3 Overbought Altcoins to Watch in the First Week of May 2025

Altcoins such as Aixbt, Echelon Prime (Prime), and Balancer (BAL) have posted massive acquisitions to the first week of May, but the key technical indicators now suggest that all three may be overly disappointed. AIXBT climbed nearly 95% in the week with a strong price momentum, yet it still disappears in the wider market with a low -power -related relative.

Both Prime and Bal have grown more than 30% in the last 24 hours, but each shows the intense RSI reading above 70 while not having a relative -child – the rising red flags about maintenance. While rallies draw short-term attention, merchants should be careful because these tokens show signs of over heating without a broader confirmation in the market.

Aixbt

Aixbt, one of the most recognized AI agents of Crypto AI, appeared as a leading performer, which fell nearly 40% in the last 24 hours and more than 95% in the last seven days.

This explosive rally puts Aixbt on the best performing altcoins of the week, drawing up increasing attention from entrepreneurs and speculators.

However, technical indicators suggest that the token may enter into excessive heat territory, guaranteeing the care of the short period of time.

Kamag -child Index Index (RSI) is a momentum indicator moving from 0 to 100. The values above 70 mean that the owner is overly thoughtful and can return. The values below 30 suggest that it is oversold and may rebound.

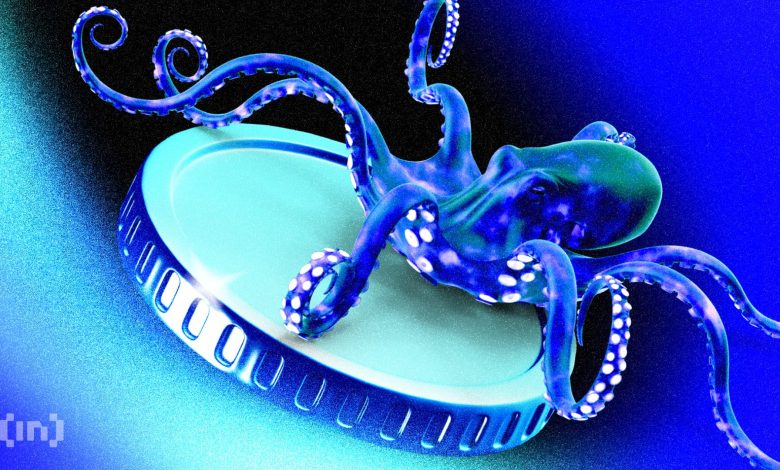

Kamag -Son -child compares (Rs) the performance of a token on a benchmark. RS above 1.0 means outperformance. Below 1.0 means underperformance. Aixbt has RSI 73.92 and an Rs of 0.69. That technical makes it very thoughtful, but is still caught behind the broader market.

It shows that the Aixbt rally is sharp, but not strong relatives in other property. Advancement can be pushed more by short-term speculation than the longevity of the market.

Echelon Prime (Prime)

Echelon Prime has risen by 33% in the last 24 hours, making it one of the top altcoins of the day.

Its trade volume exploded by 276%, reaching nearly $ 16 million – an indication of the increased interest and momentum of the businessman.

However, while the price action is amazing, the technical indicators shine in the short term.

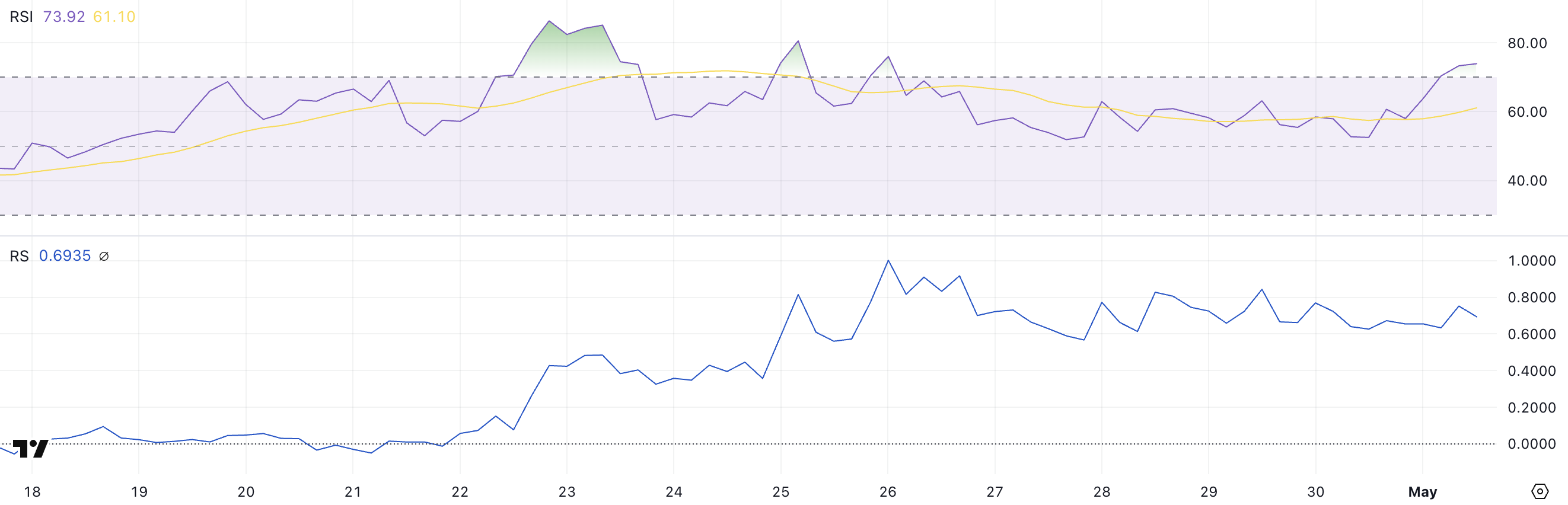

Prime's relatively power index (RSI) is currently seating at 74, stable in excessive territory. At the same time, its Kaba -Child strength (Rs) is only 0.124.

This combination – High RSI and Low RS – teaches the recent rally may not be sure.

While there is a strong short-term demand, the token lacks confirmation from the relative market strength, making a sharp correction weak if the purchase of pressure is missing.

Balancer (Bal)

The balancer jumped more than 41% in the last 24 hours, supported by a sharp increase in trading activity, with a volume of up to $ 53 million.

The price of the surge places the bal amidst the strongest performing altcoins on the market. However, technical indicators suggest that the rally can be obexted despite the breakout.

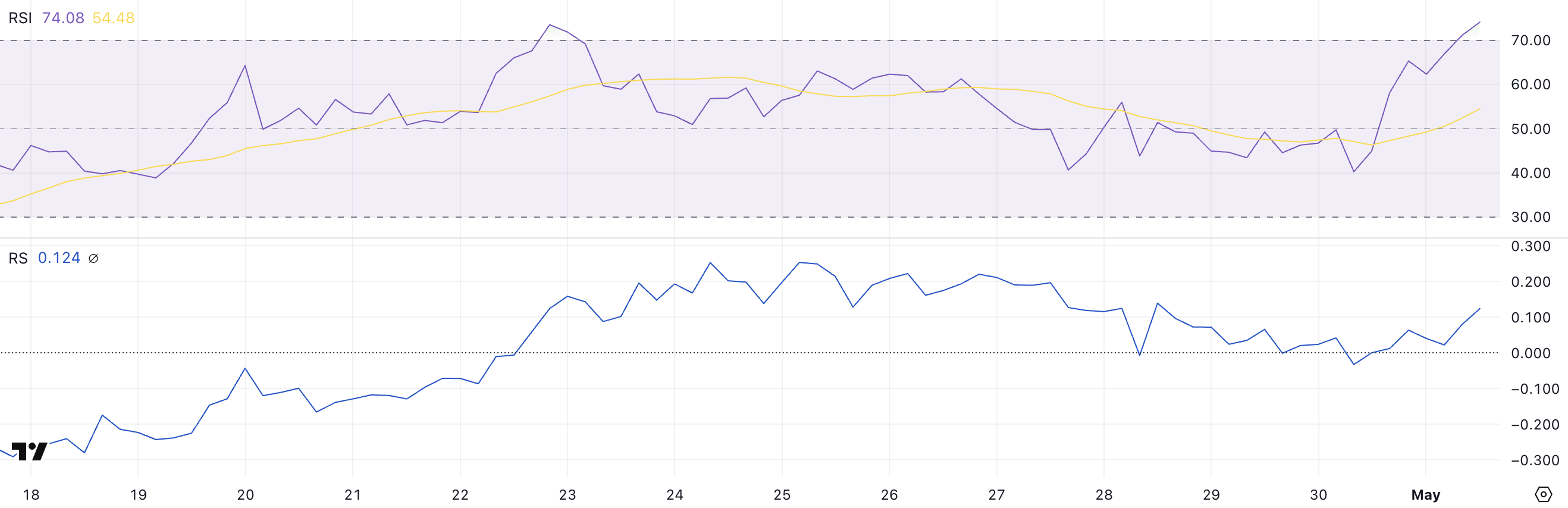

The KaMag -child index of the bal (RSI) index (RSI) is at 79.33, which signed intense conditions of excessive thinking. Meanwhile, its KaMag -Child Strength (Rs) stands only at 0.27, indicating that it is still not relevant to the wider market.

This combination – very high RSI and low RS – often points to an unstable move driven more of the hype than the underlying strength.

If there is no relative outperformance to support the momentum, the bal may be at risk of a near-term pullback once buying cool pressure.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.