344k New Users Pop Up As BTC Breaks $103k

On-chain data shows the generation of address on the Bitcoin network spiking while the BTC rallied above the $ 103,000 level.

Bitcoin network growth has increased recently

To a new one Post In X, on-chain analytics firm Santiment has discussed the latest trend in Bitcoin's network growth. “Network growth” here refers to an indicator that monitors the total number of new BTC addresses created by users day -day.

An address is said to be 'created' when it comes online to the network for the first time. In other words, when it performs the first transaction. A number of factors can contribute to a spike in the generation of address.

New users joining the network and old -fashioned selling returns, both naturally lead to an increase in network growth. The scale also climbs every time the existing users create many purses for a purpose such as privacy.

In general, all of these three factors can be assumed to play in some degrees whenever network growth observes a spike. Thus, some netting of cryptocurrency may be considered.

Today, here's a chart shared by the Analytics firm that shows the growth of the Bitcoin network growing up last month:

The value of the metric appears to have been on the rise in recent days | Source: Santiment on X

As seen in the upper graph, the growth of the Bitcoin network witnessed an increase next to the recent price recovery rally, indicating that the demand for the creation of BTC addresses increased. This trend is not surprising, as investors usually find sharp price actions such as rallies to become a great -anticipation, so they are likely to be drawn to the blockchain at such times.

In fact, the BTC rallies were only successful when they were able to get enough attention, as it was only with the fresh capital that would come in with the owners that these runs could get the fuel they needed to continue.

Just the previous day, when Bitcoin exceeded the level of $ 103,000, investors opened a total of 344,620 new network addresses, thus suggesting a well -known use of users.

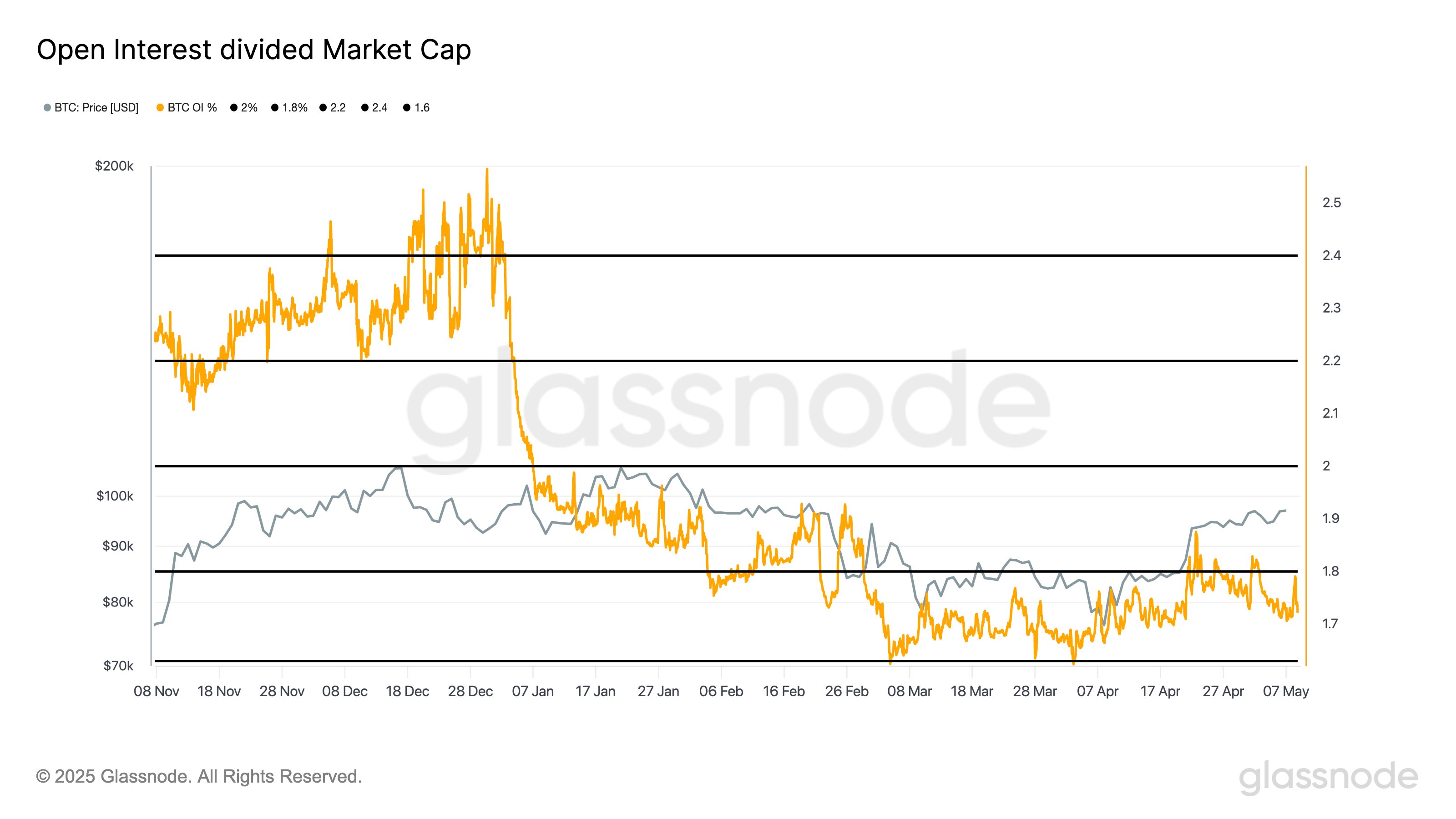

In some other news, the BTC Open interest remained low in Kamag -child in Market Cap recent Post.

The trend in the ratio between the BTC Open Interest and market cap | Source: @btcjvs on X

The “open interest” is a measure that measures the total cost of derivatives positions related to Bitcoin currently open to all centralized exchanges. In the past, spots-driven rallies have had a higher chance of being stable, so open interest now can prove to be a positive sign for property.

BTC price

At the time of writing, Bitcoin traded around $ 103,500, up to about 7% in the last seven days.

Looks like the price of the coin has rocketed up during the past few days | Source: BTCUSDT on TradingView

Featured image from Dall-E, Santiment.net, Glassnode.com, chart from tradingview.com

Editorial process For Bitcoinist centered on delivering thoroughly researched, accurate, and unbiased content. We promote strict sources of sourcing, and each page undergoes our team's enthusiastic examination of the leading technology experts and timely editors. This process ensures the integrity, relevance, and value of our content for our readers.