IBEX poised to surge to six year high [Video]

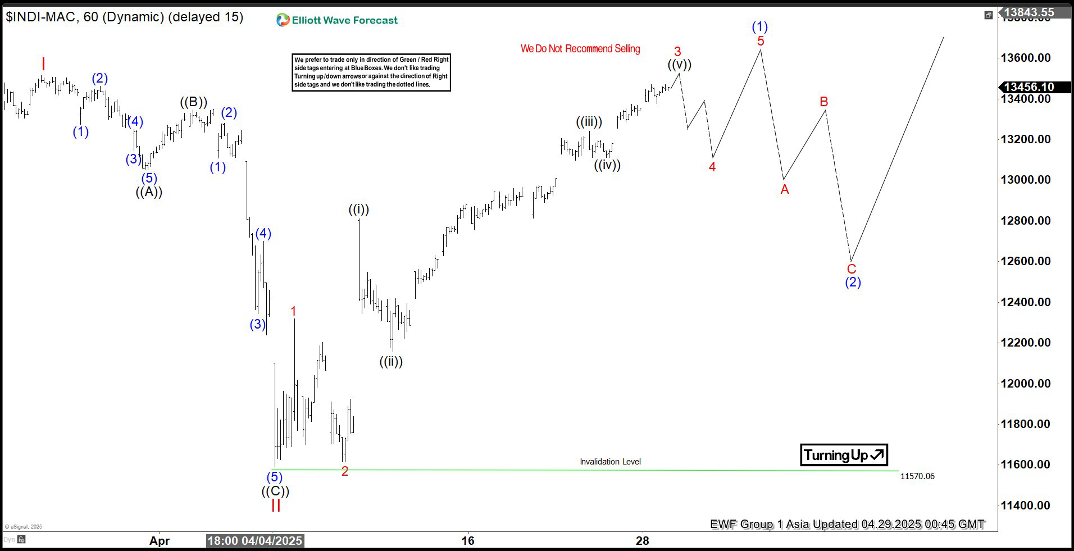

The $ IBEX, Spain's stock market index, could easily exceed its climax from March 25, 2025, before a tariff warfare has been a sale. That climax marked the end of the wave I in the Elliott wave review. The subsequent decline, wave II, was formed by a zigzag pattern, as shown in the 1-hour chart. From the high March 25, the wave ((a)) dropped to 13,051.8, the wave ((b)) bouncing to 13,347.3, and the wave ((C)) fell to 11,570.06, completing the wave II.

Since then, $ IBEX has recovered aloud, along with a rally from Wave II following an Elliott wave pattern. Starting from Wave II, Wave 1 sank to 12,318.8, and Wave 2 sank to 11,615.2. The index then climbed the wave 3, with sub-wave ((I)) at 12,810.8, ((II)) at 12,158.5, ((III)) at 13,241.2, and (IV)) at 13,110.4. It is expected that the index will soon complete the wave ((V)) of 3, followed by a 4 pullback wave, before rising again in wave 5 to finish the wave (1).

Thereafter, a wave correction (2) from April 7, 2025 low was likely before the index continued to be higher. In the near term, as long as the 11,570.06 low holds, any pullbacks should attract consumers to a 3, 7, or 11-swing pattern, supporting additional gains.