Cardano (ADA) Bulls Stand Firm Despite Slowing Momentum

Cardano (ADA) has been over 12% in the last seven days and is now trading above $ 0.70 in the first time since the end of March. Trade volume also increases, up to 33% in the past 24 hours to reach $ 723 million.

Despite the price recovery, some technical indicators suggest that the ADA momentum has weakened and approaching the key decision points. Here's a closer look at Cardano's current setup as the new week begins.

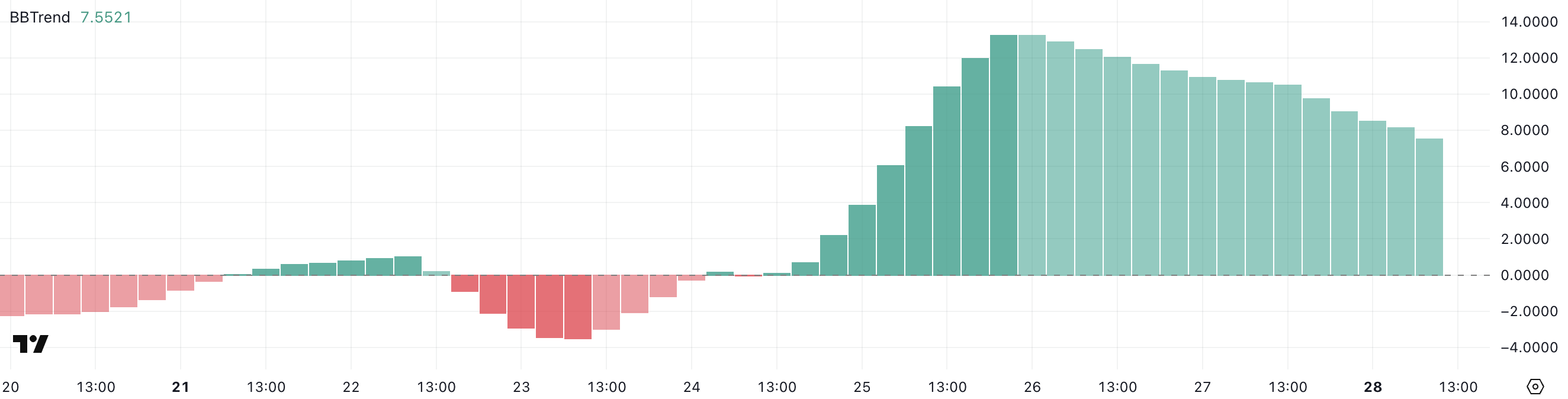

Cardano Bbtrend has weakened after a positive stripe

The Cardano Bbtrend indicator is currently at 7.55, down from 13.27 three days ago. This sharp denial shows that the strength of recent price expansion has been cooled, even though the possession has posted a positive day -to -day closure in the last four days.

The falling BBTrend suggests that while ADA is moving higher, the underlying momentum of expansion loses strength.

This shift features a potential slowing that can affect ADA's ability to maintain further acquisitions without updating the purchase pressure.

The BBtrend's trend indicator, or bollinger band, measures the strength of a price trend based on the expansion or retreat of bollinger bands.

A rising BBTrend usually indicates a strong momentum and increased volatility, while a falling BBTrend suggests weakening momentum or the onset of a companion -incorporate stage.

In ADA's BBtrend today at 7.55, the indicator still points to some positive momentum, but at a weaker speed than earlier in the week.

If the BBTrend continues to decrease, ADA may enter an integration -with the stage, but if the pressure purchase is back, the token can expand the current positive stripes.

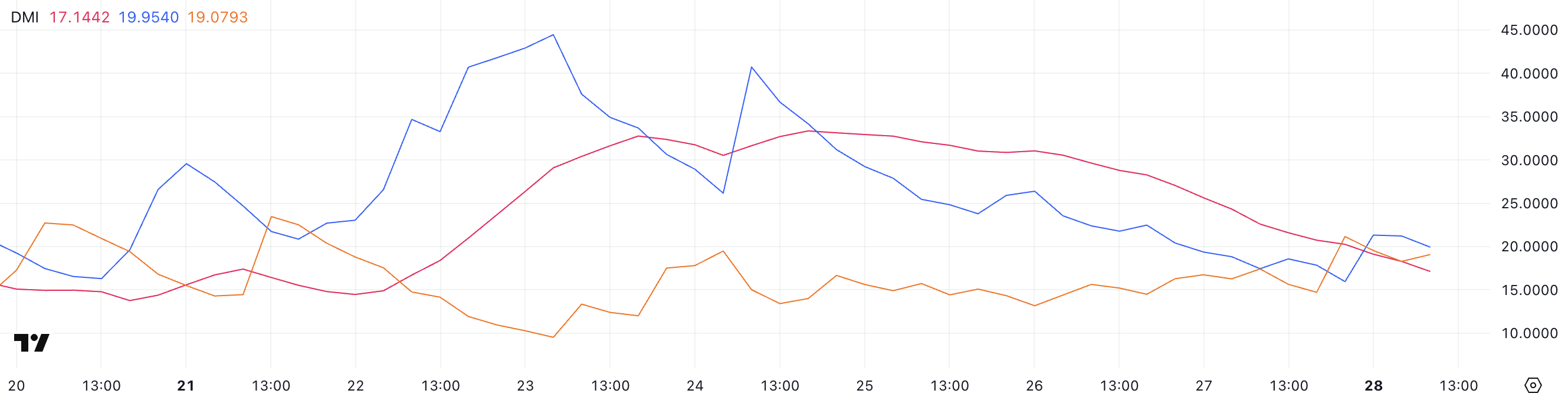

Ada faces inability as buyers and sellers fight for control

The Cardano Directional Movement Index (DMI) shows the average Directional Index (ADX) currently sitting at 17.14, a well -known collapse from 31 two days ago.

The sharp decline of signals that the strength of ADA's recent trend has weakened significantly. Meanwhile, the +Di (positive directional indicator) was 19.95, from 15.96 a few hours ago but still dropped from 26 two days ago.

The -di (negative indicator of direction) sits at 19.07, slightly dropped from 21.16 earlier but up compared to 14.49 two days ago, reflecting the mixed momentum between buyers and sellers.

ADX measures the strength of a trend without indicating its direction.

Readings above 25 usually suggest a strong trend, while the readings below 20 point to a weak or combined -with -a -joint market. At the Ada's ADX today at 17.14, the strength of the trend is weak, and buyers or sellers currently have a clear advantage.

Close values between +Di and -di suggest that Cardano can enter a period of movement of sideways unless bulls or bears will recover stronger control as soon as possible.

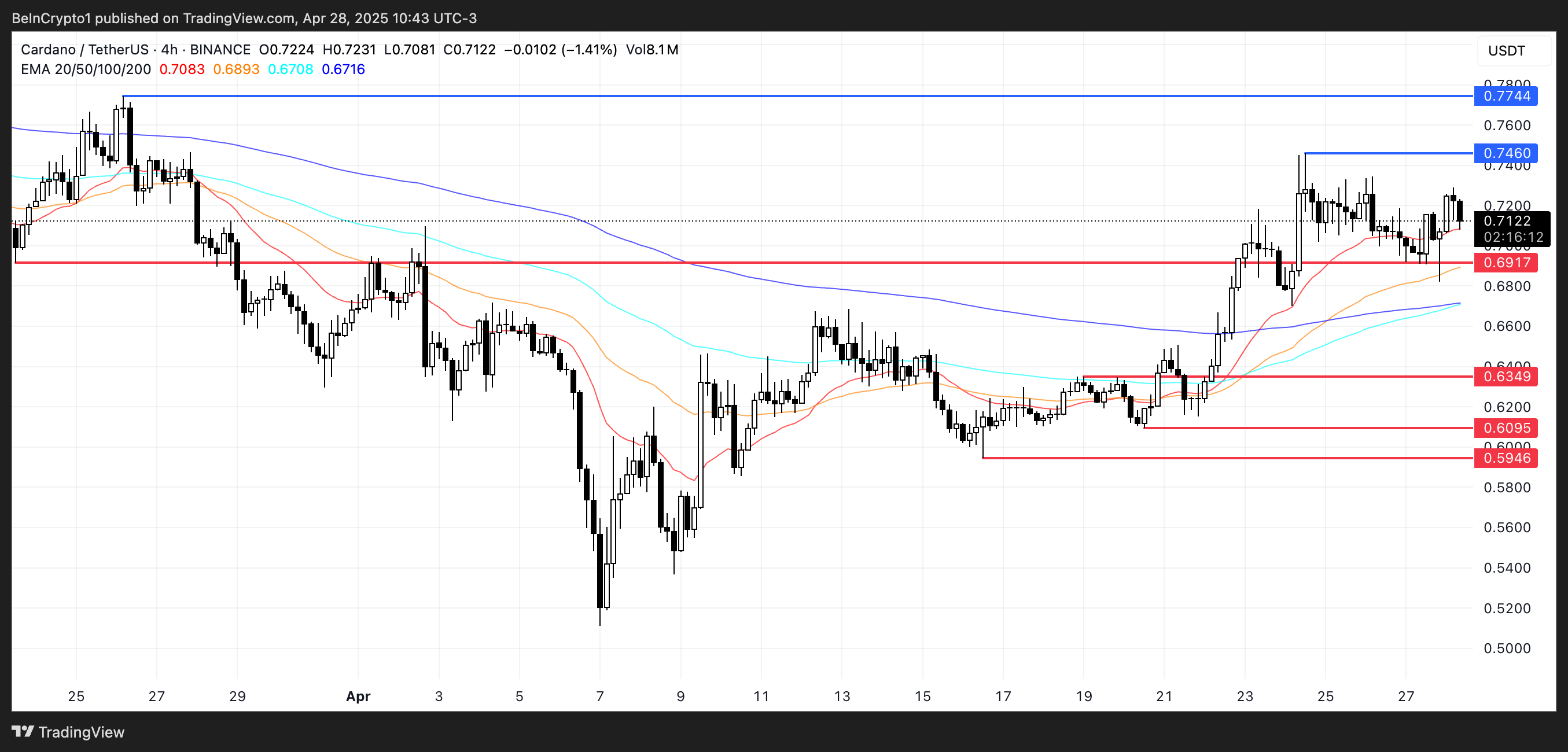

Cardano structure faced a critical trial near $ 0.69

Cardano's exponential transfer lines suggest an uprising, with short-term ema positioned above the long-term.

However, Cardano's price has repeatedly tried the support level at $ 0.69 and it is close to trade.

This price action suggests that while the wider trend remains positive, the bullish momentum weakens, and the $ 0.69 support becomes a critical zone.

If ADA loses the $ 0.69 support, the next targets downside will be around $ 0.63, followed by $ 0.609 and a potential $ 0.59 if the sale of pressure speeds up.

On the other hand, if consumers withdraw and strengthen the uprising, ADA can rally to retest a resistance to $ 0.746.

A breakout above $ 0.746 can open the door for a move towards $ 0.77, offering a strong bullish setup if the momentum re -strengthens.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.