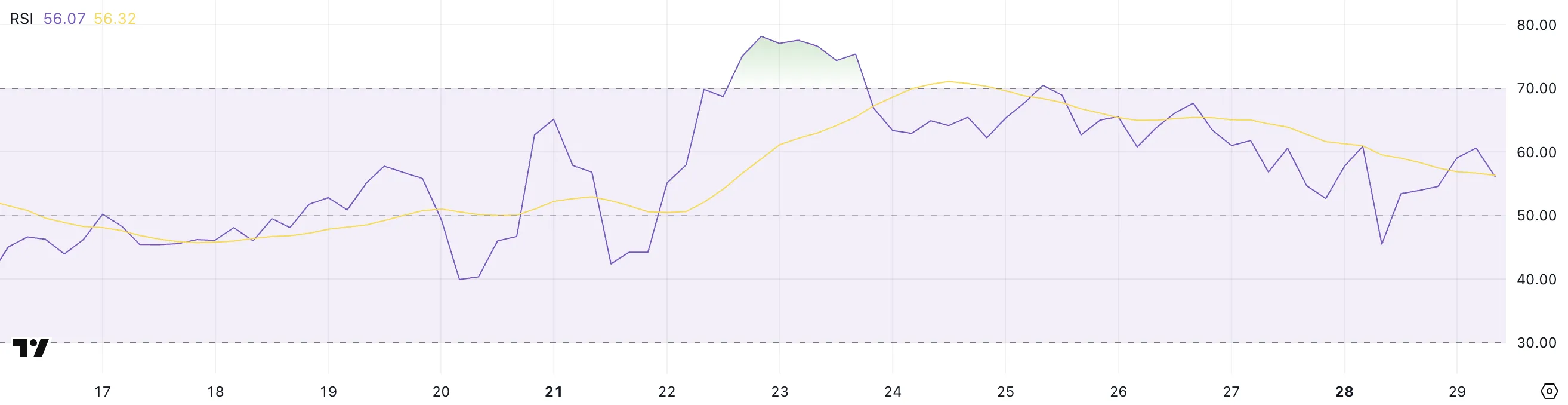

The ETH RSI went up after the sudden drop: Will the recovery hold?

The RSI of Ethereum is currently sitting at 56, from 45.5 a day ago, after reaching 70.46 four days ago. The Kaba -Child Index Index (RSI) is a momentum indicator that measures the speed and size of price movements.

Usually, an RSI above 70 suggests a possession is overwhelming and may be due to a pullback, while an RSI below 30 indicates excessive conditions and the potential for a rebound.

Readings between 30 and 70 are considered neutral, with levels around 50 that often sign a market at a decision point. The sharp swing in the RSI of Ethereum in recent days reflects the recent Bagu -change of emotions around the ETH.

By RSI up to 56, Ethereum recovered momentum after sinking into neutral-to-bearish territory. A reading above 50 is leaning slightly bullish, suggesting that consumers have begun to re -provide control, even without excessive strength.

If the RSI continues to climb towards 60 and beyond, it can signal a modified pushing higher for ETH prices.

However, if the momentum stall is again and the RSI turns away, it suggests that recovery is losing steam and that Ethereum may return to a greater integration or even a stage of correction.

Ethereum fights the main resistance as breakout or breakdown looms

Ethereum price has made many attempts in previous days to break above the resistance level to $ 1,828. If the ETH manages to break and hold above this level precisely, it can open the door for a stronger moving upward.

The next main target is $ 1,954, and if the bullish momentum remains strong, an additional rally towards $ 2,104 can open. Esthereum will eventually test $ 2,320 in a more aggressive climbing, marking a significant bullish extension.

These levels are key to watching because they can determine the strength and maintenance of any breakout in the coming days.

On the downside, if the Ethereum fails to handle the current levels and the trend returns, the first critical support to watch the lie at $ 1,749. A break below that can trigger a move less to $ 1,689.

If the pressure sale is intensifying, ETH can further expand the downtrend, with major support levels of $ 1,537 and $ 1,385 playing.

The loss of these levels will signal a deeper correction, suggesting that recent recovery attempts are only temporary before a longer bearish phase set.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.