Top Bittensor Tokens to Watch: Chutes, Taoshi and Targon

Three bittensor subnet tokens – chutes, proprietary trading networks, and targon – are among the leading projects to watch this week.

Chutes remain the largest token of the subnet through the market cap despite recent price pressure, while the proprietary trading network draws attention through the defai narrative. Meanwhile, Targon, is trading in deep oversold levels and can set up for a potential rebound. Here's a closer look at each of the bittenor -based tokens going to the first week of May.

Chutes

Chutes is a compute platform of serverless AI developed by Rayon Labs. It is designed to deploy, operate, and measure any artificial intelligence model for a few seconds.

Users can contact the chutes platform directly or easily combine it through a simple API, which offers fast and flexible AI infrastructure without the complexity of traditional server management.

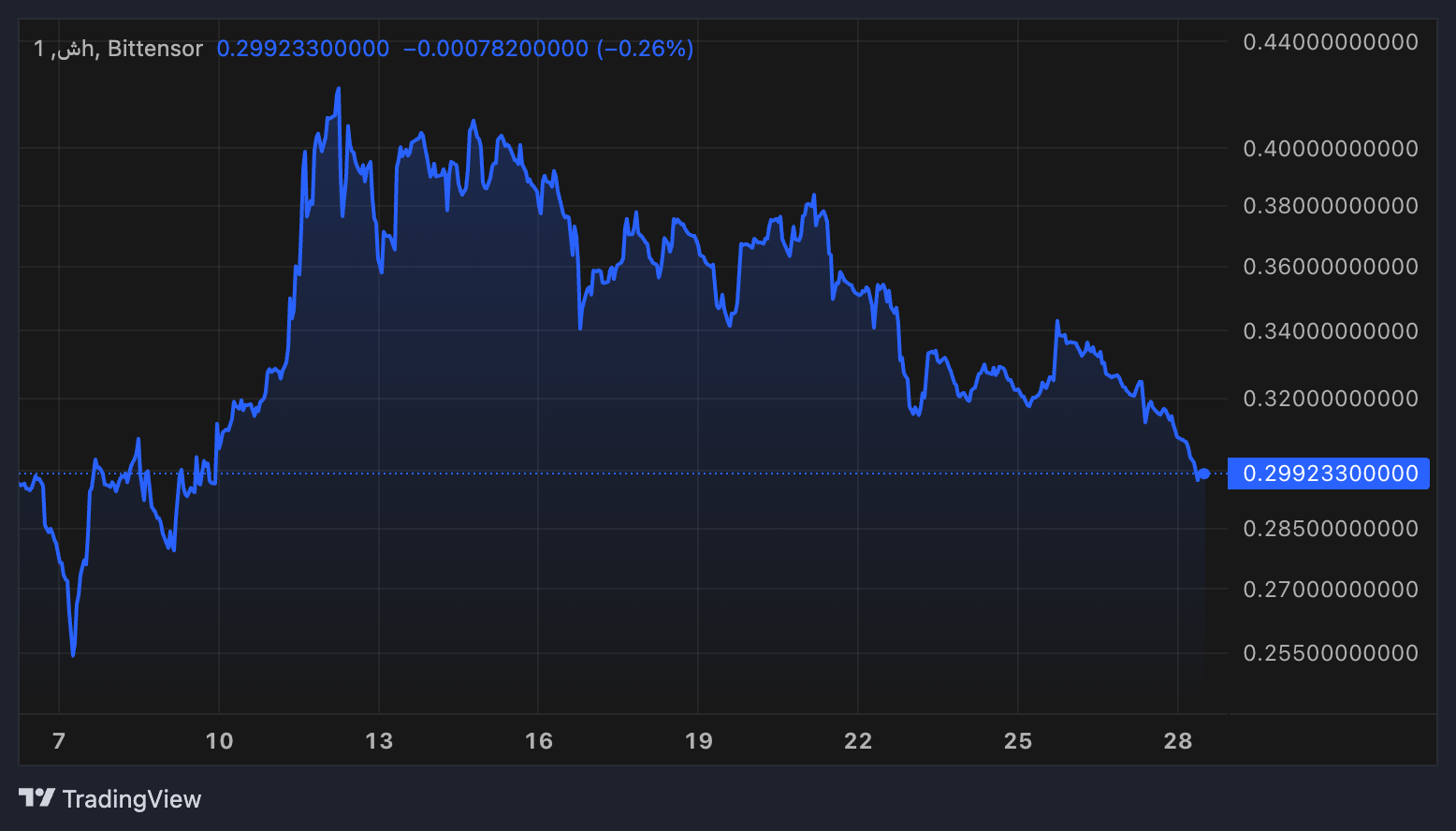

Chutes are currently the largest token of the Bittenor's Bittenor's subnet to the market cap, but it has faced pressure recently, which has dropped nearly 18% in the past seven days.

After the interview of 67% between April 7 and April 12, the token has since dropped nearly 30% from its climax. The relative -child of its Index Index (RSI) is at 23.78, which signed deep conditions.

This setup may mean that chutes are close to a potential reversal zone.

If the project manages to recover its previous momentum, being the largest subnet in the bittenor can strengthen its acquisitions through the network's effects, which potentially sparms a strong support that can drive the price to the $ 0.40 range.

Proprietary Trading Network

The proprietary trading network, or Taoshi, is a decentralized financial platform that operates inside the bittenor ecosystem. It builds dynamic subnetworks where decentralized AI and machine decentralized models study data in many classes.

Its mission is to democracy access to sophisticated trading techniques, AI, Blockchain, and financial integration to deliver advanced data that helps users make smarter financial decisions.

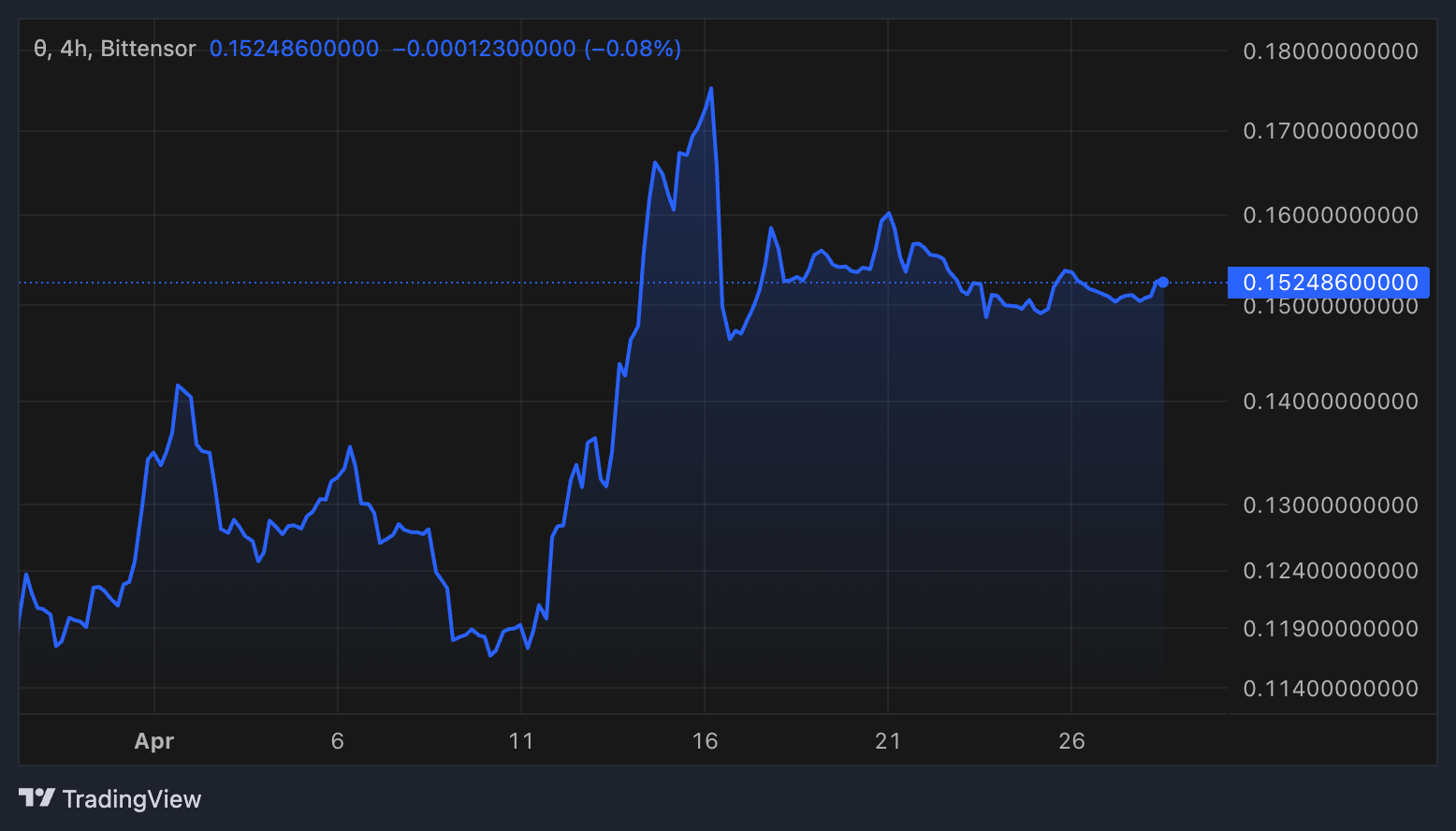

The proprietary trading network market cap is close to $ 50 million, with a trading volume jumping nearly 160% in the last 24 hours to reach $ 3 million.

With the emergence of Defai as one of the hottest narratives for 2025, the proprietary trading network has been well positioned to use its exposure to trending sectors such as AI, bittenor subnets, and trading.

If the current momentum is strengthening, the token may increase as soon as possible to review the $ 0.20 and $ 0.25 resistance levels, supported by growing attention to these sectors.

Targon

Manifold labs are developed by Targon, which is a bittenor subnet token that builds an AI Cloud platform that gives users to run references to AI models at high speeds and low costs.

Through its playground and oppressor, Targon offers many models that are optimized for completion and chat activities.

The platform emphasizes rapid performance, high scalability, and cost efficiency, allowing developers and companies to deploy and scale AI models while easily minimizing infrastructure complexity.

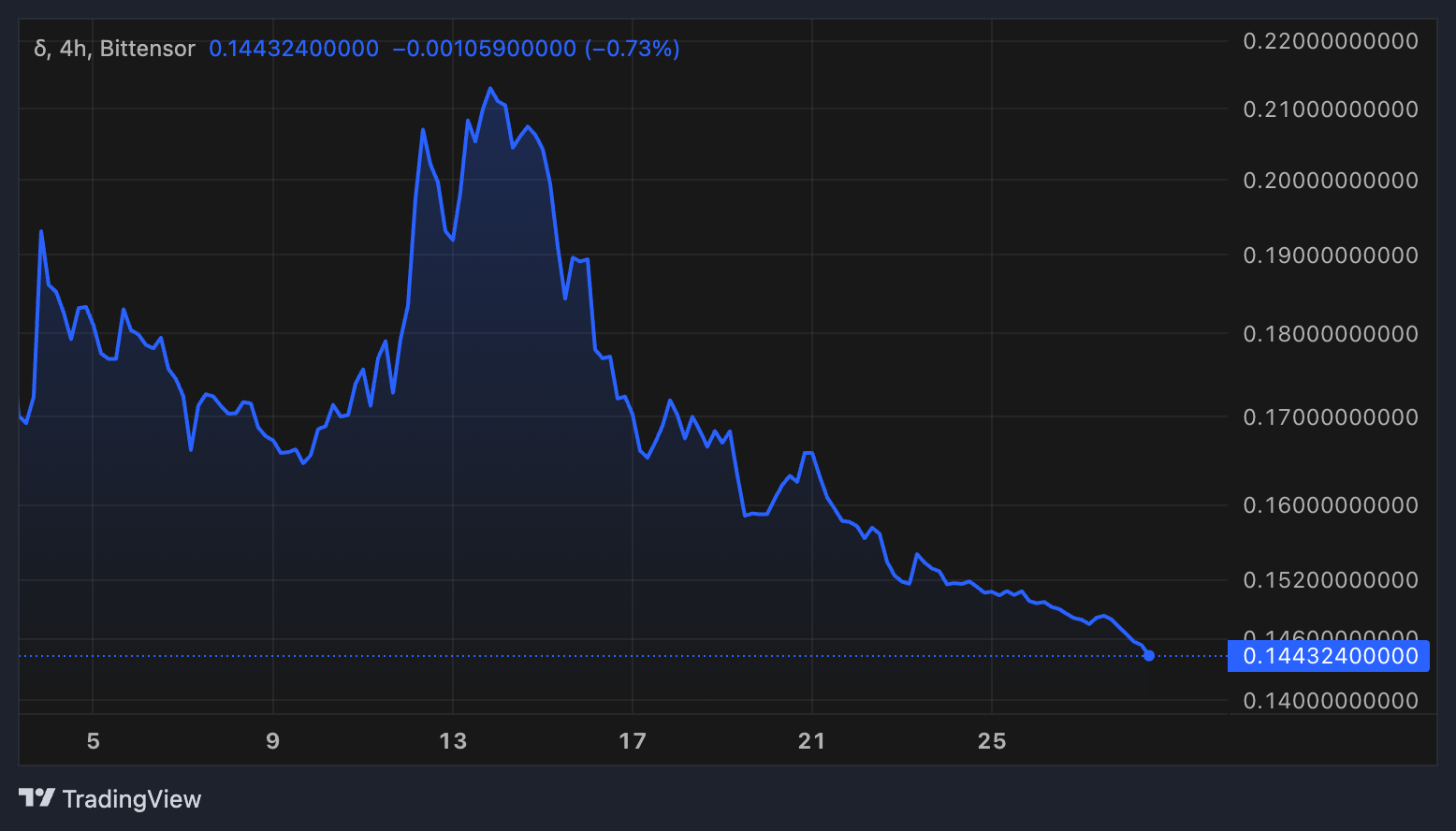

The Targon market cap is currently sitting around $ 47 million, with a day -to -day trade volume of up to $ 1.33 million.

Targon's price has dropped more than 9% in the past 24 hours. Its RSI is at 19.23, which signed deep oversold conditions that are often preceded by a rebound.

The targon can get up to 48% if the new momentum builds up and reresperts price levels from 15 days ago.

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.